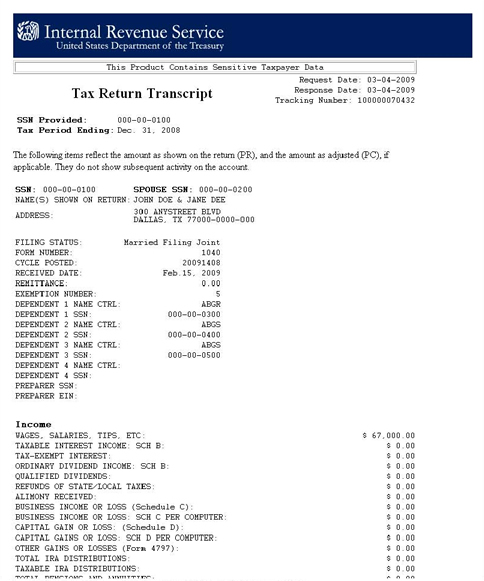

Information can be verified by obtaining a tax transcript from the irs and submitting. Upon authentication of the tax filers identity the irs will provide by us.

Irs Tax Return Transcript Financial Aid

Irs Tax Return Transcript Financial Aid

2015 irs tax return transcript for fafsa

2015 irs tax return transcript for fafsa is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in 2015 irs tax return transcript for fafsa content depends on the source site. We hope you do not use it for commercial purposes.

Postal service a printout of the tax filers 2015 irs income tax return information.

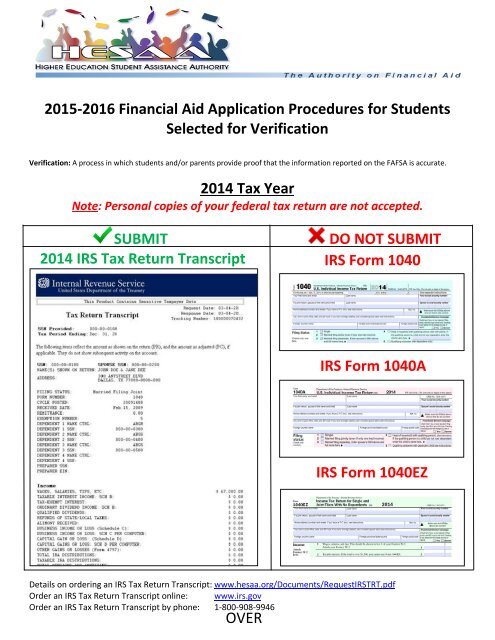

2015 irs tax return transcript for fafsa. Available for the irs data retrieval tool for electronic irs tax return filers and up to eight weeks for paper irs tax return filers. It is the students responsibility to submit the verification worksheet and applicable tax documents to the financial aid office. An individual who was the victim of irs tax related identity theft must provide.

Irs tax return transcript request 20162017 and 20172018 fafsa2015 irs tax return transcript if you have been selected by the department of education for verification there are two options available for you to get that. We will not accept tax documents sent directly from the irs. You can get various form 1040 series transcript types online or by mail.

2015 irs tax return transcript. A statement signed and dated by the tax filer indicating that he or she was a victim of irs tax related identity theft and that the irs is aware of the tax related identity theft. A tax return data base view trdbv transcript obtained from the irs and.

You should always retain a copy of your tax return either electronically or on paper and keep it in a secure place. A victim of irs identity theft who is not able to obtain a 2015 irs tax return transcript or use the irs drt must contact the irs at 1 800 908 4490. Select option 2 to request an irs tax return transcript not tax account transcript and then enter 2014.

If successfully validated tax filers can expect to receive a paper irs tax return transcript at the address provided in their telephone request within 5 to 10 days from the time of the request. Applicants filing a 2020 21 fafsa form must use federal tax information from their 2018 tax returns. Students who are selected for verification must have income and tax information verified directly by the irs.

When you completed the 2016 2017 fafsa you were given the option to link to the irs website to download your your spouses or parents 2015 1040 information directly onto your. They can do this by using the irs drt or by referring to a copy for their 2018 tax return that they have in their possession. If you are unable or choose not to use the irs data retrieval tool in fafsa on the web you must submit a 2015 irs tax return transcriptnot a photocopy of the income tax return.

If you need your prior year adjusted gross income agi to e file choose the tax return transcript type when making your requestif you only need to find out how much you owe or verify payments you made within the last 18 months you can view your tax account.

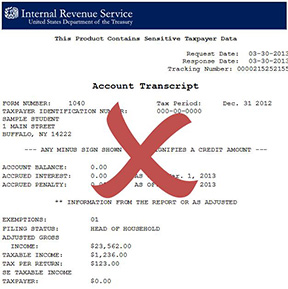

Tax Return Tax Return Vs Transcript

Irs Income Tax Irs Income Tax Transcript

Irs Tax Return Transcript Financial Aid

Irs Tax Return Transcript Financial Aid

Sample Of An Irs Tax Return Transcript And A Schedule E

Sample Of An Irs Tax Return Transcript And A Schedule E

Office Of Financial Aid Verification Frequently Asked

Office Of Financial Aid Verification Frequently Asked

Tax Return An Irs Tax Return Transcript

Irs Tax Return Transcript Request Process Oxnard College

Irs Tax Return Transcript Request Process Oxnard College

Amended Tax Return You The Parents Filed An Amended Tax Return

Irs Tax Transcripts Financial Aid Office Suny Buffalo

Ncasfaa 2015 Fall Pre Conference New Aid Officers Training

Ncasfaa 2015 Fall Pre Conference New Aid Officers Training