The state has some of the lowest property taxes in the country. Social security income is taxed.

Can Social Security Be Garnished Bankrate Com

does south carolina tax social security disability

does south carolina tax social security disability is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in does south carolina tax social security disability content depends on the source site. We hope you do not use it for commercial purposes.

One option is to visit your local south carolina social security office to complete a paper disability application.

Does south carolina tax social security disability. There are three different ways you can complete the application for social security benefits. Social security offices in south carolina. There are no taxes on disability benefits in south carolina whether they are ssdi benefits or ssi benefits.

South carolina does not tax social security retirement benefits and has a 15000 deduction for seniors receiving any other type of retirement income. You can find the closest social security location on the ssas website. North carolina exempts all social security retirement benefits from income taxes.

Browse a list of south carolina. South carolina does not offer temporary disability benefits though some employers offer both long term and short term disability policies through private insurance companies. In south carolina you can apply for ssdi or ssi through your local social security office.

Applying for social security disability in south carolina. When social security benefits are issued for disability or retirement these payments become an individuals source of income. Social security lawyers work on a contingency basis collecting 25 percent of the back pay you are awarded up to a limit of 6000.

Social security income is taxed. Are there taxes on disability benefits in south carolina. The states property and sales taxes are both moderate.

What other tax benefits may be available to disabled persons in south carolina. Some states tax social security disability benefits only when the recipients agi is under a certain amount while other states that tax disability benefits in the same way the irs does. Withdrawals from retirement.

Its important to weigh other taxes including state and local. Employees pay for social security benefits with each paycheck and self employed individuals also pay social security disability as part of their larger tax burden. South carolina does not tax social security benefits or railroad retirement income.

To compare south carolinas tax rates with other states look at each states total tax package not just the tax rates. Other forms of retirement income are taxed at the north carolina flat income tax rate of 525. Keep in mind that a tax on social security isnt the sole factor in determining whether a state is truly tax friendly for retirees.

Of course these benefits are subject to federal taxes. For example some states may have a lower individual income tax rate but tax social security benefits. If you do not win your disability case your south carolina social security disability attorney does not collect a fee.

Social Security Vannoy Murphy Attorneys At Law

Chart Book Social Security Disability Insurance Center On

Why Are Social Security Disability Benefits Taxed

Social Security Taxation Of Benefits Everycrsreport Com

States That Offer The Biggest Tax Relief For Retirees

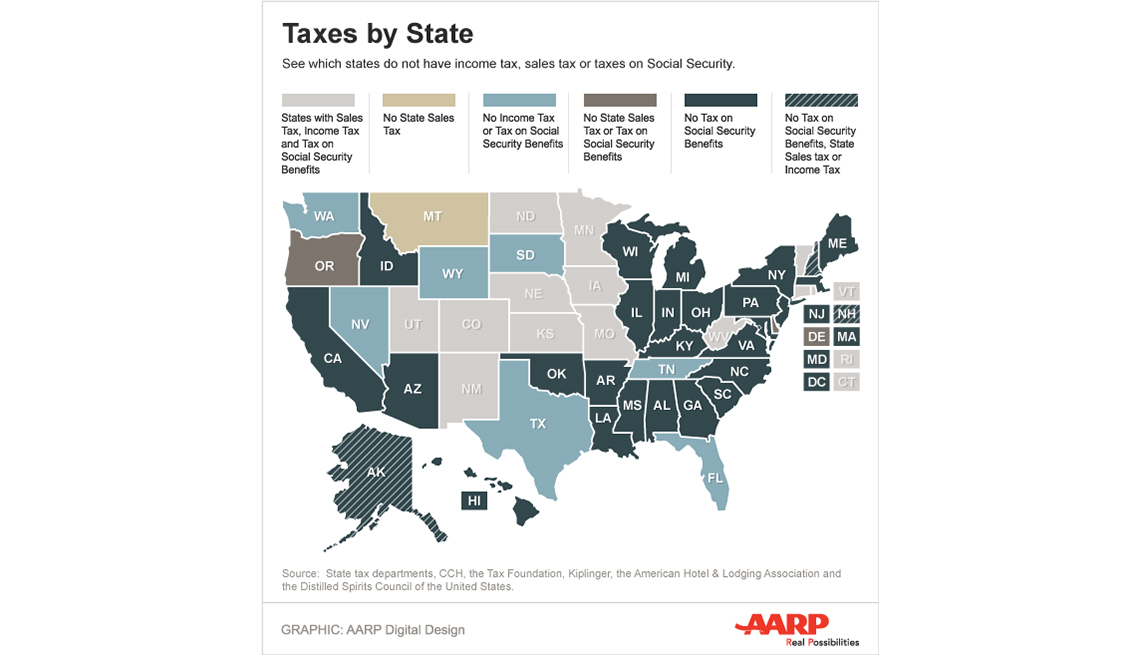

37 States That Don T Tax Social Security Benefits The

Social Security Infographics Visual Ly

Your Social Security Check Will Get A 2 8 Boost In 2019

The Facts On Social Security Disability Insurance And

Why You Shouldn T Rely On Social Security Disability

13 States That Tax Social Security Income The Motley Fool