Are contributions to foreign charities tax deductible. Irs publication 526 charitable contributions pdf provides information on making contributions to charities.

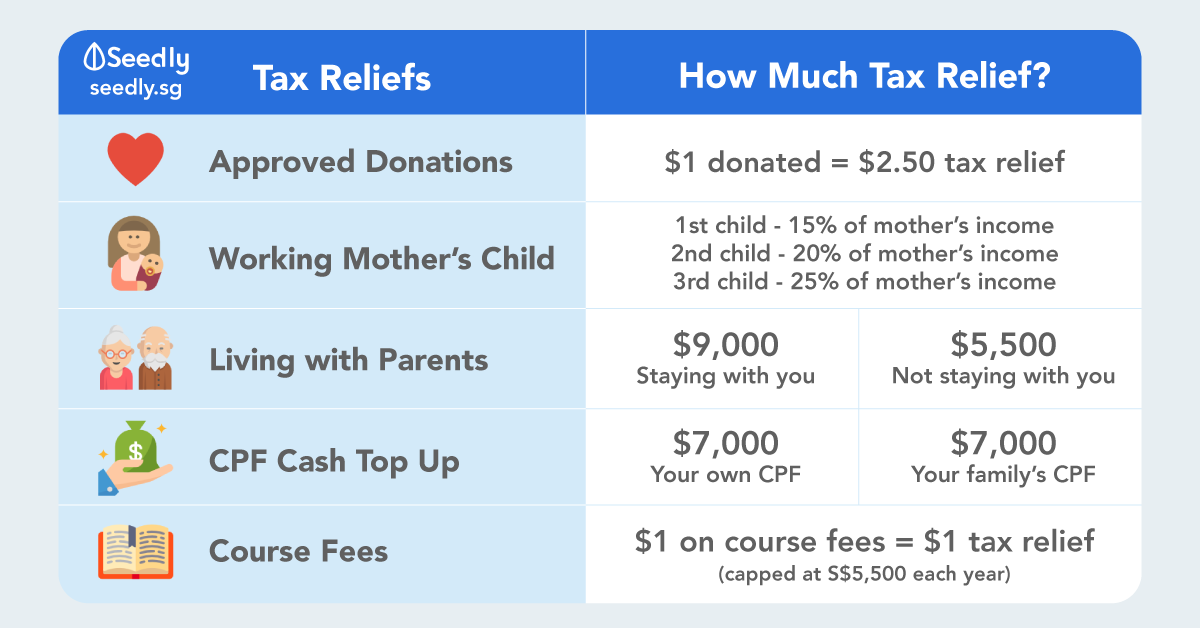

Your Cheat Sheet Personal Income Tax In Singapore Ya 2019

Your Cheat Sheet Personal Income Tax In Singapore Ya 2019

are contributions to foreign charities tax deductible

are contributions to foreign charities tax deductible is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in are contributions to foreign charities tax deductible content depends on the source site. We hope you do not use it for commercial purposes.

Cash donations with benefits.

Are contributions to foreign charities tax deductible. Are contributions to foreign charities tax deductible. Only outright cash donations that do not give material benefit to the donor are tax deductible. Except as indicated above contributions to a foreign organization are not deductible.

However special rules apply to charitable organizations in canada israel and mexico. Contributions made to foreign charities are usually not tax deductible. If donor made the gift during lifetime then no income tax deduction would be allowed because gifts to foreign charities normally are not deductible for federal income tax purposes.

Rules on charities first lets take a brief look at some of the rules for us. So assume jill donor wants to help charity x which is organized and operated in paris france. Social media has helped to make our world smaller and when natural disasters and tragedies occur we want to help with contributions of money andor other types of aid.

Reliance on tax exempt organization search. However special sets of rules apply to charities in canada israel and mexico. However as a concession certain donations made to ipcs on or after 1 may 2006 will be deemed as pure donations although there is benefit given in return for the donation.

At home countless charitable organizations are providing all types of help and generally your contributions to us. Charitable donations to foreign organizations are deductible only if made to charities in specific countries approved by the irs for charitable tax deductions. A deduction for a contribution to a canadian organization is not allowed if the contributor reports no taxable income from canadian sources on the united states income tax return as described in publication 597.

Donor advised funds work well for donors with at least 5000 to invest. Publication 3833 disaster relief. Generally donations to qualified foreign charities are deductible if the charities would qualify for tax exemption under us.

Contributions to foreign charities generally are not tax deductible. Providing assistance through charitable organizations pdf explains how the public can use charitable organizations to help victims of disasters and how new organizations can obtain tax exempt status. Contributions are tax deductible immediately and can be bunched so that one can make the equivalent of several years of donations and then distribute that money over time to charities.

Social media has helped to make our world smaller and when natural disasters and tragedies occur we want to help with contributions of money andor other types of aid. First lets take a brief look at some of the rules for us. Contributions to a donor advised fund can be in the form of cash or securities.

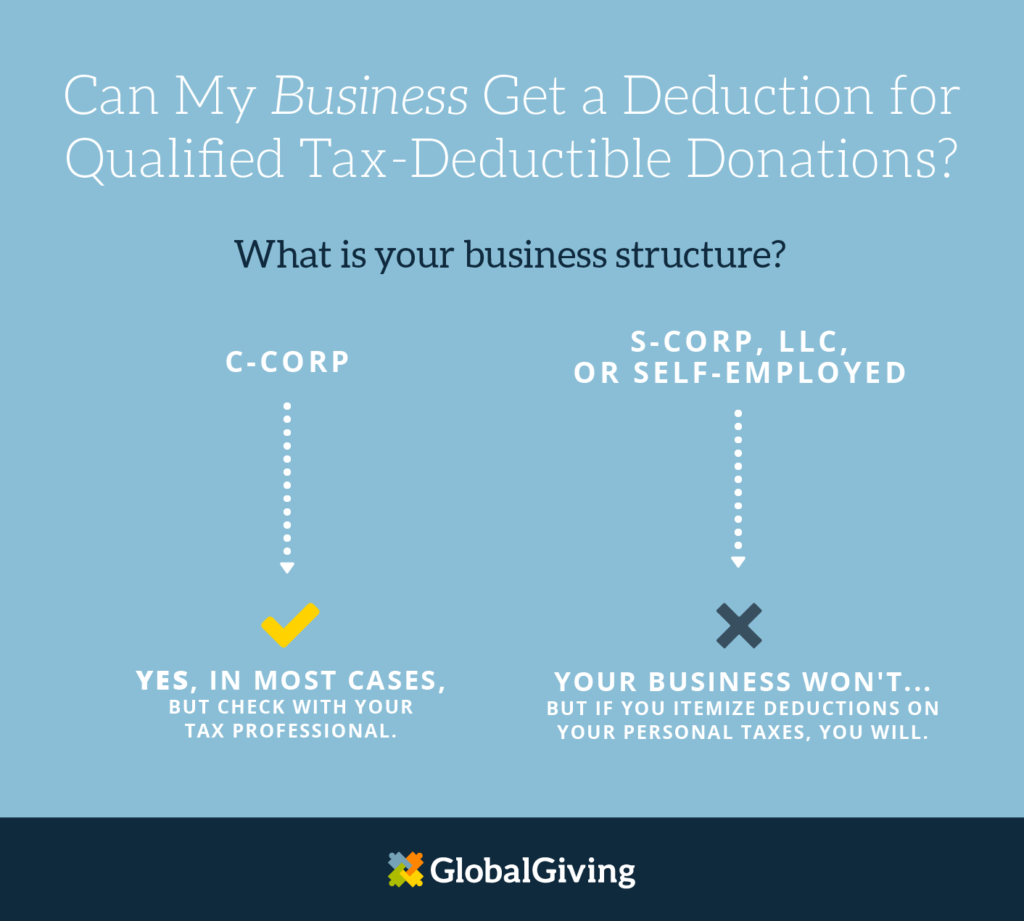

Everything You Need To Know About Your Tax Deductible

Everything You Need To Know About Your Tax Deductible

How To Reduce Your Income Tax In Singapore Make Use Of

How To Reduce Your Income Tax In Singapore Make Use Of

How To Reduce Your Income Tax In Singapore Make Use Of

How To Reduce Your Income Tax In Singapore Make Use Of

Raising Funds For Charity Dos Don Ts

Raising Funds For Charity Dos Don Ts

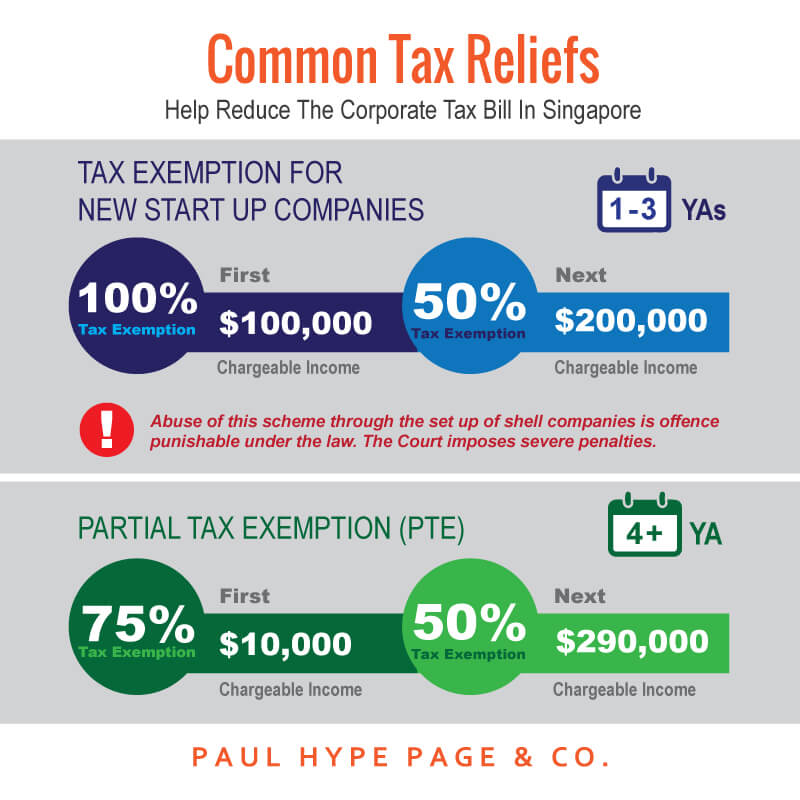

Facts About Corporate Taxes In Singapore Singapore Taxation

Facts About Corporate Taxes In Singapore Singapore Taxation

Chart Of Rev Rul 63 252 Deductibility Of Contributions

Facts About Corporate Taxes In Singapore Singapore Taxation

Facts About Corporate Taxes In Singapore Singapore Taxation

Malaysia Payroll And Tax Information And Resources