Claim the ontario energy and property tax credit if you have a low to middle income and you live in ontario. You claim rental income and expenses on form t776.

can i claim property taxes in ontario

can i claim property taxes in ontario is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in can i claim property taxes in ontario content depends on the source site. We hope you do not use it for commercial purposes.

You can claim the property tax credit if all of the following conditions apply.

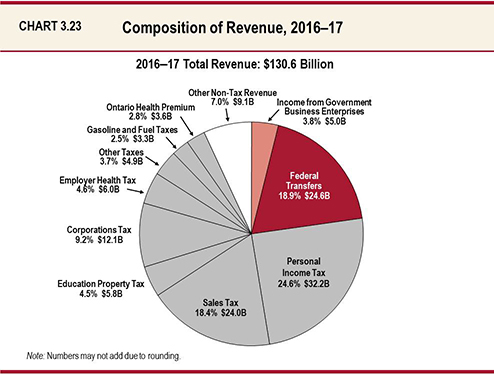

Can i claim property taxes in ontario. The 7 tax deductions ontario business owners can claim for in 2018. If you pay taxes on your personal property and owned real estate they may be deductible from your federal income tax bill. Most state and local tax authorities calculate property taxes based on the value of the homes located within their areas and some agencies also tax personal property.

The credit is calculated based on your family income for the year. Property taxes offer another way to lower your tax bill. This tax credit is part as part of the ontario trillium benefit.

Application for the ontario trillium benefit and the ontario senior homeowners property tax grant form. You can write off a number of different items on your taxes including employment expenses legal expenses etc. Generally at the start of each year you will receive notice of your tax liability that can be included in your tax calculation.

Both the otb and oshptg are designed to help low to moderate income ontario residents with costs such as energy sales tax property tax and more. The on ben form is used to claim the ontario trillium benefit otb and ontario senior homeowners property tax grant oshptg. This tax credit helps with rent and property taxes paid to your municipal government.

A prepaid expense is an expense you paid for ahead of time. Common rental property expenses include home insurance heat hydro water and mortgage insurance. Under the accrual method of accounting claim the expense you prepay in the year or years in which you get the related benefit.

Dont forget to include property taxes you may have reimbursed sellers. Ontario energy and property tax credit. Eligibility requirements basic requirements.

Claim tax deductions for any expenses related to your rental property. Under the cash method of accounting you cannot deduct a prepaid expense amount other than for inventory relating to a tax year that. With so many different things to consider weve compiled a list of the seven tax deductions you could claim as an ontario business owner.

For individuals under age 65 the combined maximum amount of property and sales tax credits you can receive in one taxation year is 1000. Information on which rental expenses you can deduct. You were a resident of ontario on december 31.

Claim the full amount of expenses if it is. Include rent collected from tenants as rental income in the current tax year. If you pay either type of property tax claiming the tax deduction is a simple matter of itemizing your.

Property taxes are deductible in the year in which you pay them. As an ontario resident you can claim your property taxes through the ontario energy and property tax credit oeptc by completing the on ben. If you would like to calculate your 2020 payment see the 2020 ontario energy and property tax credit calculation sheets or use our on line line child and family benefits calculator.

For the prior year calculation sheets go to ontario energy and property tax credit calculation sheets.

Personal Property Tax Software Thomson Reuters Onesource

Personal Property Tax Software Thomson Reuters Onesource

Statistics Canada Property Taxes

Statistics Canada Property Taxes

What To Know About Tax Lien Certificates

What To Know About Tax Lien Certificates

How To Get More Money Back From Your Tax Return 2020

How To Get More Money Back From Your Tax Return 2020

/CreatingaTax-DeductibleCanadianMortgage1_3-bbe7be25ea614913b8e8351756c52239.png) Creating A Tax Deductible Canadian Mortgage

Creating A Tax Deductible Canadian Mortgage

How To Get A Legal Description Of Property 9 Steps

How To Get A Legal Description Of Property 9 Steps

Tax Deductions On Rental Property Income In Canada Updated

Tax Deductions On Rental Property Income In Canada Updated

Ontario Energy And Property Tax Credit 2020 Show Me The Green

Ontario Energy And Property Tax Credit 2020 Show Me The Green

Understanding Your Property Tax Bill City Of Hamilton

Understanding Your Property Tax Bill City Of Hamilton