Income tax calculations and rrsp factoring for 202021 with historical pay figures on average earnings in canada for each market sector and location. Child and family benefits calculator you can use this calculator to see what child and family benefits you may be able to get and how much your payments may be.

Province Of Manitoba Fs Child Care Fees

Province Of Manitoba Fs Child Care Fees

how much is child tax in manitoba

how much is child tax in manitoba is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in how much is child tax in manitoba content depends on the source site. We hope you do not use it for commercial purposes.

Please use intuit turbotax if you want to fill your tax return and get tax rebate for previous year.

How much is child tax in manitoba. Use this canada child benefit calculator to figure out how much youre eligible for under the new plan compared to the old one. For purposes of illustration assume you operate a small business in manitoba selling stained glass ornaments and art objects that youve designed and need to know how to charge rst. The manitoba child benefit provides monthly benefits to lower income manitobans with dependent children in their care.

Please provide a photocopy of your current canada child tax benefit notice. Use the manitobas child support calculator on this page to get a base amount of what a monthly child support payment could be. Low income families may be eligible for up to 3500 per month per child.

Child disability benefit this is a tax free benefit for families who care for a child under the age of 18 who is eligible for the disability tax credit. Manitoba child support calculator. Working income tax benefit this is a refundable tax credit intended to provide tax relief for eligible working low income individuals and families who are already in the workforce.

It also provides parents with additional assistance to help with some of the costs of prescription eyeglasses for their children. This tax calculator is used for income tax estimation. By clicking calculate you agree that this website does not offer legal advice that a wide range of considerations influence the amount of any support a party is legally required to pay that this calculator adjusts payments for limited range of circumstances only does not account for all tax scenarios and should not be relied on or presented in court without.

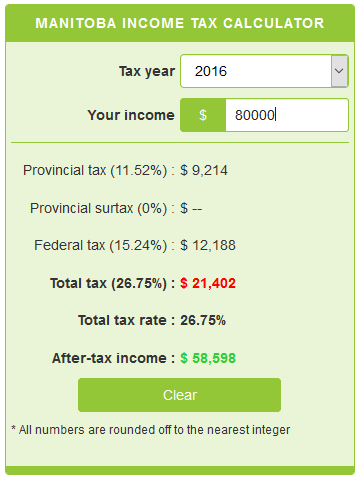

Manitoba income tax calculator for year 2012 2019. The manitoba income tax salary calculator is updated 202021 tax year. The manitoba child benefit program will use the net family income on this notice to determine your eligibility.

If you would prefer the manitoba child benefit program office can request a copy of your canada child tax benefit notice from the canada revenue agency. In manitoba provincial sales tax is called retail sales tax rst and is charged at a rate of 8. Current tax rates in manitoba and federal tax rates are listed below and check.

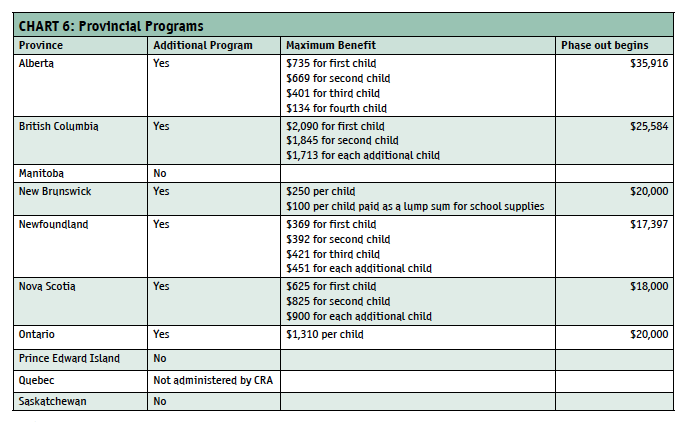

Manitoba is one of the few provinces where their own child support guidelines take precedent over that of the federal child support guidelines. Choose which province you live in input your gross family income.

Manitoba Income Tax Calculator Calculatorscanada Ca

Manitoba Income Tax Calculator Calculatorscanada Ca

5 Things To Know About The New Canada Child Benefit Cbc News

5 Things To Know About The New Canada Child Benefit Cbc News

Comparison Of Provincial And Territorial Child Benefits And

Employment And Income Assistance Winnipeg Living

Employment And Income Assistance Winnipeg Living

Canada Child Benefit Find Out How Much You Ll Get Under New

Canada Child Benefit Find Out How Much You Ll Get Under New

How To Use Rrsp Contributions To Maximize Child Tax Benefit

How To Use Rrsp Contributions To Maximize Child Tax Benefit

Provincial Child Tax Benefits Download Table

Provincial Child Tax Benefits Download Table

From Filling Tanks To Filing Taxes How The New Carbon Tax

From Filling Tanks To Filing Taxes How The New Carbon Tax

All Information You And Your Family Provide To Manitoba

All Information You And Your Family Provide To Manitoba

Ccb Understanding The Canada Child Benefit Notice Canada Ca

Ccb Understanding The Canada Child Benefit Notice Canada Ca

A Comparison Of The Carbon Tax Rebates To Families In