Dont pay a claims firm as you. If you wear a uniform at work and have to wash repair or replace it yourself you may be able to reclaim 100s of tax for up to five years of expenses.

Georgia Tax Refund Cycle Chart Pogot Bietthunghiduong Co

Georgia Tax Refund Cycle Chart Pogot Bietthunghiduong Co

how long does ga tax refund take

how long does ga tax refund take is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in how long does ga tax refund take content depends on the source site. We hope you do not use it for commercial purposes.

This is an optional tax refund related loan from axos bank member fdic.

How long does ga tax refund take. Book web gst software demo now get every update about gst only on gstinindia. Web gst software tells you about how to file gst return in india and gst filing utility. After 20 days comments are closed on posts.

Loans are offered in amounts of 250 500 750 1250 or 3500. Intuit may but has no obligation to monitor comments. Some states structure their taxes differently.

Intuit does not warrant or guarantee the accuracy reliability and completeness of the content on this blog. The content on this blog is as is and carries no warranties. Therefore the top federal tax rate on long term capital gains is 238.

This blog does not provide legal financial accounting or tax advice. It is not your tax refund. Rest assured that our calculations are up to date with all tax law changes to give you the most accurate estimate.

Use our 2019 tax refund calculator to get your estimated tax refund or an idea of what youll owe. What is a form w 4 and how does it relate to withholding allowances. A capital gains tax cgt is a tax on the profit realized on the sale of a non inventory assetthe most common capital gains are realized from the sale of stocks bonds precious metals real estate and property.

Not all countries impose a capital gains tax and most have different rates of taxation for individuals and corporations. This applies whether its just a branded t shirt or if youre a fully uniformed pilot police officer or nurse. If you are a wage earner one of the biggest ways you can decrease your tax liability or increase your refund year to year is through your selected withholdings.

Estimate your tax refund for 0 wondering what to expect when you file your taxes this year. Approval and loan amount based on expected refund amount id verification eligibility criteria and underwriting. In a state whose tax is stated as a percentage of the federal tax liability the percentage is easy to calculate.

State and local taxes often apply to capital gains. An irs audit is a reviewexamination of an organizations or individuals accounts and financial information to ensure information is reported correctly according to the tax laws and to verify the reported amount of tax is correct. Selection for an audit does not always suggest theres a problem.

Where S My State Refund Updated For 2019 Tax Year

Where S My State Refund Updated For 2019 Tax Year

2018 2019 Tax Season Average Irs And State Tax Refund And

2018 2019 Tax Season Average Irs And State Tax Refund And

2019 Income Tax Season Filing Under Way In Ga Where S

2019 Income Tax Season Filing Under Way In Ga Where S

2018 Income Tax Season Filing Begins For Georgia Taxpayers

2018 Income Tax Season Filing Begins For Georgia Taxpayers

How Long Does An Amended Tax Refund Take To Be Issued

How Long Does An Amended Tax Refund Take To Be Issued

How Long Does It Take To Get Your Tax Refund Bankrate Com

How Long Does It Take To Get Your Tax Refund Bankrate Com

:max_bytes(150000):strip_icc()/where-s-your-tax-refund-3193203-v4-5b688dc546e0fb004fc28d4e.png) Where S Your Tax Refund Check With The Irs And Your State

Where S Your Tax Refund Check With The Irs And Your State

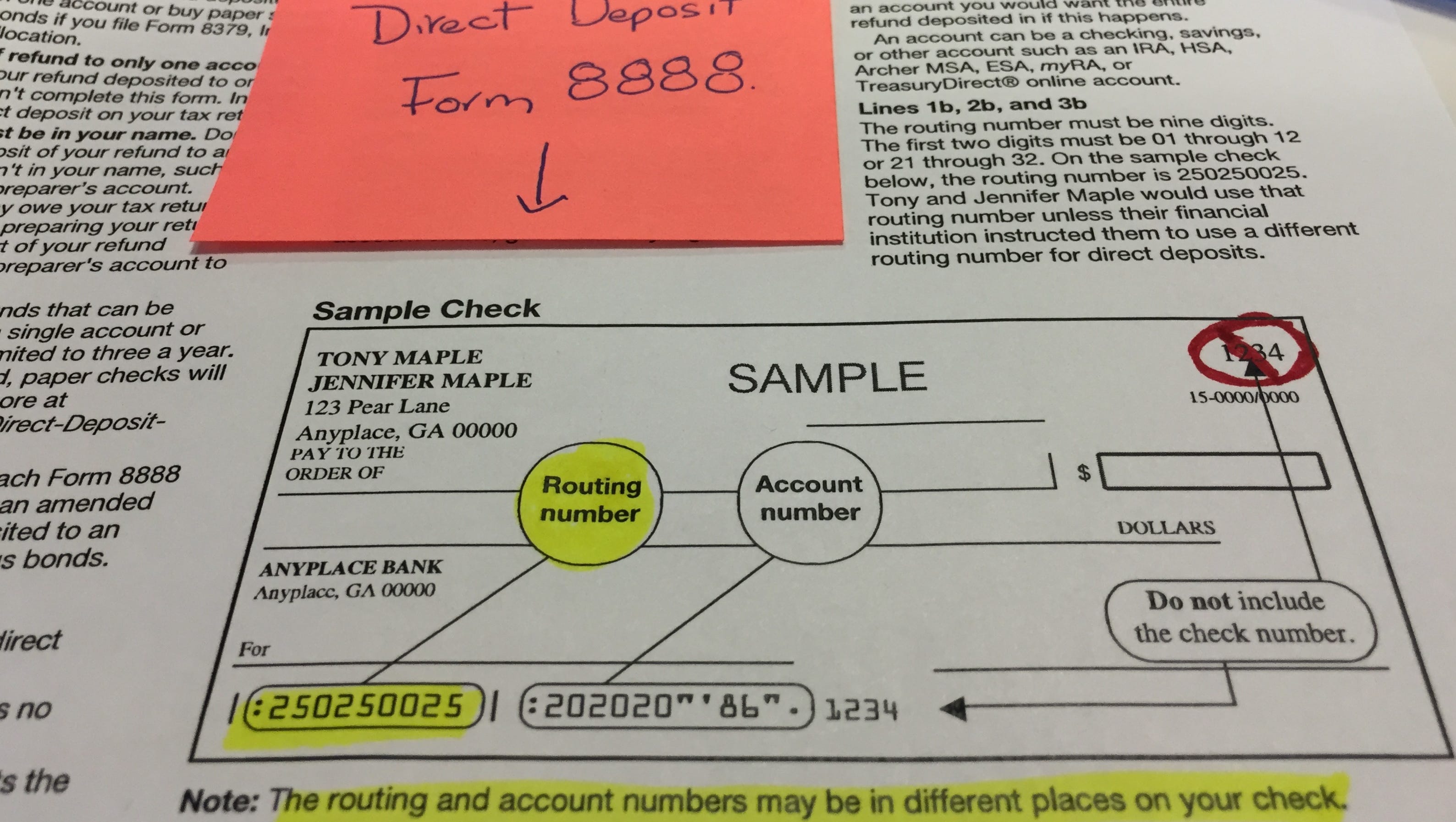

Direct Deposit For Tax Refunds Can Go Very Wrong

Direct Deposit For Tax Refunds Can Go Very Wrong

Ga Tax Day Last Minute Filing Tips Track Refund Postal

Ga Tax Day Last Minute Filing Tips Track Refund Postal

What Does It Mean If My Irs Tax Refund Is Under Review

What Does It Mean If My Irs Tax Refund Is Under Review

Where S My Georgia Ga State Tax Refund Ga Tax Bracket

Where S My Georgia Ga State Tax Refund Ga Tax Bracket