The 2018 child tax credit changes. What changes you should know about the child tax credit in 2019.

Earned Income Child Tax Credit Chart Pogot Bietthunghiduong Co

Earned Income Child Tax Credit Chart Pogot Bietthunghiduong Co

how much is child income tax credit 2018

how much is child income tax credit 2018 is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in how much is child income tax credit 2018 content depends on the source site. We hope you do not use it for commercial purposes.

Single head of household or widowed.

How much is child income tax credit 2018. How much is the child tax credit phase out limit. If you have young children or other dependents there is a good chance you qualify for the child tax credit. The child tax credit what it is and how much you can get.

These tables show rates and allowances for tax credits child benefit and guardians allowance by tax year 6 april to 5 april. What you need to know. The child tax credit offers up to 2000 per qualifying dependent child 16 or younger at the end of the calendar year.

2018 earned income tax credit. 3 limits you need to know. You should also keep in mind that the child tax credit begins to phase out at 200000 for single taxpayers and 400000 for joint taxpayers.

Income limit if 2 children. Working tax credit rates the maximum annual working tax credit. The child tax credit limit is locked in at 2000 per child.

Under the tax cuts and jobs act tcja the following new child tax credit rules went into effect in 2018 and apply to 2019 tax returns. You andor your child must pass all seven to claim this tax credit. Length of residency and 7.

In the past two years there have been notable changes to this tax credit. While a deduction reduces the amount of your income that is subject to tax a credit reduces your tax bill dollar for dollar. Income limit if 1 child.

Income limit if 3 children. There is a 500. This credit reduces your federal income tax bill by up to 2000 per child for the 2019 tax year what you file in early 2020.

The child tax credit can significantly reduce your tax bill if you meet all seven requirements. The child tax credit under tax reform is worth up to 2000 per qualifying child.

Earned Income Child Tax Credit Chart Pogot Bietthunghiduong Co

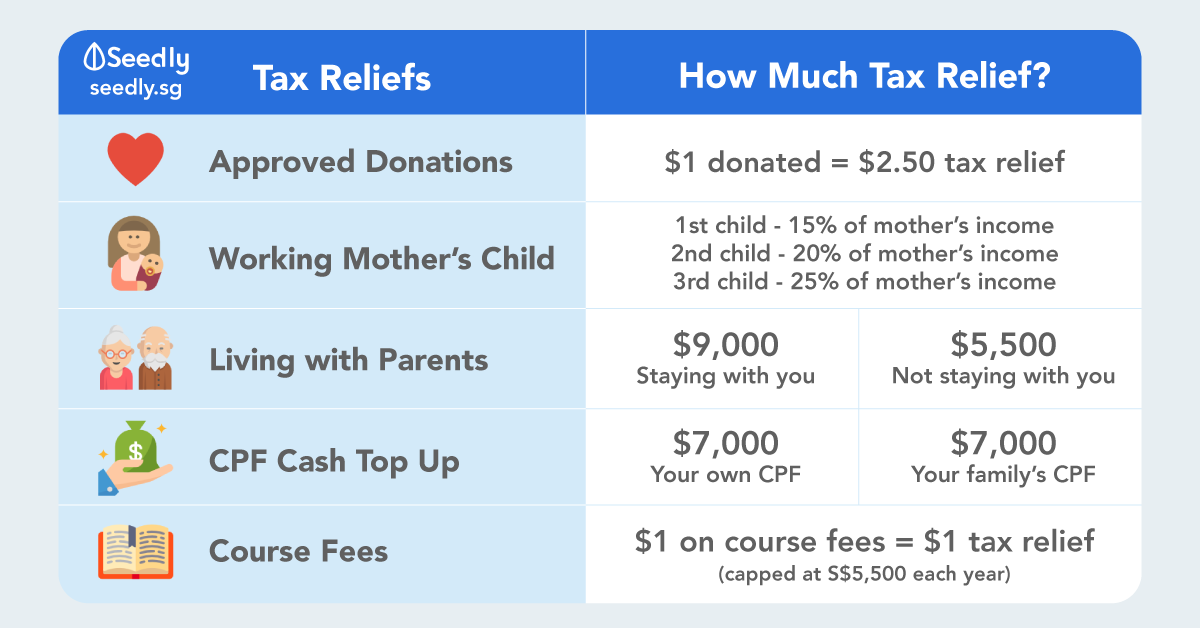

Your Cheat Sheet Personal Income Tax In Singapore Ya 2019

Your Cheat Sheet Personal Income Tax In Singapore Ya 2019

Low Income Working Families Get Little Or Nothing From House

Low Income Working Families Get Little Or Nothing From House

/cdn.vox-cdn.com/uploads/chorus_asset/file/18305764/4.4.5___figure_1.png) Tax Credit For Stay At Home Parents The New Proposal

Tax Credit For Stay At Home Parents The New Proposal

Earned Income Child Tax Credit Chart Pogot Bietthunghiduong Co

Earned Income Child Tax Credit Chart Pogot Bietthunghiduong Co

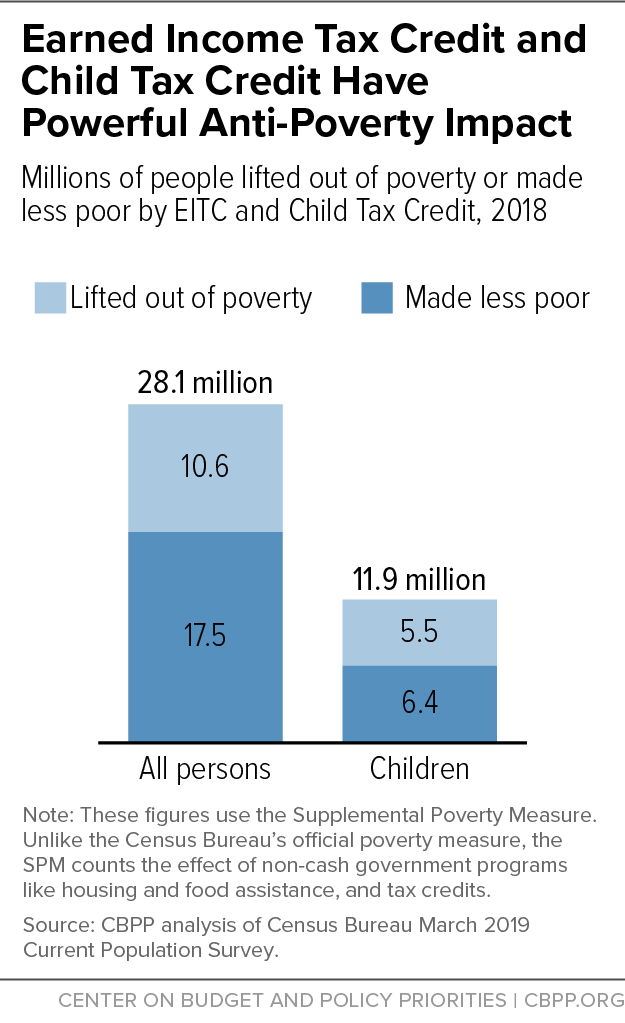

Earned Income Tax Credit And Child Tax Credit Have Powerful

Earned Income Tax Credit And Child Tax Credit Have Powerful

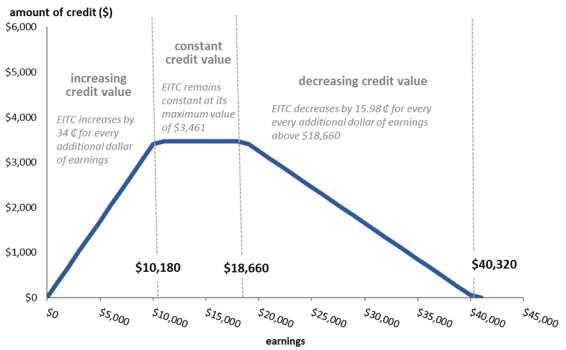

The Earned Income Tax Credit Eitc

The Earned Income Tax Credit Eitc

The Earned Income Tax Credit Helping Families At A

The Earned Income Tax Credit Helping Families At A

Want To Keep People Working Longer Expand The Earned Income

Want To Keep People Working Longer Expand The Earned Income

Earned Income Tax Credit For Households With One Child 2018

Earned Income Tax Credit For Households With One Child 2018

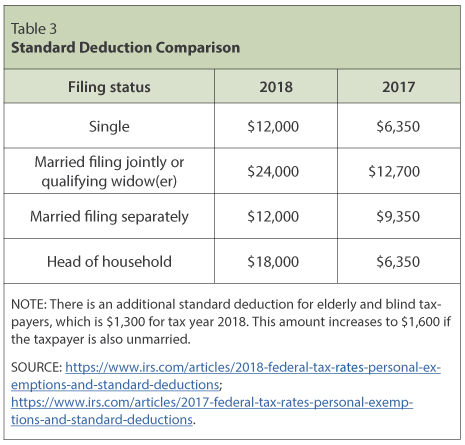

Individual Income Tax The Basics And New Changes St

Individual Income Tax The Basics And New Changes St