The married filing separately mfs status provides fewer tax benefits however. Can you file your personal income tax and your.

Should I File Taxes Jointly Or Separately If I M Married

can i file personal and business taxes separately

can i file personal and business taxes separately is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in can i file personal and business taxes separately content depends on the source site. We hope you do not use it for commercial purposes.

You can only file your personal and business taxes separately if your company it is a corporation according to the irs.

Can i file personal and business taxes separately. Youll be disqualified from claiming several advantageous deductions and credits and your income phaseout limits for other deductions will be more prohibitive. While this answer really does vary on a case by case basis generally you can file separately if you are considered the employee of a business and paid a wage. I work full time so i am filing my taxes but i also owned a small software business on the side.

I own my own business and im a married business owner. So can i separate my personal and business taxes. How should i file should i file jointly with my husband for our personal income and file a separate business return.

You will also have to file the 1040 se self employment tax and the 1040 c profit or loss from a proprietorship as part of your regular income. Can i file my business taxes separate from my personal taxes. I have a question related to filing taxes when married with a business.

If you are a sole proprietor or single member llc that is unincorporated and reporting your business income and expenses on form 1040 schedule c then no you cannot do the schedule c separate from the form 1040. It depends which business entity you are. The earned income credit cant be claimed if you file married filing separately.

Corporations are the one type of business structure where we are almost always filing business and personal taxes separate. I am trying to keep them separate but afraid if i file taxes and then try to setup another account and file again with my business it wont let me. Self employed taxpayers can deduct the business part of interest on car loans parking fees and tolls and property tax on the car.

Should i file my taxes as an employee normally and then business separately or all together. A corporation is a business thats seen as an entity separate from its owners that pays its own tax. If you are a sole proprietor you would file your business income and expenses on schedule c which is filed with your personal income tax returnyou cannot file a separate tax return for the business.

Can i file my personal and business taxes separately. Married taxpayers can file joint tax returns together or they can file separate returns. In general yes if your business is a proprietorship.

If you are a single member llc you would file your business income and expenses on schedule c which is filed with your personal income tax return. Or just file business taxes. Keeping your business and personal taxes separate is complicated and the risks of getting it wrong could prove quite costly.

Let an experienced tax attorney help you with your small business. Can i file my personal and business taxes separately. It can be claimed by all.

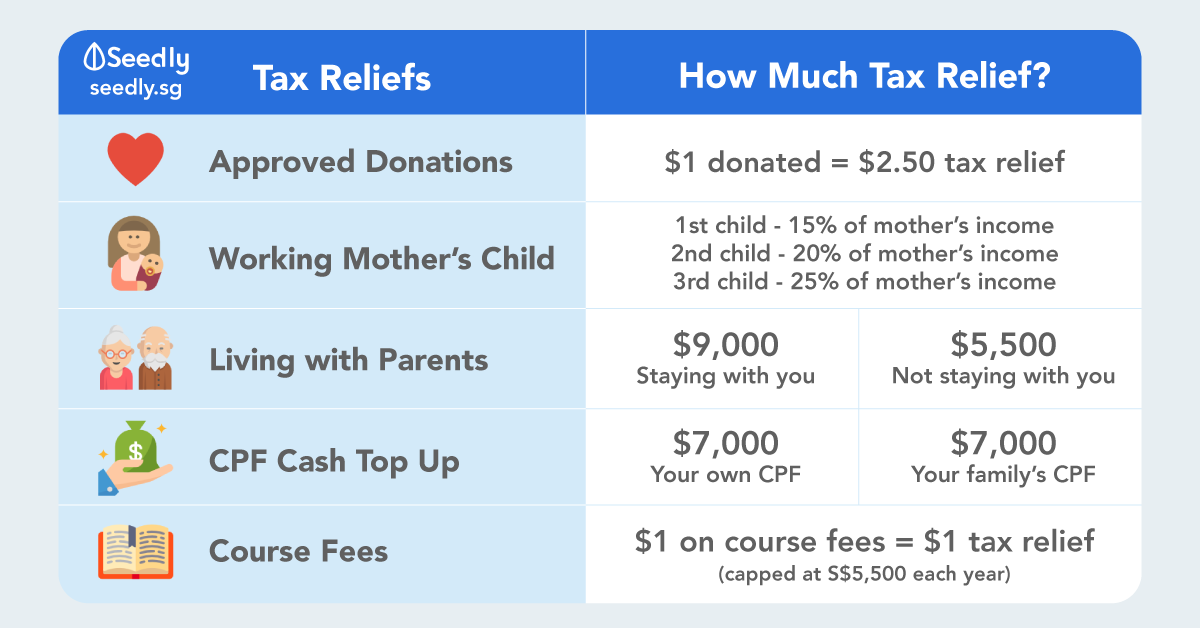

Your Cheat Sheet Personal Income Tax In Singapore Ya 2019

Your Cheat Sheet Personal Income Tax In Singapore Ya 2019

Council Post 13 Advantages Of Keeping Personal And Business

Council Post 13 Advantages Of Keeping Personal And Business

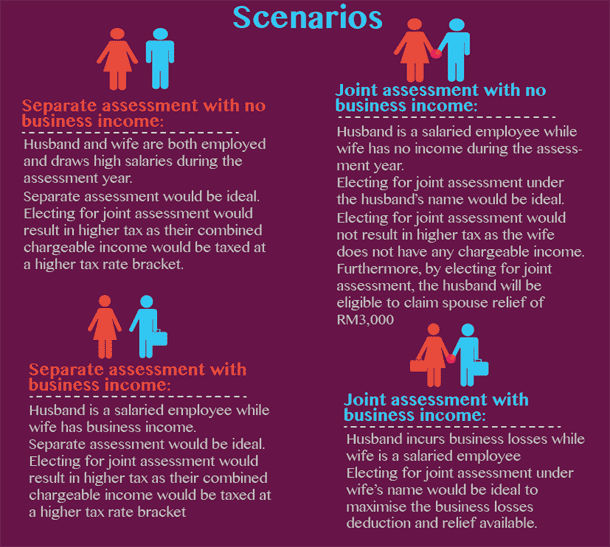

Chart Should You And Your Spouse File Taxes Jointly Or

Chart Should You And Your Spouse File Taxes Jointly Or

Should You Your Spouse File For Joint Income Tax

Should You Your Spouse File For Joint Income Tax

Should I Setup Separate Company For Every Business In Singapore

Should I Setup Separate Company For Every Business In Singapore

How To Separate Your Personal And Business Finances And Why

How To Separate Your Personal And Business Finances And Why

Why Is It Important To Separate Personal And Business Finances

Why Is It Important To Separate Personal And Business Finances

How To File For A Tax Extension

Ask A Tax Expert Is It Better To File Your Taxes Jointly Or

Ask A Tax Expert Is It Better To File Your Taxes Jointly Or

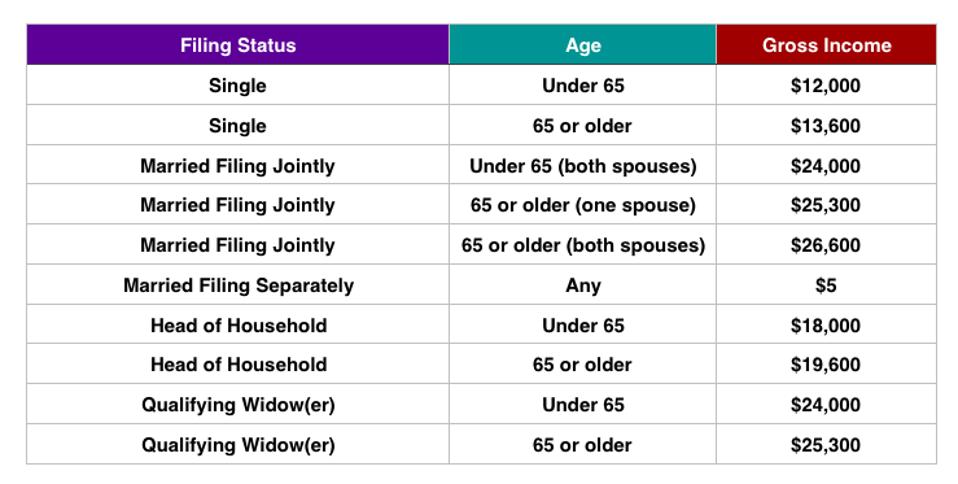

Do You Need To File A Tax Return In 2019

Do You Need To File A Tax Return In 2019

Keep Your Business And Personal Finances Separate Business

Keep Your Business And Personal Finances Separate Business