Not everyone is required to file an income tax return each year. The content on this blog is as is and carries no warranties.

Where S My Tax Refund The Turbotax Blog

Where S My Tax Refund The Turbotax Blog

how long does a turbo tax return take

how long does a turbo tax return take is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in how long does a turbo tax return take content depends on the source site. We hope you do not use it for commercial purposes.

The best turbo tax phone number with tools for skipping the wait on hold the current wait time tools for scheduling a time to talk with a turbo tax rep reminders when the call center opens tips and shortcuts from other turbo tax customers who called this number.

How long does a turbo tax return take. My childs father is past due nearly 1200 and pays by state dcs. Its that time of year again. If you didnt get a chance to implement any of my 16 tax.

Here are some tax tips on how to get more money back from your tax return using free and paid programs. After 20 days comments are closed on posts. What am i missing.

How can i save this or invest it for him to make it last as long as possible. The amount of income that you can earn before you are required to file a tax return also depends on the type of income your age and your filing status. See how to max out your canadian tax return in 2019.

Turbo tax premier 2018 will not allow me to change from standard deductions to itemized deductions. How long does it take to see a deposit for child support arrears. How long does it take to get amended tax return back.

The turbo tax website states that there is a check box to allow me to choose either and see how the deduction changes but my screen does not have a check box. The negative is that all contributions and earnings you withdraw from an ira even profits from long term capital gains are taxable as ordinary income. Intuit does not warrant or guarantee the accuracy reliability and completeness of the content on this blog.

There is no reason to let the government keep your money any longer. When the irs processed your taxes they likely noticed on your w2s that you had overwitheld and adjusted your tax return and refund of overpayment. If youre expecting a tax refund the most common advice is that you should file your tax return as soon as possible.

But for some filers this year your early tax return will be delayed because of new laws designed to stop identity theft. This blog does not provide legal financial accounting or tax advice. Whether you generate a short term or long term gain in your ira you dont have to pay any tax at all until you take the money out of the account.

Turbo tax said my return this year was 424 and today i woke up to a 2300 transfer to my account from irs. Generally if your total income for the year doesnt exceed certain thresholds then you dont need to file a federal tax return. I have to say amending a tax return with turbotax is really as easy as 1 2 3.

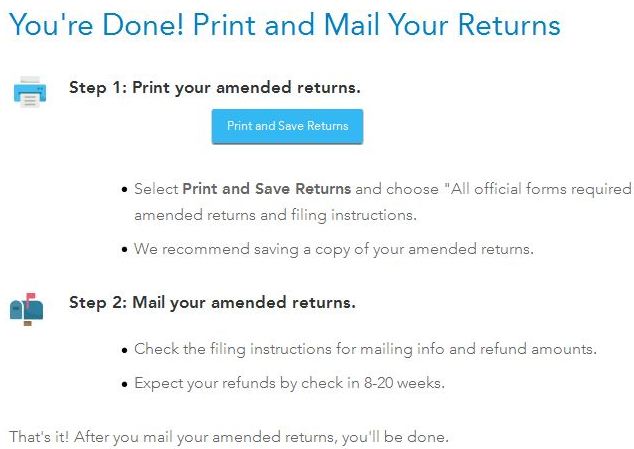

Intuit may but has no obligation to monitor comments. Its that time of year again. Recently i filed my 1040x and i used turbotax online.

How Long Does It Take To Get Amended Tax Return Back

How Long Does It Take To Get Amended Tax Return Back

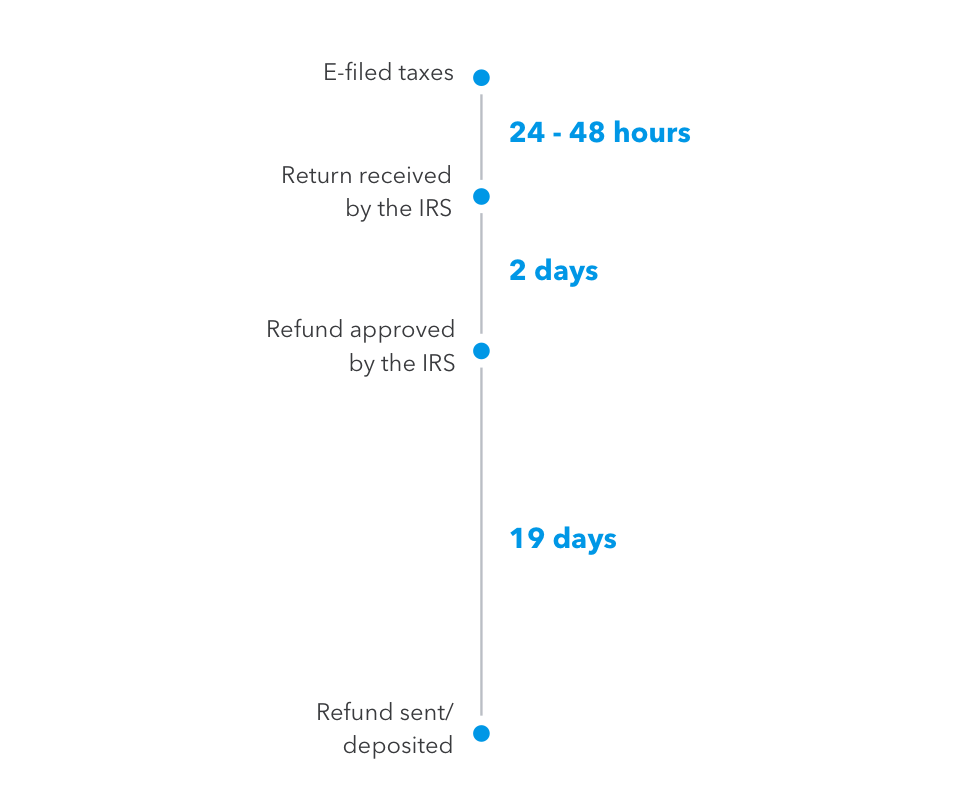

4 Steps From E File To Your Tax Refund The Turbotax Blog

/turbotax-57565f195f9b5892e84fe3ef.png) Backup Your Tax Return As A Pdf In Turbotax

Backup Your Tax Return As A Pdf In Turbotax

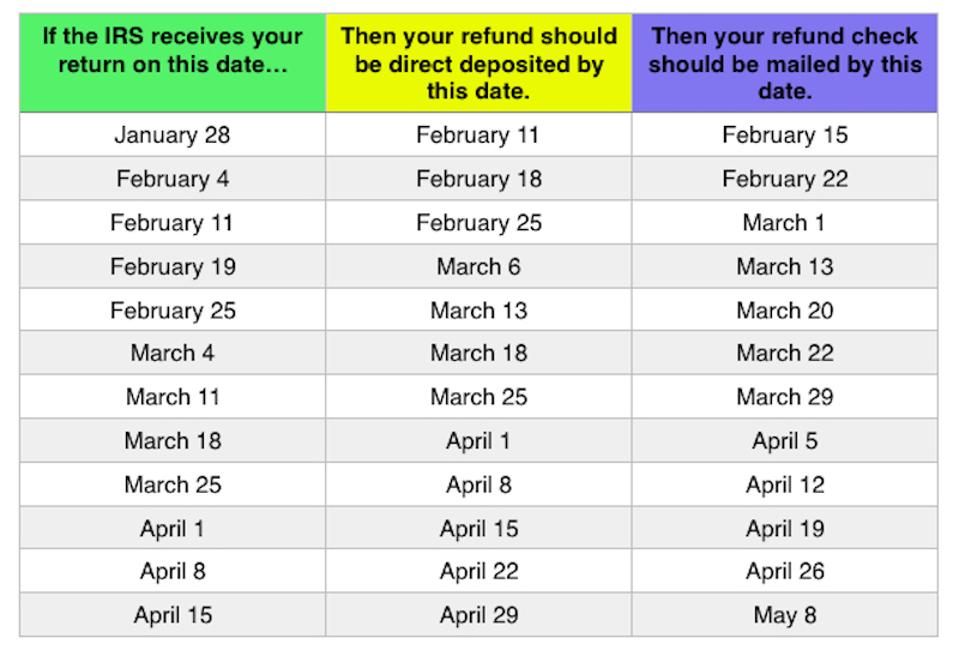

How Long Will Your Tax Refund Really Take This Year

2019 Tax Refund Chart Can Help You Guess When You Ll Receive

2019 Tax Refund Chart Can Help You Guess When You Ll Receive

How To Use Turbotax To File Your Taxes For Free In 2018

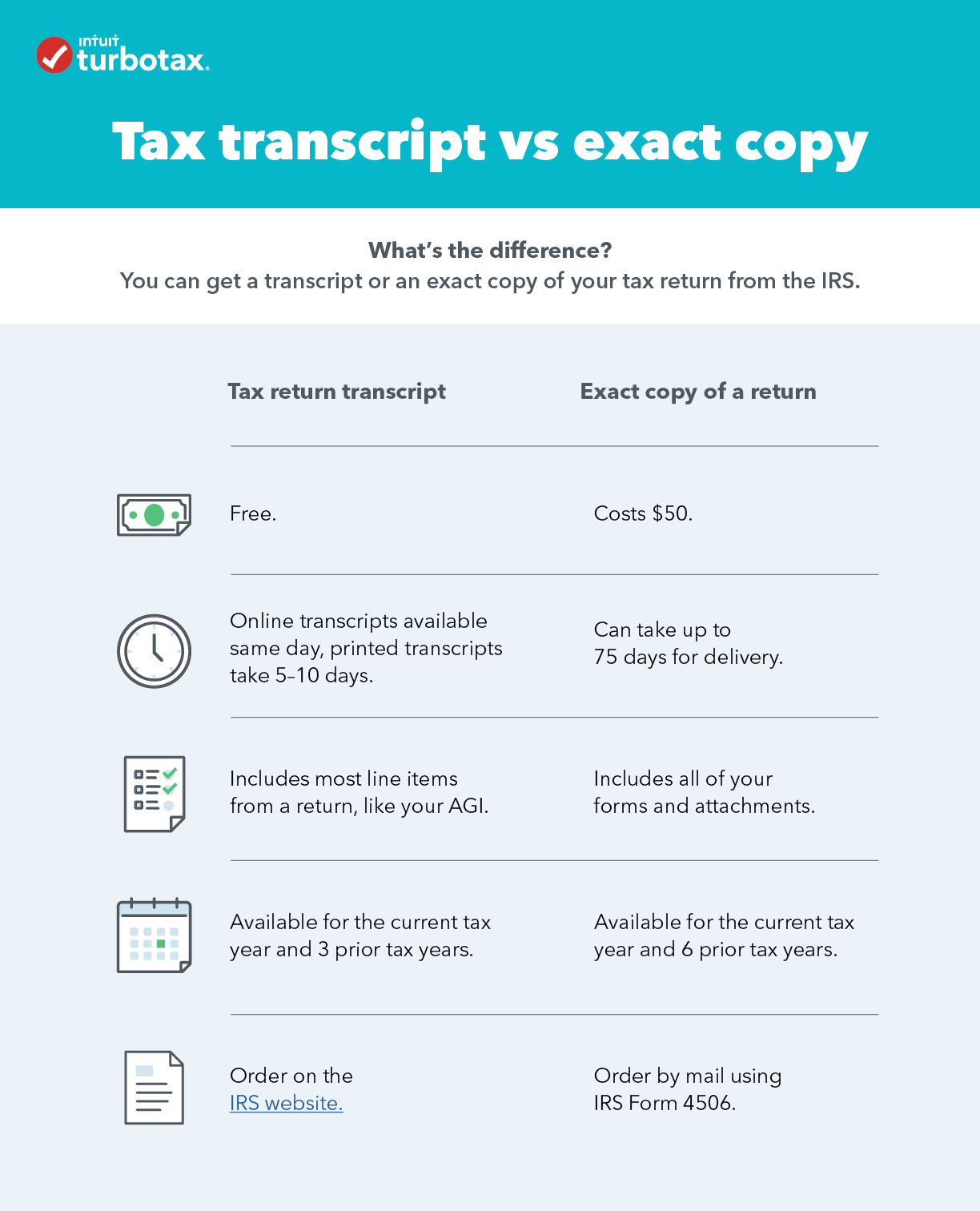

How Do I Get A Copy Of My Tax Return Or Transcript

How Do I Get A Copy Of My Tax Return Or Transcript

/cdn.vox-cdn.com/uploads/chorus_image/image/59391107/GettyImages-507814528.0.0.0.jpg) Turbotax Don T File Your Taxes With It Vox

Turbotax Don T File Your Taxes With It Vox

How Long Does It Take To Get A Tax Refund Smartasset

How Long Does It Take To Get A Tax Refund Smartasset

How To Check Your Tax Refund Status Turbotax Tax Tips Videos

How To Check Your Tax Refund Status Turbotax Tax Tips Videos

Where S My Refund Tax Refund Tracking Guide From Turbotax

Where S My Refund Tax Refund Tracking Guide From Turbotax