The pay rate calculator is not a substitute for pay calculations in the payroll management system. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs.

How Much Taxes You Will Pay On A 64 000 Salary In Nyc

how much is payroll tax in nyc

how much is payroll tax in nyc is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in how much is payroll tax in nyc content depends on the source site. We hope you do not use it for commercial purposes.

Reporting payroll taxes.

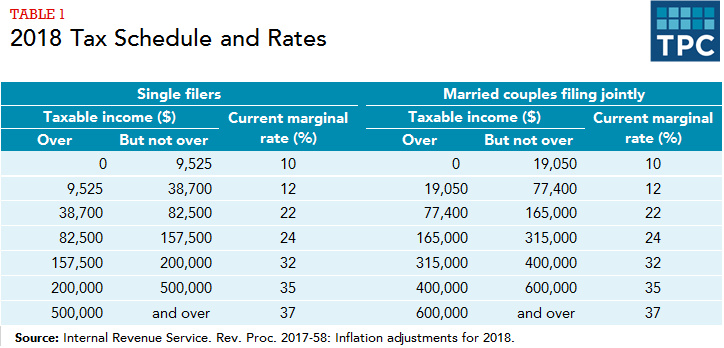

How much is payroll tax in nyc. Ny payroll tax paycheck calculator 2020 free fed tax 2020 nys tax 2020 nyc tax 2020. Certain additional regulations apply for. Employers are required to withhold and pay personal income taxes on wages salaries bonuses commissions and other similar income paid to employees.

People trusts and estates must pay the new york city personal income tax if they earn income in the city. You can take a refundable credit of 125 if youre married and filing a joint return and you have income of 250000 or less. To use our new york salary tax calculator all you have to do is enter the necessary details and click on the calculate button.

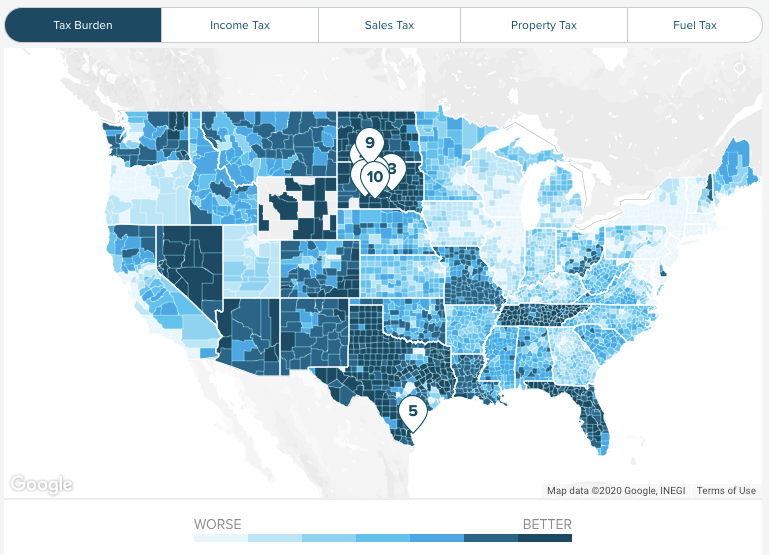

The tax is collected by the new york state department of taxation and finance dtf. Calculate your net pay or take home pay by entering your per period or annual salary along with the pertinent federal state and local w4 information into this free federal paycheck calculator. The tax usually shows up as a separate line on pay stubs.

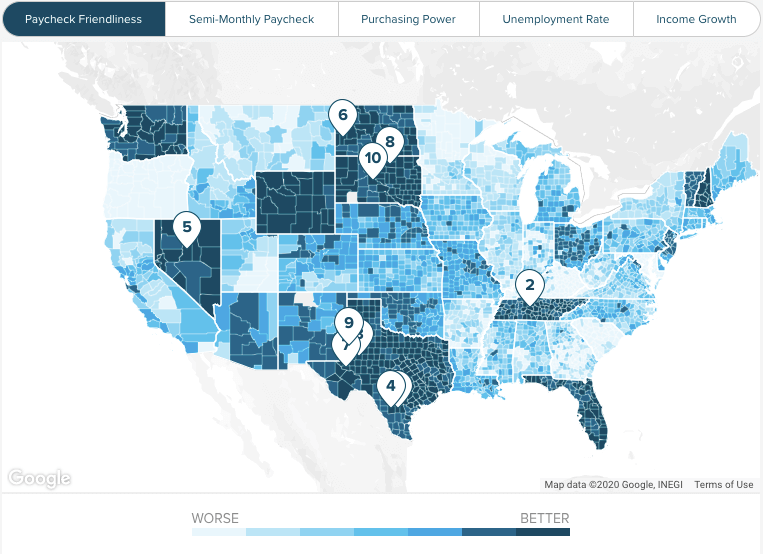

Use smartassets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Social security and medicare. The metropolitan commuter transportation mobility tax mctmt is a tax imposed on certain employers and self employed individuals doing business within the metropolitan commuter transportation district mctd.

In the event of a conflict between the information from the pay rate calculator and the payroll management system calculations from the payroll management system prevail. The metropolitan commuter transportation mobility tax mctmt otherwise known as the mta tax is a payroll tax in certain new york areas. That payroll tax holiday was legislated as part of the tax relief act of 2010 which was then extended by hr 3765 and extended again by hr 3630.

The new york city school tax credit is available to new york city residents or part year residents who cant be claimed as a dependent on another taxpayers federal income tax return. After a few seconds you will be provided with a full breakdown of the tax you are paying. Overview of federal taxes when your employer calculates your take home pay it will withhold money for federal income taxes and two federal programs.

But the employee portion of social security reverted back to the full 62 percent in 2013.

New York Paycheck Calculator Smartasset

New York Paycheck Calculator Smartasset

New York Paycheck Calculator Smartasset

New York Paycheck Calculator Smartasset

New York Income Tax Calculator Smartasset

New York Income Tax Calculator Smartasset

Free New York Payroll Calculator 2020 Ny Tax Rates Onpay

Employer Payroll Tax Calculator Gusto

Employer Payroll Tax Calculator Gusto

Albany Boosts Taxes On Wealthiest Wsj

Albany Boosts Taxes On Wealthiest Wsj

Taxes Generational Equity New York State And New York

Taxes Generational Equity New York State And New York

Sales Taxes In The United States Wikipedia

Sales Taxes In The United States Wikipedia

Payroll Calculator Ny State Colona Rsd7 Org

Payroll Calculator Ny State Colona Rsd7 Org

Office Of Payroll Administration

Office Of Payroll Administration