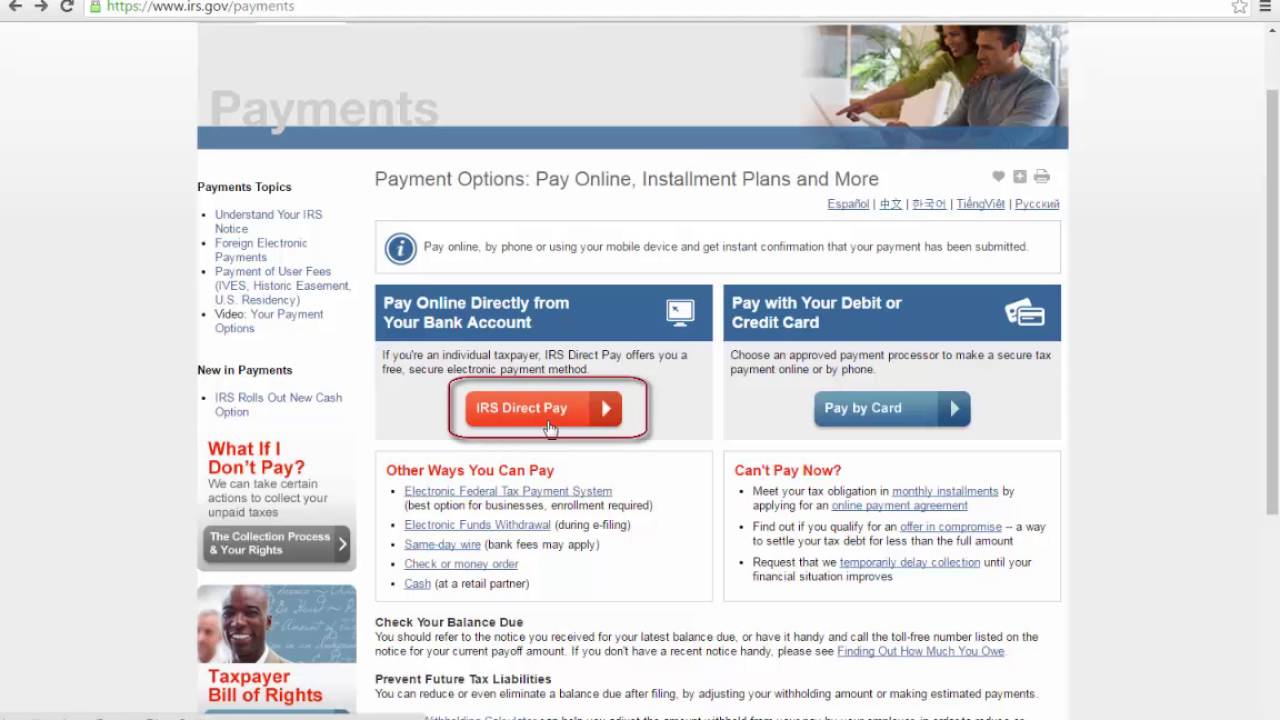

Payments internal revenue service. Penalties and interest may apply to money you owe after the due date.

How Do I Pay My Income Tax Online

How Do I Pay My Income Tax Online

how do you pay federal taxes online

how do you pay federal taxes online is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in how do you pay federal taxes online content depends on the source site. We hope you do not use it for commercial purposes.

Also we separately calculate the federal income taxes you will owe in the 2019 2020 filing season based on the trump tax plan.

How do you pay federal taxes online. Irs and state income tax payment options. Using the electronic federal tax payment system eftps is the easiest way for individuals as well as businesses to pay federal taxes. You can pay your personal and business taxes to the canada revenue agency cra through your financial institutions online banking app or website.

Your household income location filing status and number of personal exemptions. How to pay federal taxes online. Pay your taxes view your account or apply for a payment plan with the irs.

For taxpayers due a refund there is no penalty for filing a late return. Federal and state taxes usually have the same filing deadlines. If your payroll tax obligation is 100000 or more you must deposit the next day and you must continue to make next day deposits for the rest of that year and the following year.

Each period has a pay online by phone or by mail refer to the section of form 1040 es titled how to pay estimated tax for additional information refer to publication 505 tax withholding and estimated tax. How to pay estimated taxes. If you do not file and pay your taxes on time you will be charged interest and a late payment penalty.

Most financial institutions also let you set up a payment to be made on a future date. Use this option to make a payment for your current tax return. If it ends up that you pay too muchyour tax bill is less than you thought it was after you spent some time finalizing your returnthe irs will send you a refund just as it would if you had overpaid all year through withholding from your paychecks.

The process is easy once youve enrolled and online filers often receive quicker refunds. Besides mailing your payment you can pay online by debit or credit card which incurs a convenience fee or by using the eftps system which has no fee but you have to enroll. How income taxes are calculated.

Deposit taxes from payrolls paid on wednesday thursday or friday by the following wednesday. Our income tax calculator calculates your federal state and local taxes based on several key inputs. You no longer have to race to the post office at the last minute to pay your taxes on april 15.

The irs makes it possible for you to file online. To make sure you file on time find out the tax filing due dates in your state. If you do not have the money to pay remit at least as much as you can.

You have a range of options for submitting estimated tax payments.

3 Ways To Pay Federal Taxes Wikihow

3 Ways To Pay Federal Taxes Wikihow

How To Pay Quarterly Estimated Taxes Online

How To Pay Quarterly Estimated Taxes Online

3 Ways To Pay Federal Taxes Wikihow

3 Ways To Pay Federal Taxes Wikihow

I Tried 11 Websites That Let You File Your Taxes Online For

I Tried 11 Websites That Let You File Your Taxes Online For

Tax Online Direct Tax Online Payment

How To Pay Federal Estimated Taxes Online To The Irs

How To Pay Federal Estimated Taxes Online To The Irs

How To Pay Taxes Online Pay State Federal Taxes Online

How To Pay Taxes Online Pay State Federal Taxes Online

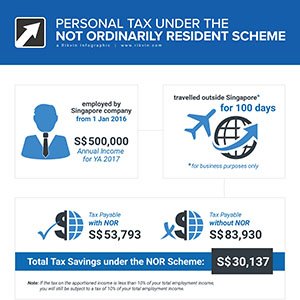

Personal Income Tax Guide For Foreigners In Singapore

Personal Income Tax Guide For Foreigners In Singapore

You Can Now Download Your Tax Return Transcripts From The

How To Pay Federal Taxes Online By Johnmilton Issuu

How To Pay Federal Taxes Online By Johnmilton Issuu