Earn more than 45000 per year. Taxation of deasp pensions.

3 Steps To Claim Back Tax On Pension Contributions

3 Steps To Claim Back Tax On Pension Contributions

claim back tax relief on pension contributions

claim back tax relief on pension contributions is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in claim back tax relief on pension contributions content depends on the source site. We hope you do not use it for commercial purposes.

You may be able to claim tax relief on pension contributions if.

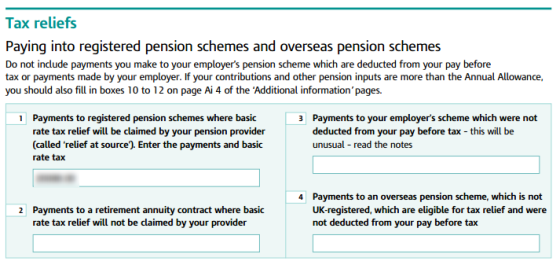

Claim back tax relief on pension contributions. If you are self employed. Even if an individual has no earnings they will still be able to claim tax relief on any pension contributions they make by relief at source up to the limit of 3600. If your employer does not deduct the contributions use myaccount to claim tax relief.

Relief at source is the only method that allows members to get this extra tax relief on contributions that exceed their relevant uk earnings up to 3600. If youre paying contributions into certain types of pension scheme such as a retirement annuity contract that you started before 6 april 1988 and your contribution is not treated as paid net of basic rate income tax relief you can claim back all tax relief due both basic rate and any higher rate relief from hmrc. Contribute into a personal pension like a pensionbee pension contribute from your personal bank account.

You can claim back extra income tax on the contributions youve made if you. If you contribute into your current workplace pension tough luck. For more information on how you can claim tax relief in your form 11 see help claiming a relief for pension contributions.

You pay income tax at a rate above 20 and your pension provider claims the first 20 for you. When you have to claim tax relief. Sign into ros to claim tax relief.

Tax relief on pension contributions explained find out how the government tops up your pension savings in the form of pension tax relief and use our pension tax relief calculator to see how much youll get. When to claim or not to claim.

Income Tax Relief 4 Things You Must Do Now Before Year End

Income Tax Relief 4 Things You Must Do Now Before Year End

Claiming Tax Relief For Pension Contribution In Your Form 11

Claiming Tax Relief For Pension Contribution In Your Form 11

Claiming Extra Pension Tax Relief For High Earners Iexpats

Claiming Extra Pension Tax Relief For High Earners Iexpats

6 Ways You Can Legally Reduce Your Income Tax For Ya 2020

6 Ways You Can Legally Reduce Your Income Tax For Ya 2020

Income Tax Relief 4 Things You Must Do Now Before Year End

Income Tax Relief 4 Things You Must Do Now Before Year End

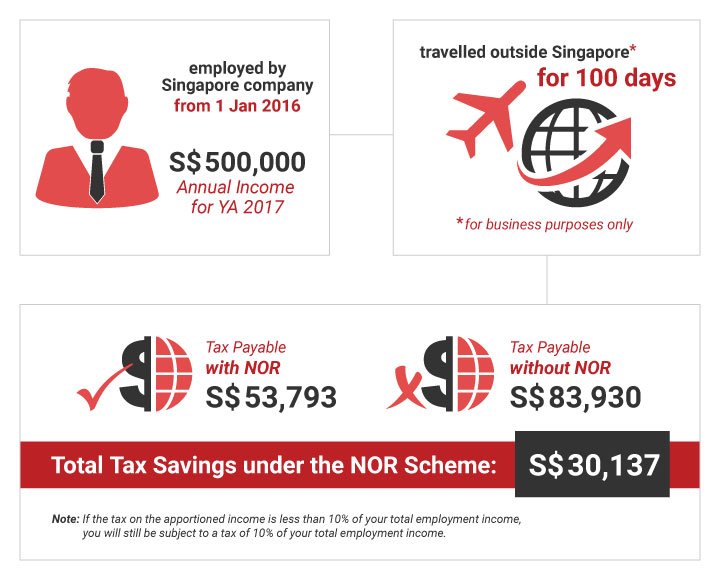

Not Ordinarily Resident Scheme Nor Taxation Guide

Not Ordinarily Resident Scheme Nor Taxation Guide

Iras Parent Relief Handicapped Parent Relief

Iras Parent Relief Handicapped Parent Relief

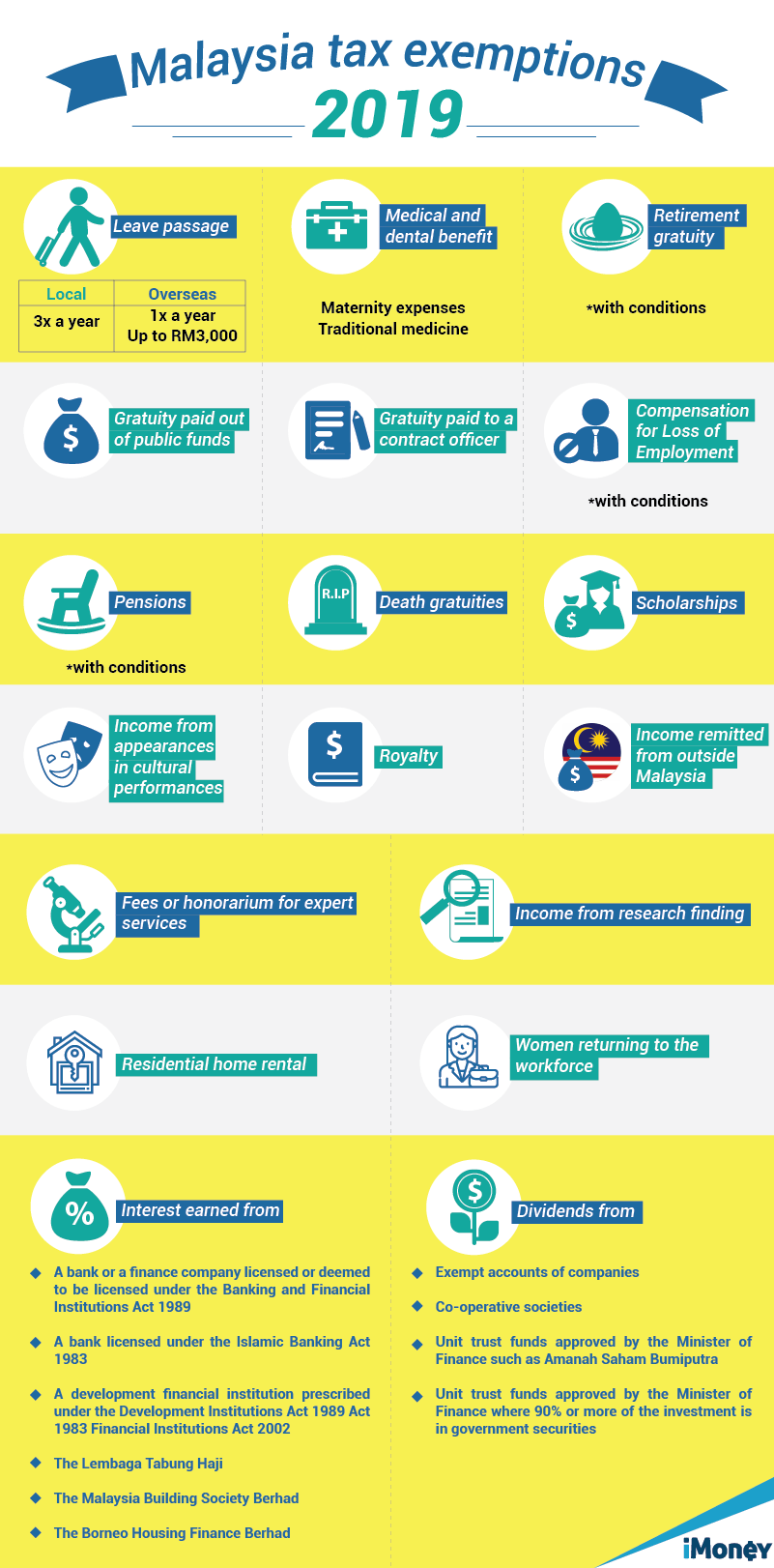

Get More Tax Exemptions For Income Tax In Malaysia Imoney

Get More Tax Exemptions For Income Tax In Malaysia Imoney

Pensions Tax Reliefs Pdf Free Download

Pensions Tax Reliefs Pdf Free Download