The earned income tax credit or eitc for short is an excellent option for low income families and individual filers to utilize for a larger return and overall cash back from the government when you file your taxes. And have been a us.

Income Limits For The Earned Income Tax Credit How The

Income Limits For The Earned Income Tax Credit How The

how do i file earned income tax credit

how do i file earned income tax credit is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in how do i file earned income tax credit content depends on the source site. We hope you do not use it for commercial purposes.

To qualify for and claim the earned income credit you must.

How do i file earned income tax credit. Figure the credit yourself. Both your earned income and adjusted gross income agi must be no more than. The credit was intended to be just a temporary legislative provision at first but its still around all these years later.

The earned income credit is a benefit for those who are working and have low to moderate incomes. Must not file form 2555 foreign earned income or form 2555 ez foreign earned income exclusion. Your tax year investment income must be 3600 or less for the year.

The earned income tax credit eic or eitc is a refundable tax credit for taxpayers who earn low or moderate incomes. Citizen or resident alien for the entire tax year. The federal government created the earned income tax credit eitc in 1975 to help low income taxpayers keep more of their hard earned money.

This credit is meant to supplement the income you have earned through working whether for yourself self employed or for someone elseif you qualify for the earned income tax credit you can reduce your taxes and increase your tax refund. You need to file your federal taxes. To do this you must use the earned income credit worksheet eic worksheet in the instruction booklet for form 1040 and the earned income credit eic table in the instruction booklet or use the eitc assistant tool online.

The earned income tax credit is a refundable tax credit available to low and moderate income families. The irs estimates that about 15 of eligible individuals do not claim this tax credit. Your total earned income must be at least 1.

The eic provides support for low and moderate income working parents with qualifying children in the form of tax credits. See how it works how to qualify and how much you can get in 2019 2020. It is available in both english and spanish.

To qualify you must file an income tax returnhere is a look at the rules surrounding this credit. How does the earned income credit work. And have a valid social security number not an itin for yourself your spouse if filing jointly and any qualifying children on your return.

To score this credit first things first. The earned income tax credit eitc is a valuable tool for lower income taxpayers. Certain rules for income earned during 2019.

The earned income tax credit is available to claim for the 2019 2020 tax season.

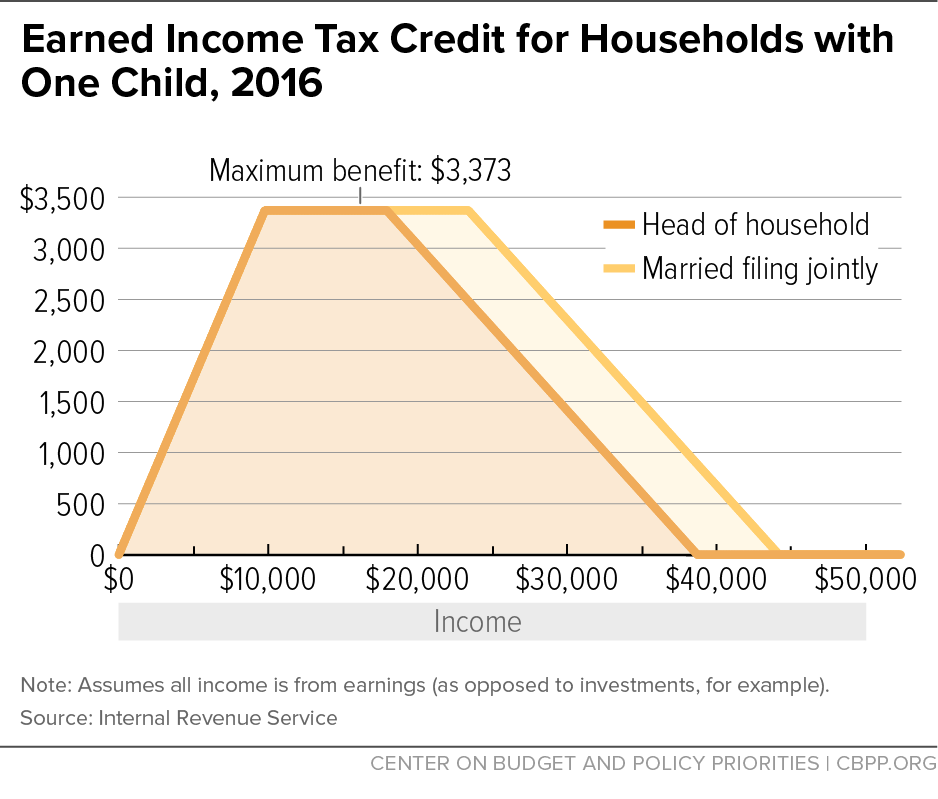

Earned Income Tax Credit For Households With One Child 2016

Earned Income Tax Credit For Households With One Child 2016

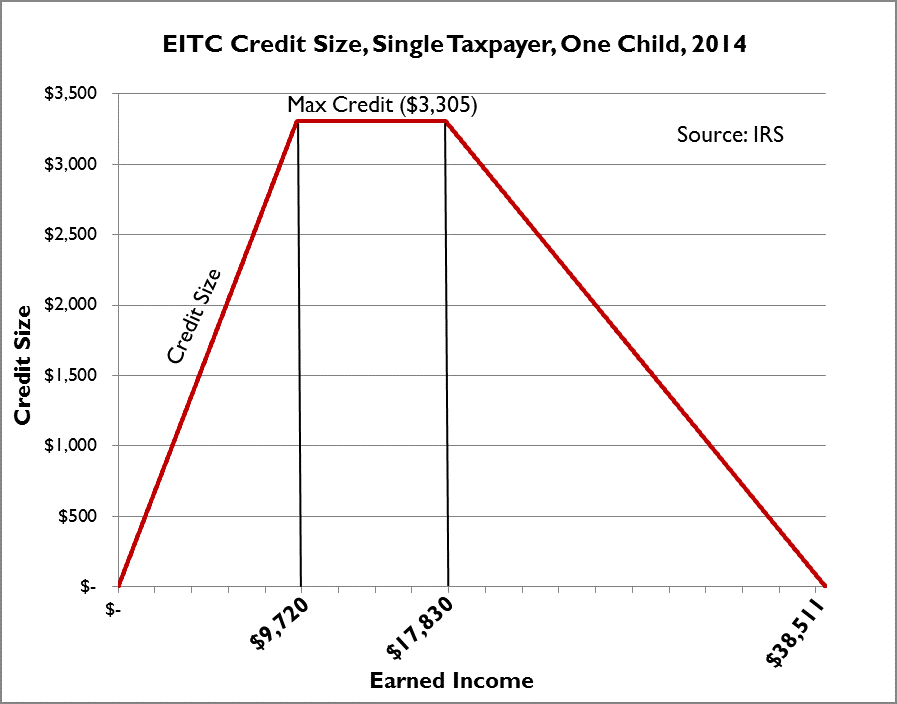

Taxes From A To Z 2019 E Is For Earned Income Tax Credit Eitc

Taxes From A To Z 2019 E Is For Earned Income Tax Credit Eitc

Probability Of Claiming The Earned Income Tax Credit Eitc

Probability Of Claiming The Earned Income Tax Credit Eitc

Overview Of The Earned Income Tax Credit On Eitc Awareness

Overview Of The Earned Income Tax Credit On Eitc Awareness

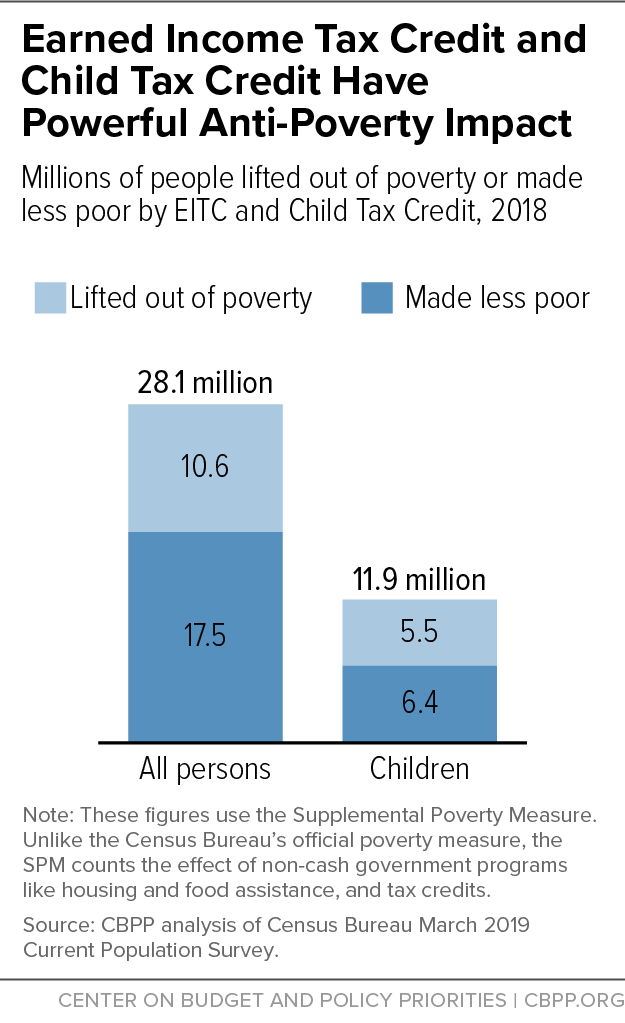

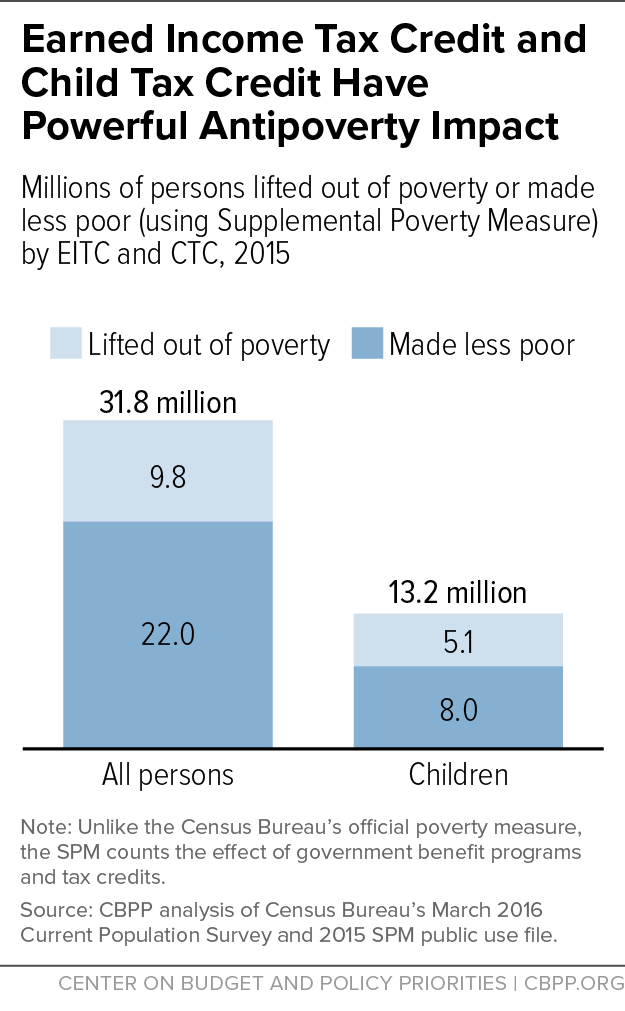

Earned Income Tax Credit And Child Tax Credit Have Powerful

Earned Income Tax Credit And Child Tax Credit Have Powerful

Earned Income Credit Chart Bobi Karikaturize Com

Earned Income Credit Chart Bobi Karikaturize Com

Improper Payments And Eitc Reform The Online Tax Guy

Improper Payments And Eitc Reform The Online Tax Guy

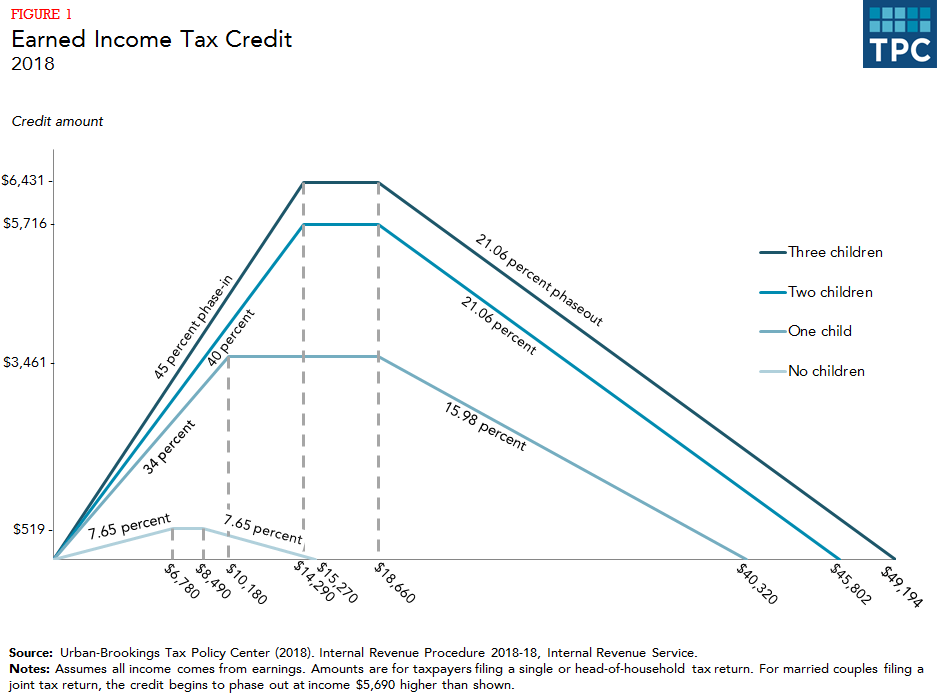

Earned Income Tax Credit Eitc A Primer Tax Foundation

Earned Income Tax Credit Eitc A Primer Tax Foundation

Newborn Earned Income Tax Credit Eitc Claim Rate

Newborn Earned Income Tax Credit Eitc Claim Rate

Earned Income Tax Credit And Child Tax Credit Have Powerful

Earned Income Tax Credit And Child Tax Credit Have Powerful

The Earned Income Tax Credit May Help You Get The Biggest Refund

The Earned Income Tax Credit May Help You Get The Biggest Refund