Click here for a 2019 federal tax refund estimator. Employers generally must withhold part of social security and medicare taxes from employees wages and you pay a matching amount yourself.

:max_bytes(150000):strip_icc()/understanding-form-w-2-wage-and-tax-statement-3193059-v4-5bc643e646e0fb0026d3aafc-5c0ab974c9e77c000168e8d4.png) Understanding Form W 2 The Wage And Tax Statement

Understanding Form W 2 The Wage And Tax Statement

how much in federal taxes do i pay

how much in federal taxes do i pay is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in how much in federal taxes do i pay content depends on the source site. We hope you do not use it for commercial purposes.

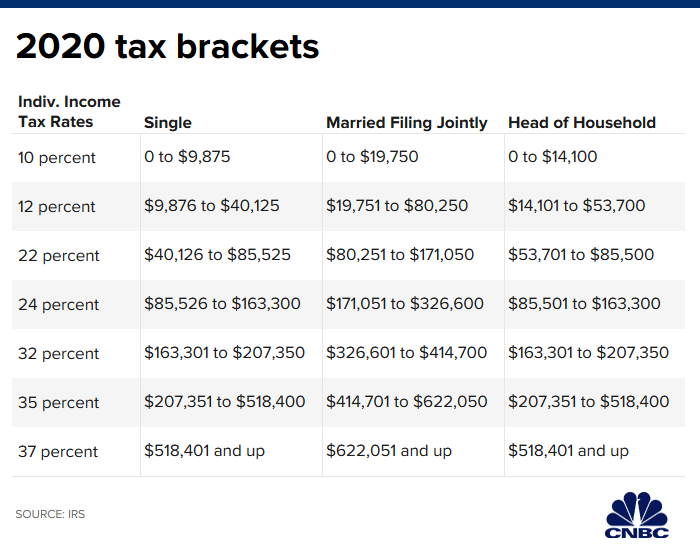

Meaning people with higher taxable incomes pay higher federal income tax rates.

How much in federal taxes do i pay. The amount of federal taxes you pay depends on how much you make and on the filing status and number of withholding allowances you put down on your w 4 form. Recent analysis by the joint committee on taxation shows that these respondents can rest easy. You can do this yourself if you want and make sure the right amount of tax is taken out of your paycheck.

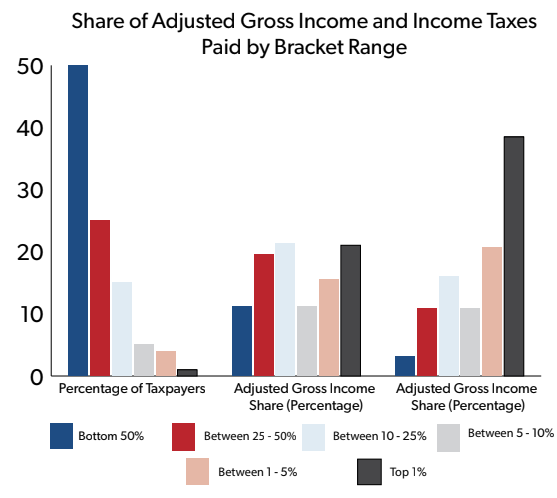

Also we separately calculate the federal income taxes you will owe in the 2019 2020 filing season based on the trump tax plan. That much maligned minority the richest percent of americans pay 395 of all federal income tax. This calculator can give you a good starting point for how much youll owe uncle sam at tax time.

Or federal employment taxes for a household employee. You dont have to pay federal income tax if you make this much money by bill bischoff. Use the following calculator to help determine your estimated tax liability along with your average and marginal tax rates.

Employers use formulas provided by the irs to calculate tax withholding. The richest percent of american taxpayers pay in 54264 billion of a total take of federal income tax of 137 trillion. Apr 15 2019.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. How much will i pay in federal taxes. The tax cuts and jobs act signed in december 2017 comes with several key changes to how small businesses pay taxes and how much tax they pay.

How income taxes are calculated. To put that percentage in absolute figures. To figure out how much tax to withhold use the employees form w 4 and the methods described in publication 15 employers tax guide and publication 15 a employers supplemental tax guide.

2019 federal income tax calculator. Thank god for the 1. A recent poll by pew research center found that the feeling that some wealthy people dont pay their fair share bothered 79 percent of respondents some or a lot.

Taxes are unavoidable and without planning the annual tax liability can be very uncertain. 2019 federal income tax brackets for taxes due in april 2020 or in october 2020 with an extension tax rate. That is one of the most eye catching figures in a study released by the tax foundation earlier this month.

Tax reform means changes in how small businesses pay taxes. Tax day is a day away and this time of year there are always questions about who pays how much in taxes. Your household income location filing status and number of personal exemptions.

Income Tax In The United States Wikipedia

Income Tax In The United States Wikipedia

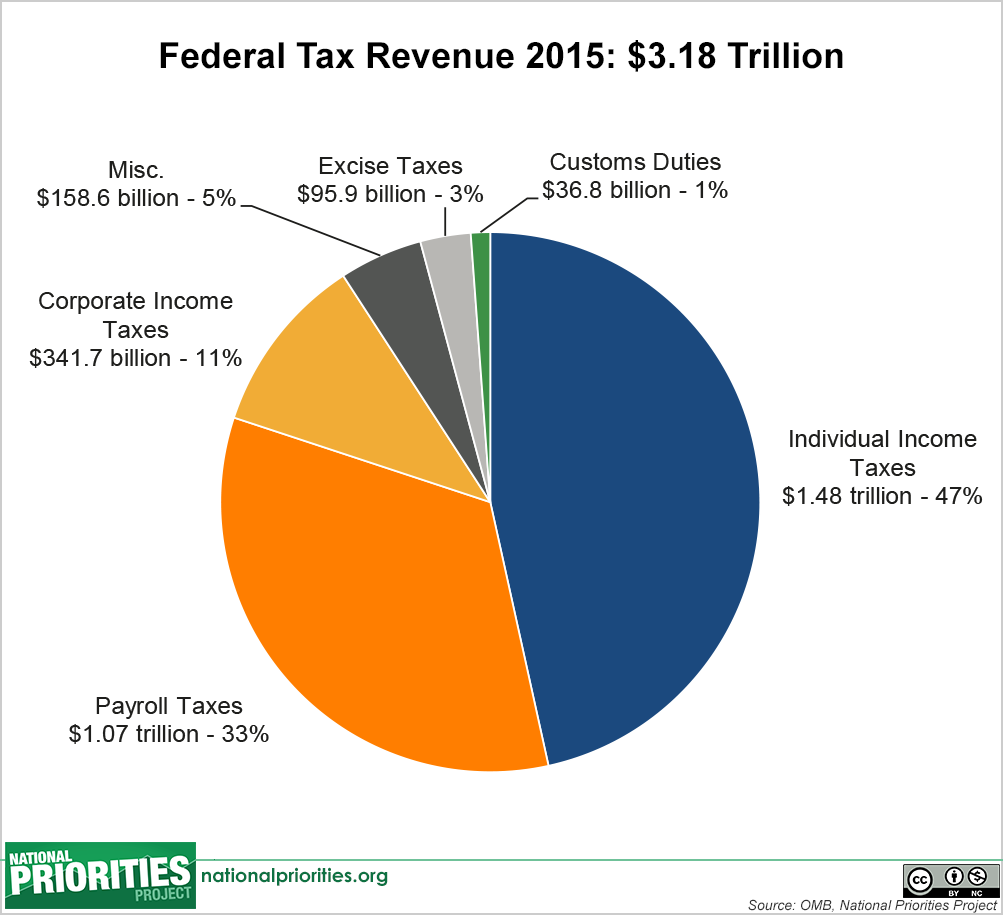

Federal Revenue Where Does The Money Come From

Federal Revenue Where Does The Money Come From

Policy Basics Where Do Federal Tax Revenues Come From

Policy Basics Where Do Federal Tax Revenues Come From

In Pictures How Much The Top Earners Already Pay In Taxes

This Is Why Filing Your Income Tax Return Will Never Be The Same

This Is Why Filing Your Income Tax Return Will Never Be The Same

Who Pays Income Taxes Foundation National Taxpayers Union

Who Pays Income Taxes Foundation National Taxpayers Union

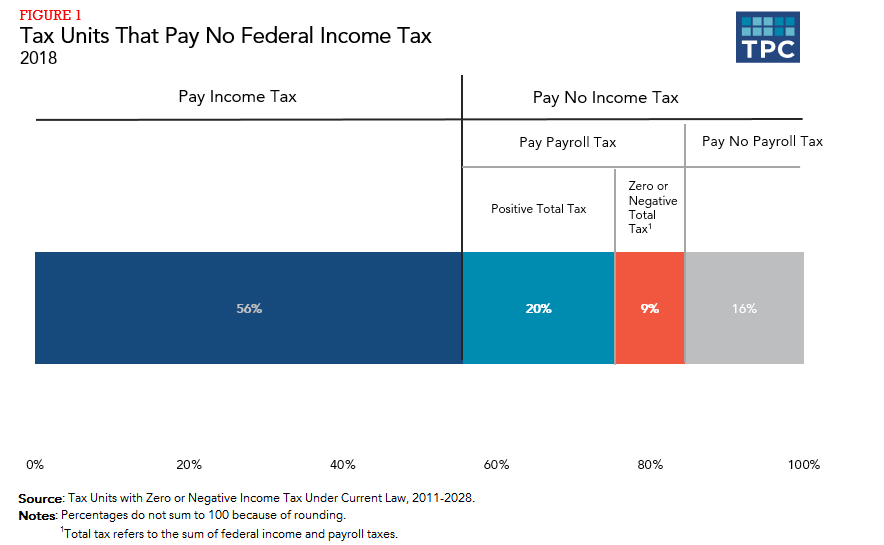

The Tcja Is Increasing The Share Of Households Paying No

The Tcja Is Increasing The Share Of Households Paying No

How To Find Out What Tax Bracket You Re In Under The New Tax Law

How To Find Out What Tax Bracket You Re In Under The New Tax Law

Taxation In The United States Wikipedia

Taxation In The United States Wikipedia

California State Taxes Are Some Of The Highest

California State Taxes Are Some Of The Highest