However i am wondering if its possible to efile it. You may still prepare a 2014 tax return online to file by mail.

can i still efile my 2014 tax return

can i still efile my 2014 tax return is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in can i still efile my 2014 tax return content depends on the source site. We hope you do not use it for commercial purposes.

I need to file 2014 return.

Can i still efile my 2014 tax return. I should receive a refund on my 2018 taxes. Learn more about free tax return preparation. File 2014 tax return.

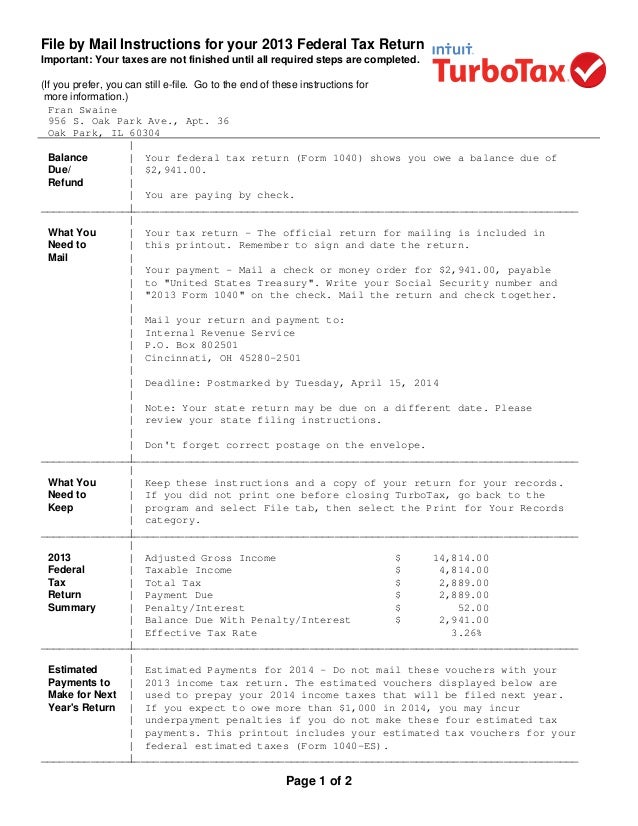

A 2014 return has to be printed signed and mailed. I filed for an extension using form 4868 on my 2018 return but i never filed that past year return. Can i file 2015 tax return now.

Use a free tax return preparation site. I know that i can still paper file 2015 tax return now. You do not need to include this information on your tax return or the form t2200.

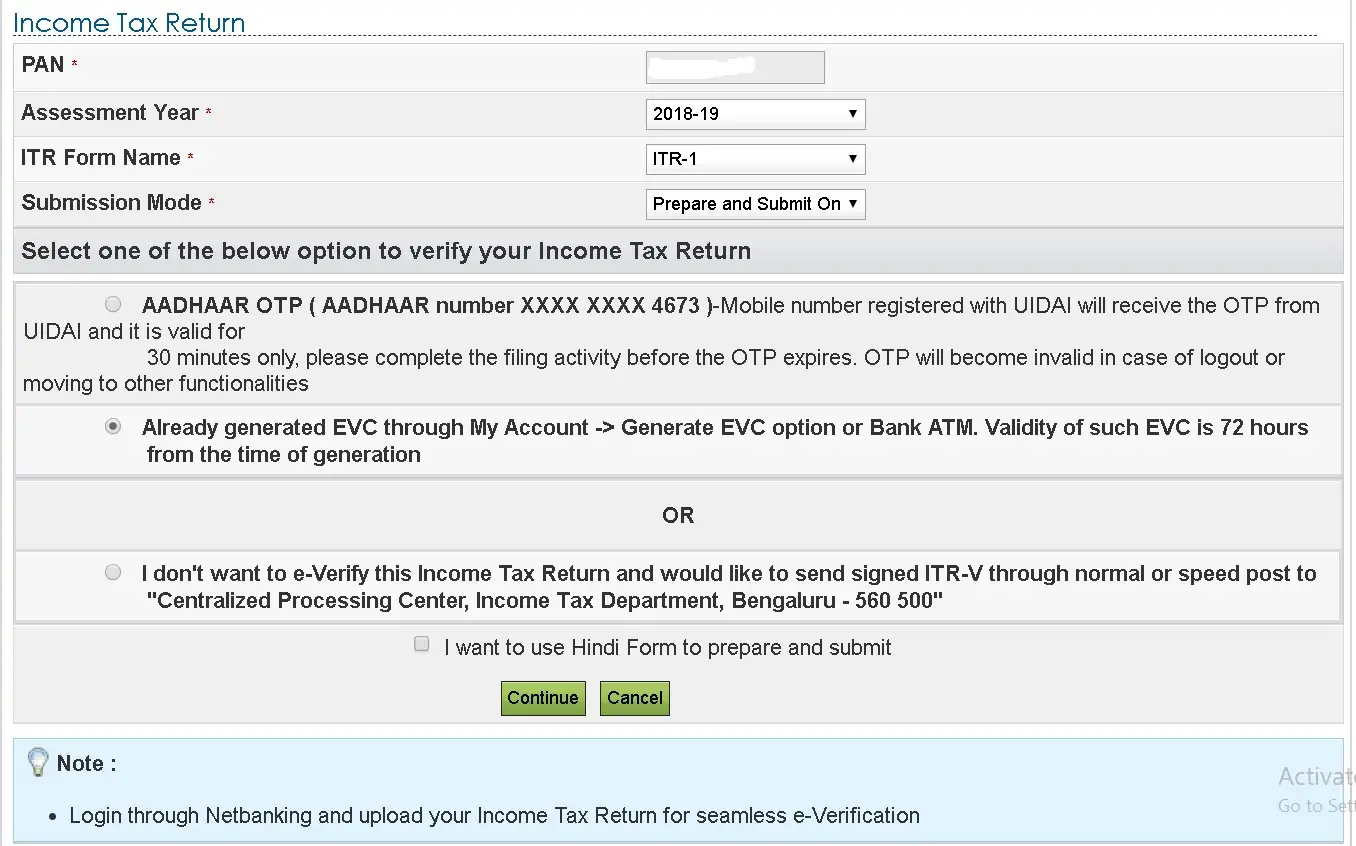

This change will take effect at the start of the 2020 filing season for the 2019 tax year. Did you know that electronic filers can now scan t183 forms for retention. Electronic filers can now keep a scanned version of the original.

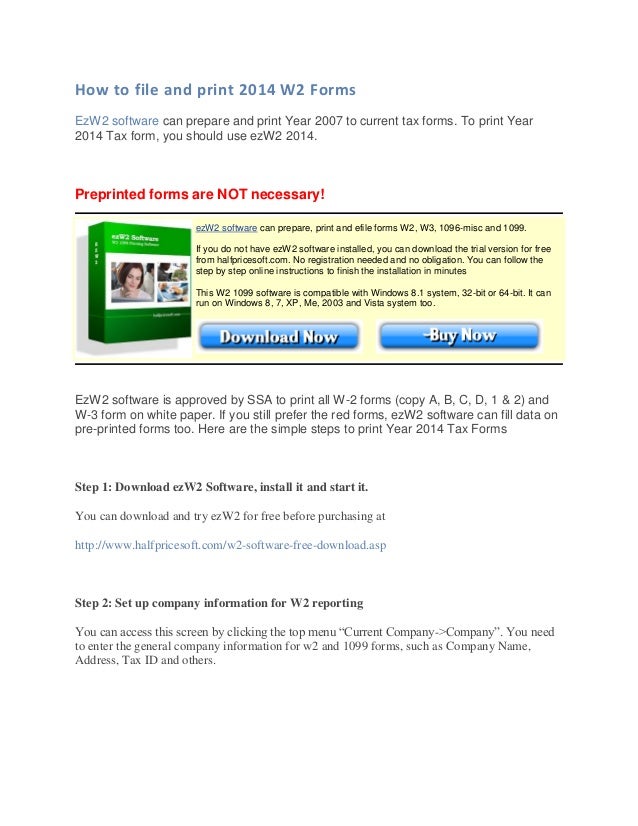

We can import your w 2 electronically from over one million participating employers and financial institutions so you can finish your taxes sooner. If you didnt receive your w 2 yet you can still start your tax return now and get your tax refund as fast as possible by importing your w 2 with turbotax w 2 form finder. The irs does not allow electronic filing of prior year tax returns and the deadline for 2014 electronic filing has passed on october 15 2015.

View my prior year returns after you file. You can still file 2014 tax returns. Industry and services provided.

Even though the deadline has passed you can file your 2014 taxes online in a few simple steps. Only a 2018 tax return can be e filed. I have a question regarding the need to file prior year return.

The irs volunteer income tax assistance vita and the tax counseling for the elderly tce programs offer free tax help and e file for taxpayers who qualify. Use a mailing service that will track it such as ups or certified mail so you will know the irs received the return. I found following info in taxact websitethe irs allows electronic filing of tax returns for the current tax year and the two previous tax years.

Can i still e file my 2014 tax returns. File 2013 tax return. Can i file a 2018 return now since i did request extension.

When you mail a tax return you need to attach any documents showing tax withheld such as your w 2s or any 1099s. The efile and refile services are open for transmissions from february 18 2019 at 830 am. Taxpayers will still be able to register.

It is too late to receive a tax refund for a 2014 return but if you owe tax due the irs wants you to pay. Eastern time until january 17 2020 for the electronic filing of your clients 2015 2016 2017 and 2018 t1 personal income tax and benefit returns. Use commercial tax prep software to prepare and file your taxes.

Skip to main. Provides information for the efile news and program updates. File 2012 tax return.

How To Do E Filing For Income Tax Return In Malaysia Just

How To Do E Filing For Income Tax Return In Malaysia Just

2014 Handbook For Authorized E File Providers Ftb Pub Pdf

4 Steps From E File To Your Tax Refund The Turbotax Blog

Calameo Personal Tax Extension Form 4868

Calameo Personal Tax Extension Form 4868

What Are The 2015 Refund Cycle Dates Rapidtax

New Jersey Nj1040 E File Software Developers Handbook Pdf

New Jersey Nj1040 E File Software Developers Handbook Pdf

15 Tax Deductions You Should Know E Filing Guidance

Irs Announces E File Open Day Be The First In Line For Your

Irs Announces E File Open Day Be The First In Line For Your

When To Expect My Tax Refund Tax Refund Calendar 2019 2020

When To Expect My Tax Refund Tax Refund Calendar 2019 2020

15 Tax Deductions You Should Know E Filing Guidance