This means that money you collected from social security or pensions wont count. You are able to earn or receive up to 12500 in the 2019 20 tax year 6 april to 5 april and not pay any tax.

6 Ways You Can Legally Reduce Your Income Tax For Ya 2020

6 Ways You Can Legally Reduce Your Income Tax For Ya 2020

how much can you earn before paying tax when retired

how much can you earn before paying tax when retired is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in how much can you earn before paying tax when retired content depends on the source site. We hope you do not use it for commercial purposes.

You will likely not owe any tax on your benefits.

How much can you earn before paying tax when retired. How your pension is taxed. However if you have earned income during the tax year you may have to pay taxes on some of your social security earnings. You can normally withdraw up to 25 of your pension pot tax free.

If youre self employed and worried that youre paying too much tax or if you have any other questions about tax and self employment after state pension age you can contact your tax office. If you are over 65 you get access to the seniors and pensioners tax offset sapto. There are specific tax and superannuation issues you should consider if you are over 55.

Theres a limit to how much you can earn outside of your unearned income. A retired couple that is 65 or old that is filing jointly can earn up to 23300 combined without paying taxes. If you earn or receive less than this then youre a non taxpayer.

For married couples filing jointly the earned income limit is 23300 if both are over 65 or older and 22050 if only one of you has reached the age of 65. Income tax personal allowances. Paying tax on social security benefits.

Hm revenue customs hmrc or if youre newly self employed you can call the newly self employed helpline. However if you earn income. For those who have reached age pension age they can earn even more without paying tax.

If you do owe taxes. Retirement and taxes a single retire that is 65 or older can 11950 without paying taxes. This is called your personal allowance.

Those issues may vary depending on whether or not you are still working planning to retire about to make the transition into retirement or already retired. Retirement may mean long soothing days without a boss breathing down your neck to get the reports done. How much can i earn before paying taxes after age 65.

How much can i make before i have to pay. If youre 65 and older and filing singly you can earn up to 11950 in work related wages before filing. So you can earn another couple of thousand dollars before you have to pay tax.

Income Tax Relief 4 Things You Must Do Now Before Year End

Income Tax Relief 4 Things You Must Do Now Before Year End

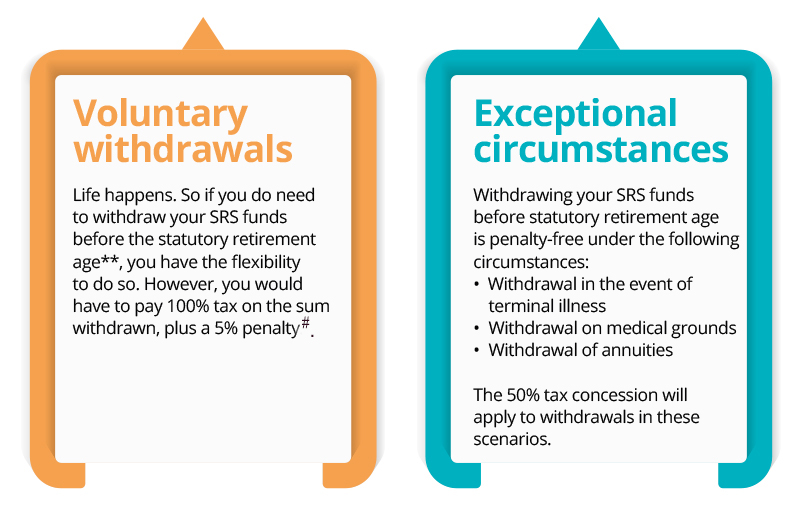

Supplementary Retirement Scheme Dbs Singapore

Supplementary Retirement Scheme Dbs Singapore

Income Tax Relief 4 Things You Must Do Now Before Year End

Income Tax Relief 4 Things You Must Do Now Before Year End

How Much Can We Earn In Retirement Without Paying Federal

How Much Can We Earn In Retirement Without Paying Federal

4 Ways To Reduce Your Income Tax In 2017

4 Ways To Reduce Your Income Tax In 2017

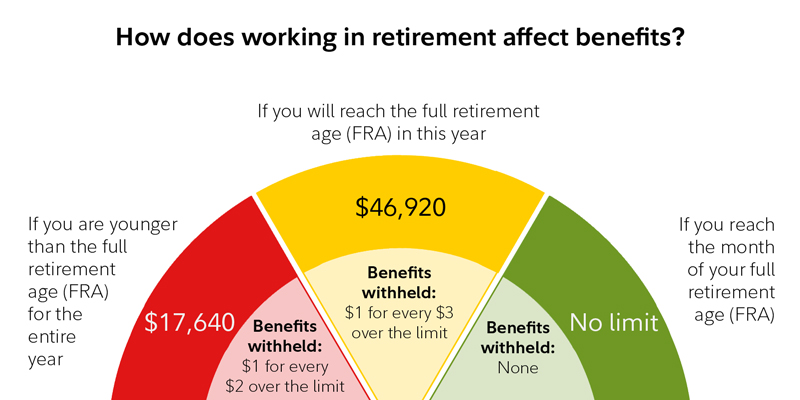

:max_bytes(150000):strip_icc()/Clipboard01-452705347a6e49ed8e82ca42d0a5cfa2.jpg) Paying Social Security Taxes On Earnings After Full

Paying Social Security Taxes On Earnings After Full

Learn About Social Security Income Limits

Learn About Social Security Income Limits

First Time Tax Payer Here Are 6 Tax Reliefs You May Not

First Time Tax Payer Here Are 6 Tax Reliefs You May Not

/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg) Are Social Security Benefits Taxable After Age 62

Are Social Security Benefits Taxable After Age 62

Working In Retirement Social Security Taxes Fidelity

Working In Retirement Social Security Taxes Fidelity

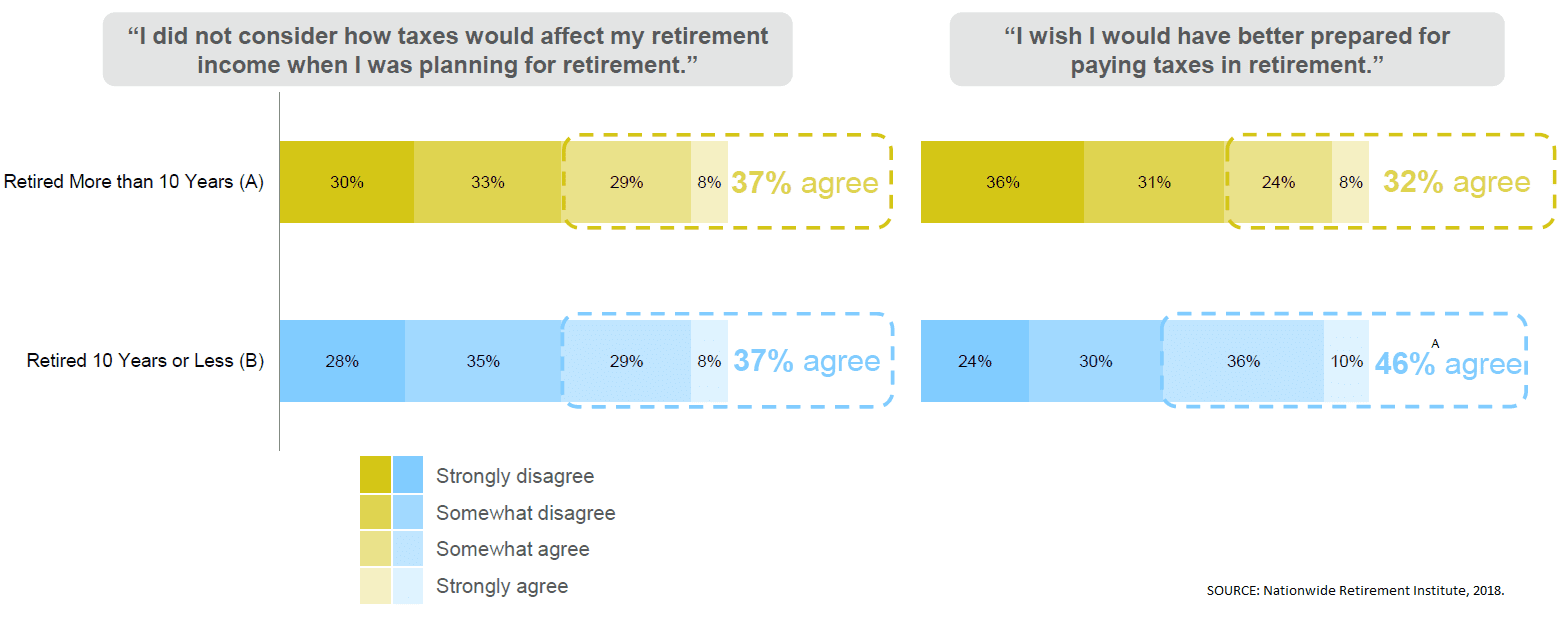

6 Ways To Cut Retirement Tax Surprises

6 Ways To Cut Retirement Tax Surprises