To get the value of the estate on which inheritance tax iht is due use these stepswork out the market value of all the assets in the estate. It may also show you the importance of financial planning such as making a will.

Calculating Inheritance Tax Tax

Calculating Inheritance Tax Tax

how to calculate inheritance tax on property

how to calculate inheritance tax on property is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in how to calculate inheritance tax on property content depends on the source site. We hope you do not use it for commercial purposes.

The good news is that there are lots of ways to cut down your bill which weve explained in full in our guides to inheritance tax.

How to calculate inheritance tax on property. How to calculate an inheritance tax bill. The value of your estate is below the. The calculator works out whether your estate may be subject to inheritance tax if you were to die today.

Examples of how to calculate property tax are also provided. At first instance any property that is inherited from ancestors by the individual does not have any tax liability at the time of inheritance. The fair market value fmv of the property on the date of the decedents death whether or not the executor of the estate files an estate tax return form 706 united states estate and generation skipping transfer tax return.

The fmv of the property on the alternate valuation date but only if the executor of the estate files an estate tax. No tax is levied on that at present. Work out the value of the estate.

When you inherit money you have to pay taxes on the money. Enter the current value of your home other properties personal possessions savings accounts and investments. All other properties continue to be taxed at 10 of the annual value.

Six states also charge a separate inheritance tax. Open the free inheritance tax calculator. Inheritance tax paid on what you leave behind to your heirs and they could pay as much as 40 tax on what they inherit.

It is not personal advice. In the united states you have to pay estate tax to the federal and state governments. However as and when the inheritor sells out the inherited property the capital gains that are earned on the sale of the property will be taxable.

This calculator works out your inheritance tax iht liability. Property tax rates on owner occupied and non owner occupied residential properties are applied on a progressive scale. How to calculate inheritance tax.

But this calculator can help you estimate what potential inheritance tax bill your heirs might potentially have to pay. To quickly calculate your potential inheritance tax bill we have created a simple and easy to use inheritance tax calculator. For confirmation of how inheritance tax might affect you please.

Theres normally no inheritance tax to pay if either. Inheritance tax is a tax on the estate the property money and possessions of someone whos died.

Inheritance Tax Calculation Bertomeu Eu Residential

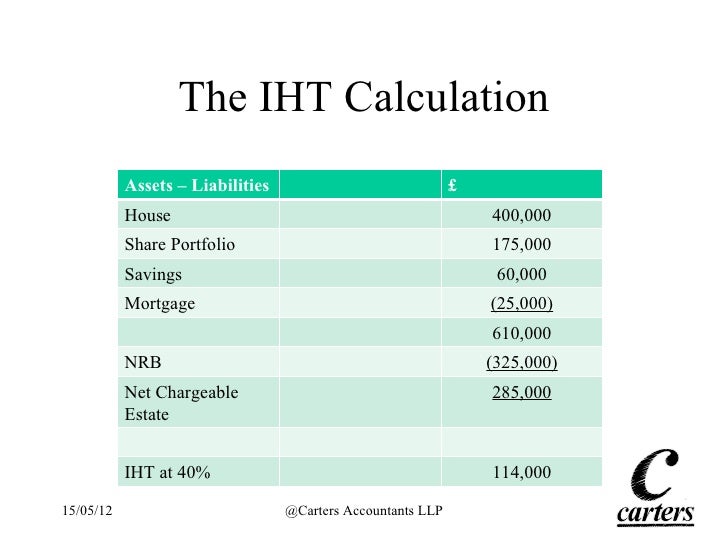

Inheritance Tax Presentation May 2012

Inheritance Tax Presentation May 2012

Alex Picot Trust Calculating Inheritance Tax Liability

Alex Picot Trust Calculating Inheritance Tax Liability

Calculation Of Inheritance Tax Ministry Of Finance

Calculation Of Inheritance Tax Ministry Of Finance

Inheritance Tax Calculation Bertomeu Eu Residential

Is Inheritance Tax Payable When You Die In Singapore

Is Inheritance Tax Payable When You Die In Singapore

Estate Tax Definition Examples How To Calculate Estate Tax

Estate Tax Definition Examples How To Calculate Estate Tax

Inheritance Archives Oliver Asset Management

Inheritance Archives Oliver Asset Management