While you are able to deduct unreimbursed expenses such as therapy not all medical expenses are eligible for tax deduction. Mexico and any us.

Tax Tips For Massage Therapists Massage Therapy Journal

Tax Tips For Massage Therapists Massage Therapy Journal

can massage therapy be claimed on income tax

can massage therapy be claimed on income tax is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in can massage therapy be claimed on income tax content depends on the source site. We hope you do not use it for commercial purposes.

Information for representatives of a provincial or territorial government or a health care profession governing body show.

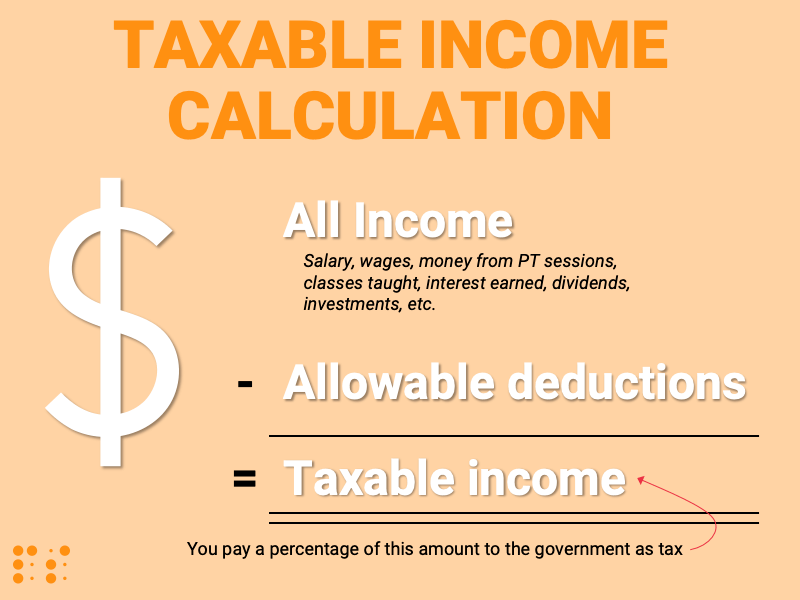

Can massage therapy be claimed on income tax. The following list identifies the health care professionals recognized by the canada revenue agency as medical practitioners for the purposes of the medical expense tax credit. If a person is self employed the premiums paid for a private health services plan can be deducted from self employment income instead of being claimed as a medical expense. How massage therapists can prepare for and navigate the upcoming tax season.

Getting the training you need to become a massage therapist doesnt come cheap but you may be able to deduct the cost of your education on your tax return using the lifetime learning tax creditthis deduction for higher education can provide a tax credit for up to 2000 depending on your income level. Training membership and certification costs. You should keep all receipts from your massages and any prescriptions or doctors records that indicate massage is a necessary part of your therapy rehabilitation or program.

Tax deductions for massage therapy. Which lowers your income tax and your self employment tax. State or territory can be claimed as a.

Whether your trip to the massage therapist or spa yields tax breaks and how you claim them depends on the reason you are receiving the treatments. For tax years 2017 and 2018 you can deduct allowable medical care expenses during the tax year that exceed 75 percent of your adjusted gross income. In general you should keep your tax records for at least seven years after your taxes are filed as all periods of limitations will have run out by the end of that period.

But if you use the rug in your home too. Whether you are a new massage therapist or have had a practice of your own for many years the need for a complete timely record keeping system is mandatory. Odd tax breaks that may save you cash.

Learn the benefits of such an accounting system including preparation of accurate income tax returns and managing information to more successfully run your massage therapy business. Massages can relieve tension anxiety pain and tax burdens. This would result in greater or at least equal tax savings and is a way to provide a tax free benefit to employees of a small business.

If you buy a rug for your massage therapy practice you can deduct the full cost. Luckily the irs allows you to deduct some of these expenses. If you are a small business owner the list of potential tax breaks can sound just.

15 Tax Deductions You Should Know E Filing Guidance

Eofy Fitness Expenses For Your Tax Return Paul Stokes

Eofy Fitness Expenses For Your Tax Return Paul Stokes

Are Massages Tax Deductible What You Need To Know Zeel

Are Massages Tax Deductible What You Need To Know Zeel

15 Tax Deductions You Should Know E Filing Guidance

Top Tax Deductions For Massage Therapists Turbotax Tax

Top Tax Deductions For Massage Therapists Turbotax Tax

When It Comes To Reporting Gratuities Here S What Mt S Need

When It Comes To Reporting Gratuities Here S What Mt S Need

/GettyImages-1129640389-00d4c7c7013548bf8fc2f475f25195d7.jpg) Are Fsa Contributions Tax Deductible

Are Fsa Contributions Tax Deductible

Medical Expenses Deductions Health Insurance System Ibm

What The New Tax Law Means For Massage Therapists

What The New Tax Law Means For Massage Therapists

15 Tax Deductions You Should Know E Filing Guidance