This is not the case. Some general tax guidance for first time workers which apprentices may find useful can be found in our employment section.

Apprenticeship Levy Training National Insurance Pay As You

Apprenticeship Levy Training National Insurance Pay As You

do apprentices pay tax and national insurance

do apprentices pay tax and national insurance is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in do apprentices pay tax and national insurance content depends on the source site. We hope you do not use it for commercial purposes.

Apprentices have to pay income tax in the same way as everyone else.

Do apprentices pay tax and national insurance. Conditions shown above then you will not have to pay national insurance contributions. Anything over that total will of course be subject to the standard income tax. This means that you will have to pay income tax and national insurance contributions nics in the same way as everyone else.

Unlike income tax national insurance is not an annual tax. Employer contributions for apprentices under 25 who is likely to be affected. Do apprentices pay national insurance.

National insurance contributions are a tax on earnings paid by employees and employers and help to build your entitlement to certain state benefits such as the state pension and maternity allowance. Apprentices are employees and they are treated as such for tax purposes. You can check the level of contributions payable and find out more about national insurance in our working section.

Employers of apprentices under the age of 25. There are two types of tax credit working tax redit wt and hild tax redit t. There is a common misconception that apprentices do not have to pay tax.

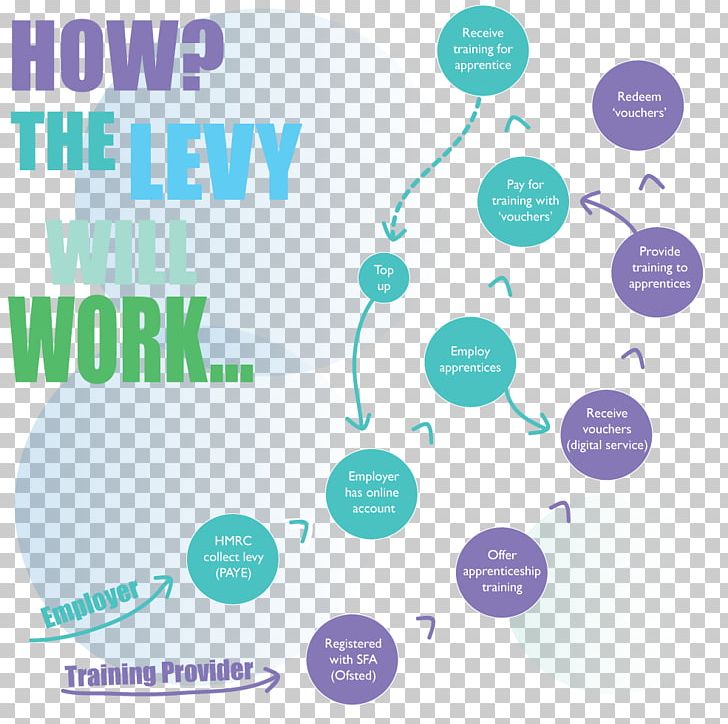

For the 20182019 tax year if they earn more than 162 per week then they have to make their contribution nic. Factsheet for apprentices which contains further information on the national minimum wage how you are taxed national insurance contributions and tax credits factsheet on pension automatic enrolment you can read more about apprentices on the main litrg website in the disabled people and carers guidance. General description of the measure from april 2016 employers of apprentices under the age of 25 will no longer be required to pay secondary class 1 employer national insurance contributions nics on earnings up to.

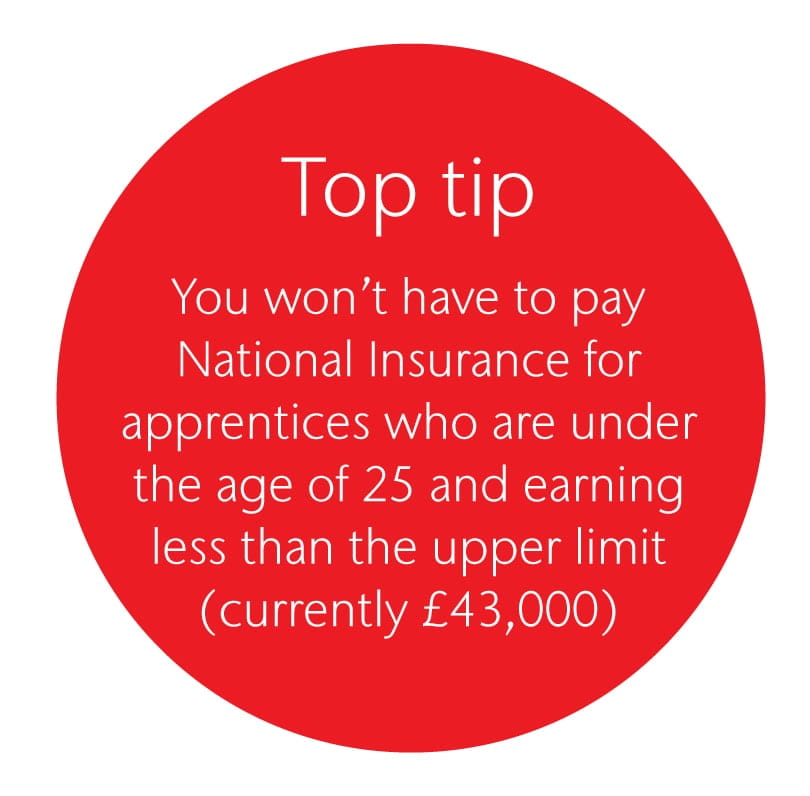

From 6 april 2016 if you employ an apprentice you may not need to pay employer class 1 national insurance contributions nics on their earnings below 827 a week 43000 a year. This is not the case. Can apprentices claim tax credits.

There is a common misconception that apprentices do not have to pay tax. The type theyll pay is a class 1 nics. If you employ an apprentice under the age of 25 you may no longer have to pay employer class 1 national insurance contributions on their earnings up to the new apprentice upper secondary threshold.

Benefits What Is Involved Types Of Apprenticeships Page 2

Benefits What Is Involved Types Of Apprenticeships Page 2

Helping Businesses To Grow With Apprentices Ppt Download

Benefits What Is Involved Types Of Apprenticeships Page 2

Benefits What Is Involved Types Of Apprenticeships Page 2

Apprenticeship Funding Ppt Download

Apprenticeship Funding Ppt Download

Student Services Presentation 3 Simon

Student Services Presentation 3 Simon

Hr Services Consultant Banstead By Ramshaw Hr Issuu

Hr Services Consultant Banstead By Ramshaw Hr Issuu

Pathway Apprenticeships Event For Saf

Pathway Apprenticeships Event For Saf

How Much Should Apprentices Be Paid Employer Advice

How Much Should Apprentices Be Paid Employer Advice