The irs was not allowed to issue refunds for those claiming the earned income tax credit and the additional child tax credit until after feb. How to request a free transcript of a federal tax return.

Where S My Tax Refund How To Check Your Refund Status The

Where S My Tax Refund How To Check Your Refund Status The

how long does it take to get efile tax return

how long does it take to get efile tax return is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in how long does it take to get efile tax return content depends on the source site. We hope you do not use it for commercial purposes.

How long for tax return to be processed can also be affected by special circumstances.

How long does it take to get efile tax return. Generally the irs makes tax return copies available for seven years from the original date they are filed before they are destroyed by law. The content on this blog is as is and carries no warranties. S corporation tax return cd 401s instructions web 12 18 where to get forms in an effort to save the cost of printing and mailing tax booklets the department does not print or mail franchise and corporate income tax forms.

Also if you have federal tax withholdings perhaps because you also have form w 2 income or because one of the companies you contract with takes withholdings you may be exempt from filing quarterly taxes as long as those federal tax withholdings equal 90 or more of what youll owe for the year. Next enter one of the 3 digit numbers below for the desired tax information. Franchise and corporate income tax forms.

Dial 1 800 829 4477 then press 1 for english and then 2 for teletax topics. Intuit may but has no obligation to monitor comments. Discount valid only for tax prep fees for an original 2017 personal income tax return prepared in a participating office.

Also included with turbotax free edition after filing your 2019 tax return. Included with all turbotax deluxe premier self employed turbotax live or prior year plus benefits customers and access to up to the prior seven years of tax returns we have on file for you is available through 10312021. Get tax assistance through teletax 24 hours a day seven days a week.

You may want to have a pen and paper handy to take notes. After 20 days comments are closed on posts. File as a tax practitioner.

Tax topics teletax. Intuit does not warrant or guarantee the accuracy reliability and completeness of the content on this blog. May not be combined with any other promotion including free 1040ez.

Low cost to efile an amendment. In 2018 for instance credits slowed things down. Discounted pricing for bulk efiling unlimited business registrations under your account unlimited employee identification number bulk data upload for many 2290 truck filings exclusive customer support service.

This blog does not provide legal financial accounting or tax advice. A new client is defined as an individual who did not use hr block or block advisors office services to prepare his or her prior year tax return.

4 Steps From E File To Your Tax Refund The Turbotax Blog

How Long Will Your Tax Refund Really Take This Year

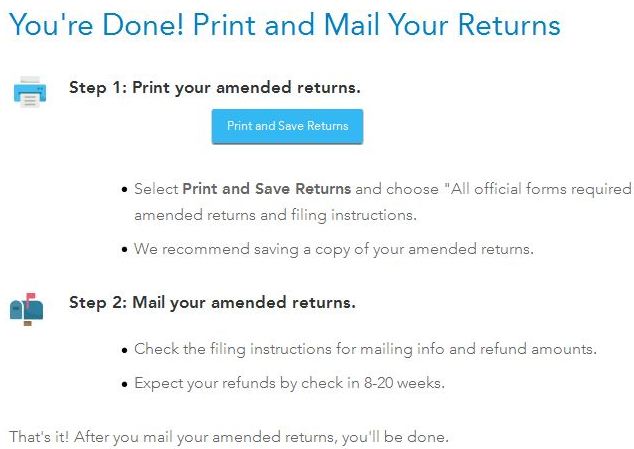

How Long Does It Take To Get Amended Tax Return Back

How Long Does It Take To Get Amended Tax Return Back

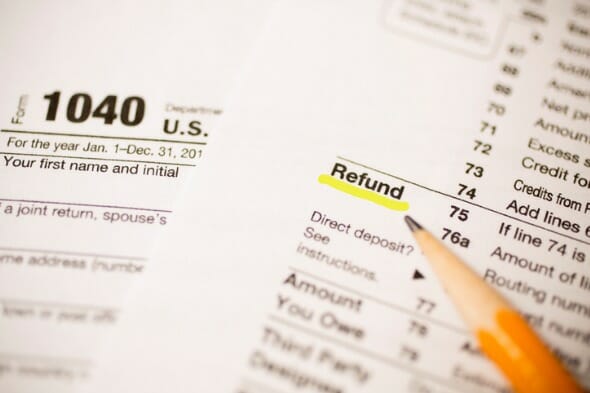

How Long Does It Take To Get A Tax Refund Smartasset

How Long Does It Take To Get A Tax Refund Smartasset

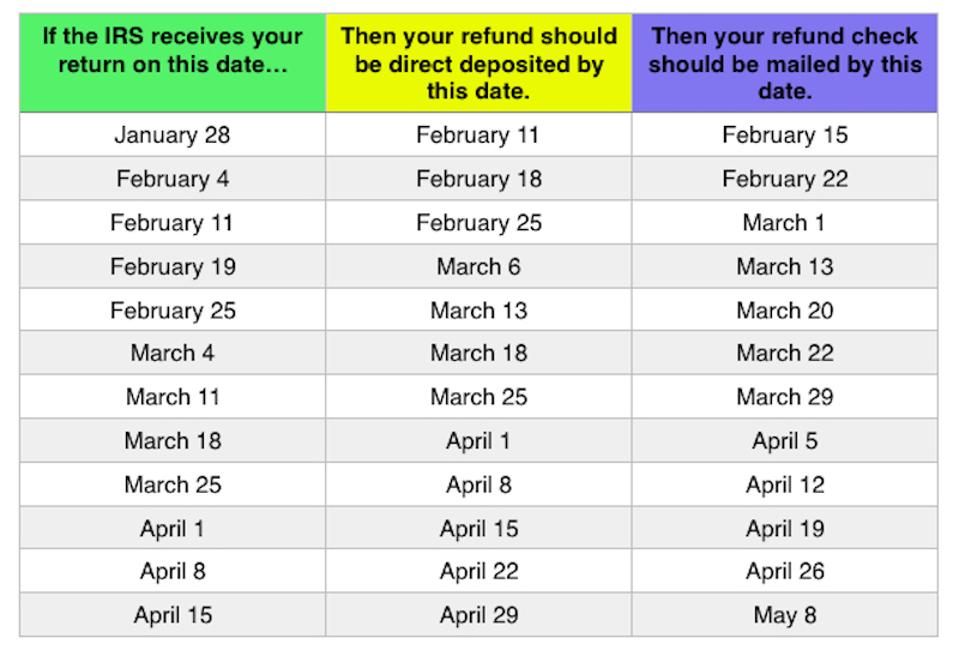

When To Expect My Tax Refund Tax Refund Calendar 2019 2020

When To Expect My Tax Refund Tax Refund Calendar 2019 2020

When To Expect My Tax Refund Tax Refund Calendar 2019 2020

When To Expect My Tax Refund Tax Refund Calendar 2019 2020

Efiling Income Tax Return 2018 19 For Free Guide On E

Efiling Income Tax Return 2018 19 For Free Guide On E

2019 Tax Refund Chart Can Help You Guess When You Ll Receive

2019 Tax Refund Chart Can Help You Guess When You Ll Receive

How To Use Sars Efiling To File Income Tax Returns Taxtim Sa

How To Use Sars Efiling To File Income Tax Returns Taxtim Sa