Their motivations are irrelevant to the wrongdoing being exposed. You cannot find instructions on how to make your payment in other paying hmrc guides.

Penalty For Not Paying Payroll Taxes Consequences Tips

Penalty For Not Paying Payroll Taxes Consequences Tips

how much are penalties for not paying taxes

how much are penalties for not paying taxes is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in how much are penalties for not paying taxes content depends on the source site. We hope you do not use it for commercial purposes.

It doesnt matter if the whisetleblower is acting out of greed and wants 30 of the taxes and penalties.

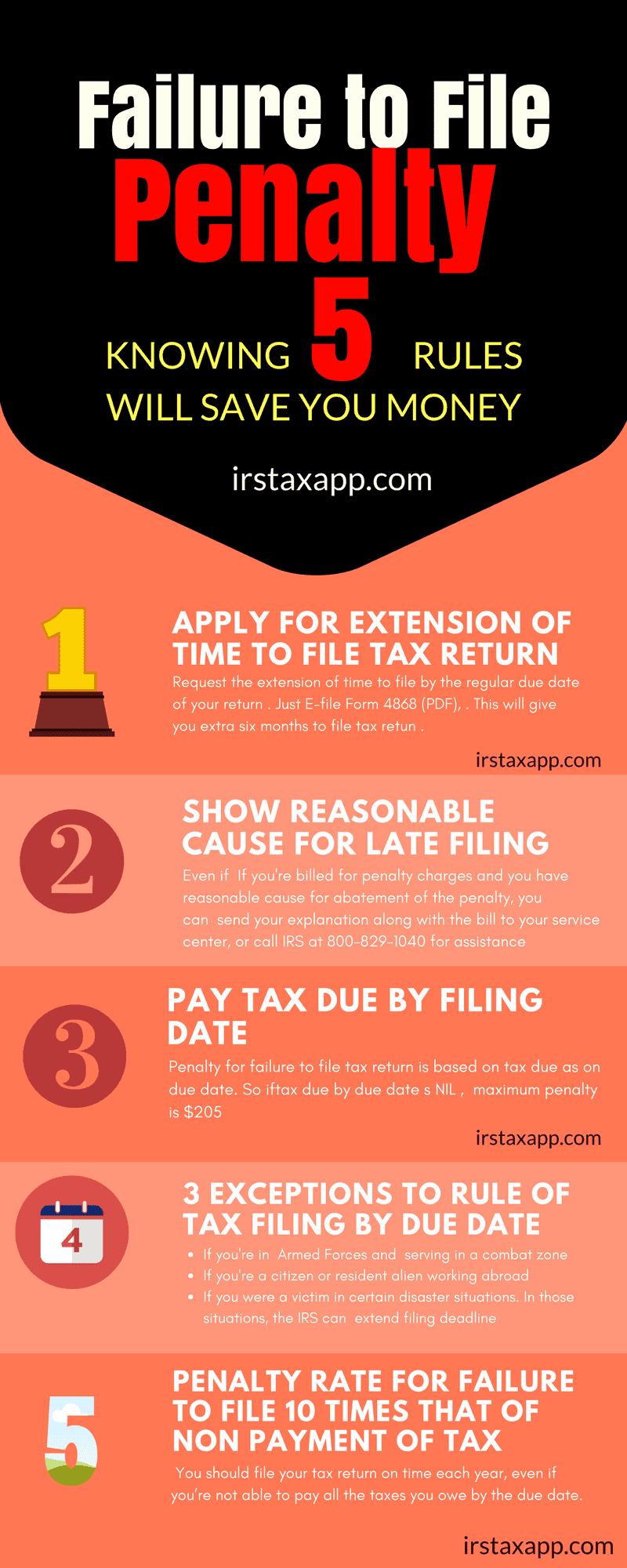

How much are penalties for not paying taxes. Ignoring it will only make the problem worse and potentially cause you to have additional penalties and fess for paying your taxes late. Here are eight important points about penalties for filing or paying late. The ultimate consequence of not paying property taxes is losing the house either at a tax sale or through the purchase of a tax lien.

I recommend doing this asap so you can get this sorted out. If both the late filing and late payment penalties apply the maximum amount charged for the two penalties is 5 percent per month. Taxpayers who continue to not file a required return and fail to respond to irs requests for a return may face a variety of enforcement actions including penalties andor criminal prosecution.

The penalty is generally 05 percent of taxpayers unpaid taxes per month. Taxpayers should file even if they cant pay. The bad guy is the mormon church if what he is saying is true.

By law the irs may assess penalties to taxpayers for both failing to file a tax return and for failing to pay taxes they owe by the deadline. It can build up to as much as 25 percent of their unpaid taxes. Hes not the bad guy.

Serving on active duty to pay delinquent property taxes on property in which the person owns an interest without paying additional penalty or accrued interest. If you owe less than 50000 in tax interest and penalties combined you can set up a plan that allows you to pay down over time with regular monthly payments. Lets not get into the game of attacking the person who exposes the wrongdoing.

They can help you file for an extension and get your taxes in order and if necessary request a payment plan from the irs. Not paying your taxes will warrant stiff penalties and interest resulting in an ongoing and very expensive relationship with the irs. If a written request for a waiver is not timely made the governing body of a taxing unit may not waive any penalties or interest.

If you owe more in taxes than you can afford to pay you have better options than simply not paying. Only use this guide if you want to pay taxes penalties or enquiry settlements to hmrc and. A failure to file penalty may apply if you did not file by the tax filing deadline.

Dont pay any more in extra taxes than you have to. Municipalities give delinquent taxpayers time to make amends. Taxing units usually.

Combined penalty per month. Paying your taxes on time avoids the added costs including interest and penalties and you have options to minimize those costs.

Iras Late Filing Or Non Filing Of Tax Returns

Penalty For Late Tax Return Fees Penalty Relief More

Penalty For Late Tax Return Fees Penalty Relief More

Iras Late Filing Or Non Filing Of Tax Returns

Penalty For Filing Taxes Late How To Prevent Internal

Penalty For Filing Taxes Late How To Prevent Internal

Calculate Irs Tax Late Filing Or Payment Penalties On Efile Com

Calculate Irs Tax Late Filing Or Payment Penalties On Efile Com

Petition Senator Time Scott Stop Making Middle Class

Petition Senator Time Scott Stop Making Middle Class

Understanding The Irs And Cryptocurrency Penalties Tax

Understanding The Irs And Cryptocurrency Penalties Tax

Tax Amnesty Waiver And Remission Of Tax Penalty

Business In Singapore Late Payment Or Non Payment Of Taxes

Business In Singapore Late Payment Or Non Payment Of Taxes

The Penalties For Not Paying Tax On Time

The Penalties For Not Paying Tax On Time

3 Direct Negative Consequences Of Not Paying The 2 Tax

3 Direct Negative Consequences Of Not Paying The 2 Tax