For further detail you must read the below listed key difference between sales tax and withholding tax. From the point of view of a layman providing services means assistance in any work taking up of any work on.

U S Property Taxes Comparing Residential And Commercial

difference between sales tax and property tax

difference between sales tax and property tax is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in difference between sales tax and property tax content depends on the source site. We hope you do not use it for commercial purposes.

First of all lets start with basic definition and meaning service tax it is a form of indirect tax imposed only on services provided.

Difference between sales tax and property tax. All are kinds of sales tax. The main difference between sales tax and use tax is that sales tax is remitted to the illinois department of revenue by a registered retailer or service person but use tax is paid directly to the department of revenue by the purchaser because tax was not collected when the merchandise was sold. Federal excise duty customs duties gross receipts tax value added tax general sales tax fair tax turnover tax etc.

Sales tax is paid when you purchase something and is added to the sales price. Sales tax is a pass through tax similar to vat in the uk in that a merchant must collect this from customers and then. Following are the main points which clear you the difference between the sales tax and the withholding tax from each other.

It may be paid to a national government a federated state. A sales tax is a government levy that is payable on the sales of described goods and services. Check out difference between debit card and credit card in pakistan.

Property tax is an annual assessment that is levied continually. Personal property tax is an annual tax which is based on the current value of the property. Use tax is defined as a tax on the storage use or consumption of a taxable item or service on which no sales tax has been paid.

Normally the rate of sales tax remained fixed for each goods and service category separately. Individuals pay federal and unless youre lucky enough to live in a state without it state income tax. Sales tax franchise tax and property tax.

A property tax or millage tax is a levy on property that the owner is required to pay. Use tax applies to purchases made outside the taxing jurisdiction but used within the state. Income tax is a direct tax paid by individuals on their income sales tax is a pass through tax charged on a sale.

Use tax is a complementary or compensating tax to the sales tax and does not apply if the sales tax was charged. What is the difference between sales tax and personal property tax. Difference between sales tax and withholding tax.

Understanding us business taxes. The tax is levied by the governing authority of the jurisdiction in which the property is located. The differences between income tax and sales tax in a nutshell.

Sales tax is a one time tax which is collected at the point of sale.

U S Property Taxes Comparing Residential And Commercial

What Is Tax Liability Definition Examples More

What Is Tax Liability Definition Examples More

What Is The Difference Between Sales Tax And Vat

What Is The Difference Between Sales Tax And Vat

Comparing The Value Added Tax To The Retail Sales Tax

Comparing The Value Added Tax To The Retail Sales Tax

State And Local Sales Tax Rates 2019 Tax Foundation

State And Local Sales Tax Rates 2019 Tax Foundation

Sales Taxes In The United States Wikipedia

Sales Taxes In The United States Wikipedia

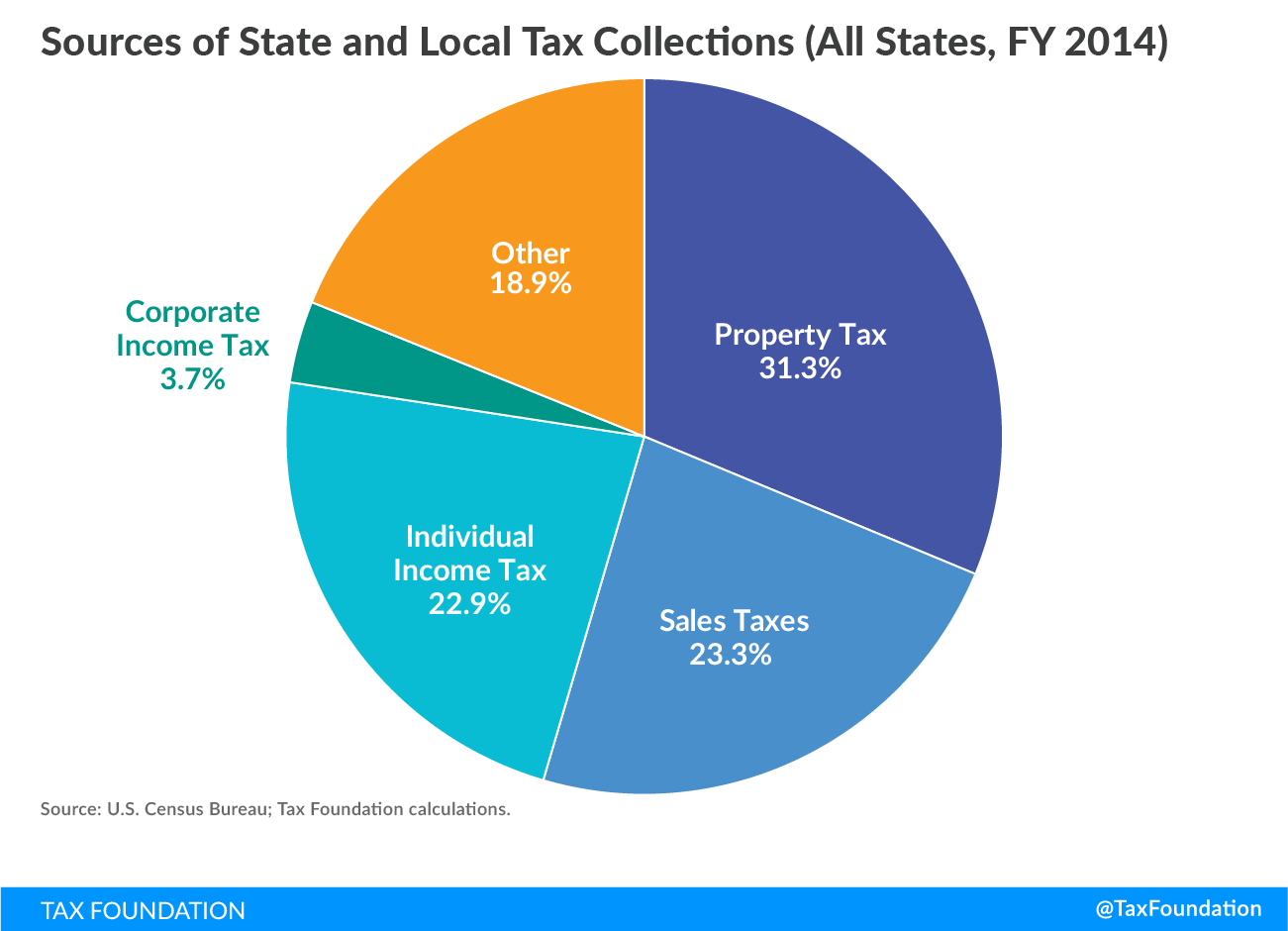

State Local Tax Toolkit Sources Of Tax Collections Tax

State Local Tax Toolkit Sources Of Tax Collections Tax

Sales Tax By State Are Grocery Items Taxable

Sales Tax By State Are Grocery Items Taxable

The U S Corporate Effective Tax Rate Myth And The Fact

The U S Corporate Effective Tax Rate Myth And The Fact

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345_FINAL-5c0fe47cc9e77c0001ec54a0.png) States That Do Not Tax Earned Income

States That Do Not Tax Earned Income