These taxes deter outside companies from infringing on opportunities for american businesses and workers. How to import from china into the usa.

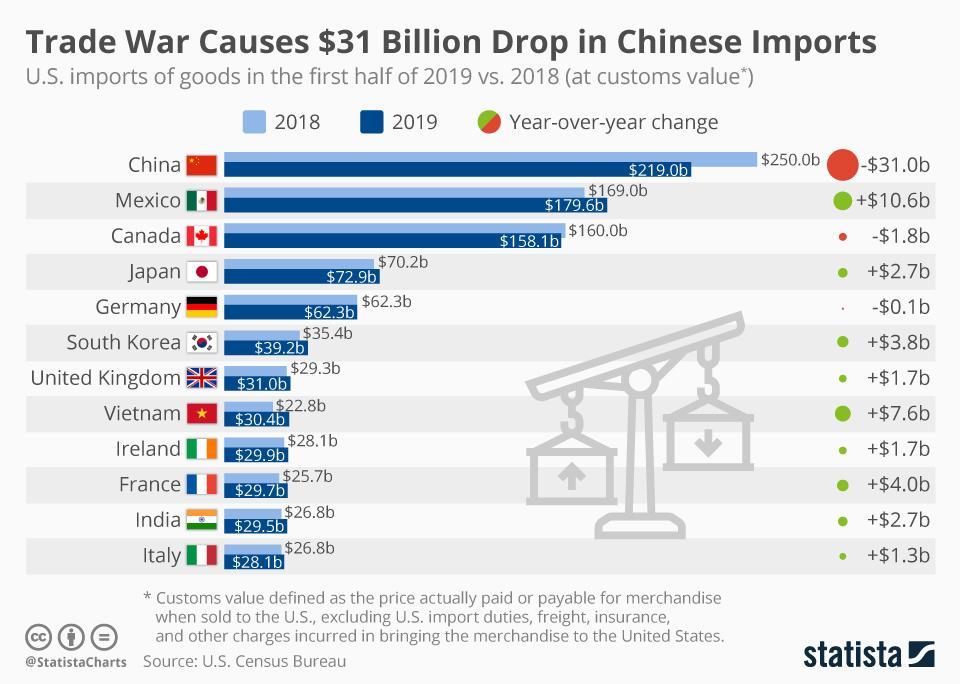

Sap Brandvoice The Long Term Impact Of Us Tariffs On China

Sap Brandvoice The Long Term Impact Of Us Tariffs On China

how much are import taxes from china to usa

how much are import taxes from china to usa is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in how much are import taxes from china to usa content depends on the source site. We hope you do not use it for commercial purposes.

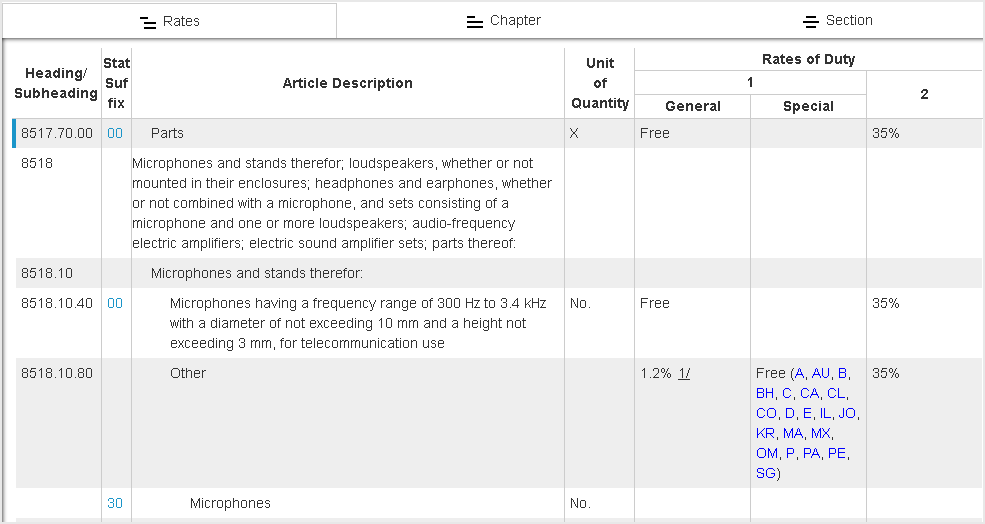

Failing to use the correct hs codes will result in problems at the customs clearance that can cost much money and time.

How much are import taxes from china to usa. You must pay taxes and duties in spain to import goods from outside the european union. The robot is less than 500 is it free as in no duty for personal use. However importing items on your own requires establishing relationships.

For instance the maximum amount of tariff for imported eel products is 16 percent while the same maximum for imported zinc oxide is 55 percent. The import tax from china to the united states varies based on the product. You need to use hs codes for a country to collect trade data control imports and exports to determine import duties and more.

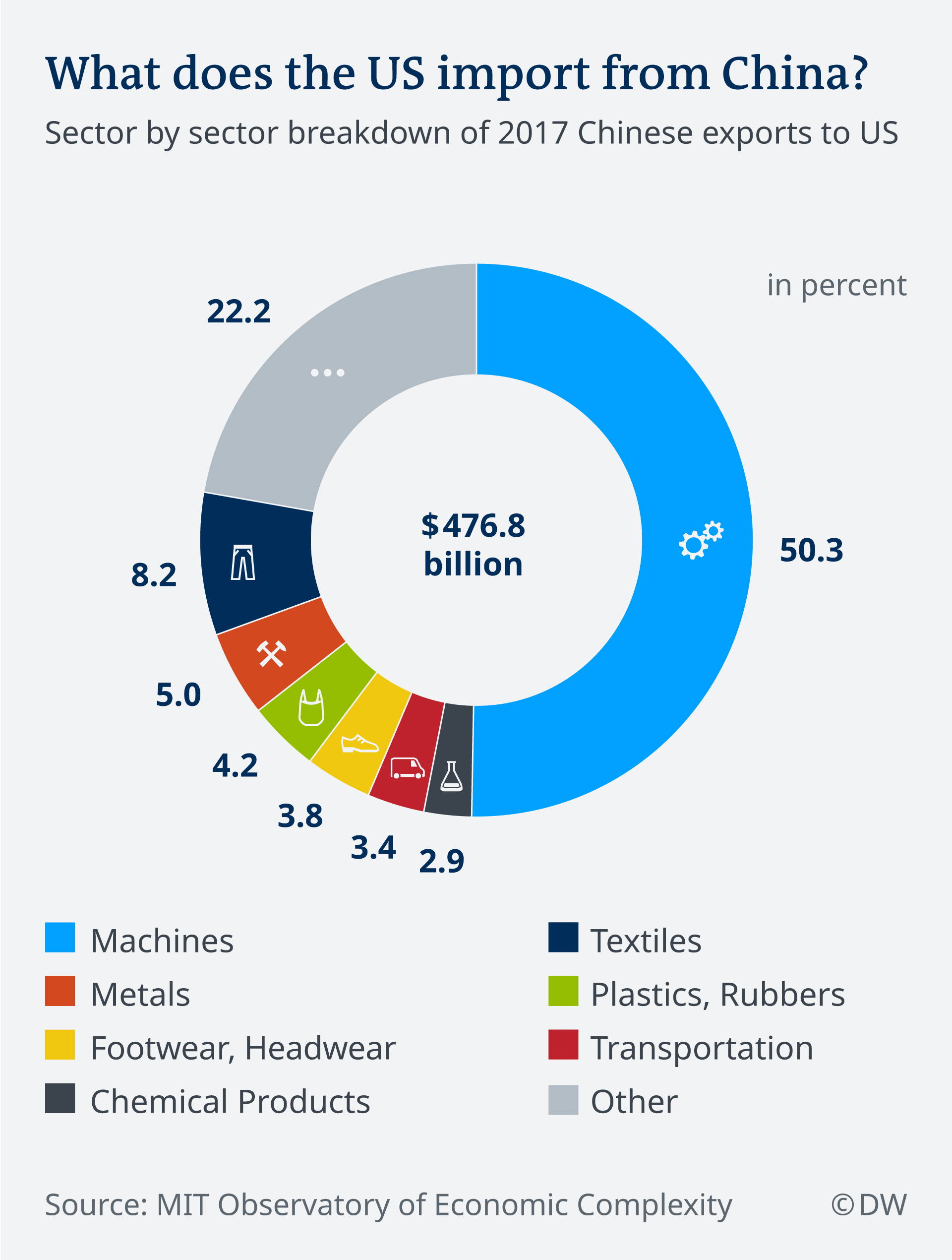

When importing products from china it is important to understand import duties customs fees and clearance documentsas an importer chinese manufacturing is a good choice for many products that can be sold locally or online and reap huge profits. Worldwide importing is a mammoth industry in itself. When we talk about import the one country that comes to our mind is china.

What would be the import duty for buying a sports equipment a ping pong robot that is bought in china and shipped to usa. This includes a passenger bringing goods in her luggage or a person mailing goods into the united states. As per world bank data on import the united states imported goods worth 2248 billion dollars during the year 2016.

The customs import duty rate is a tax on goods brought into the united states from international destinations. Importing items from china can be an affordable way to acquire materials for use in manufacturing or products for sale. The cost in the united states is around 2000 euros is it right to say i would need to pay an additional 21 in taxes on import to spain.

Since 2018 china has promulgated a series of regulations to reduce import export taxes and duties to promote a higher level of openness and domestic consumption made more urgent due to the ongoing us china trade war. As in the case of the eu certain imports are taxed more than others especially food and agricultural products. Import means bringing goods or services from an outside country to your home country.

Planning import from china and south korea to spain every month. How much are import duties from china to the united states. Tariffs depend on the products and commodities you import from china to the united states which makes the entire international trade process for.

The codes arent used in china only but internationally. If there is a duty then how much would it be approx i read around 30 on one of gov sites. Import duties are charged on all imports with a customs value of us200 or above.

Us Import Tax From China Archives China Sourcing Agent

Us Import Tax From China Archives China Sourcing Agent

What Us China Trade War Means For Imports Exports And Soybeans

What Us China Trade War Means For Imports Exports And Soybeans

Importing From China To Usa Customs Duties China

Importing From China To Usa Customs Duties China

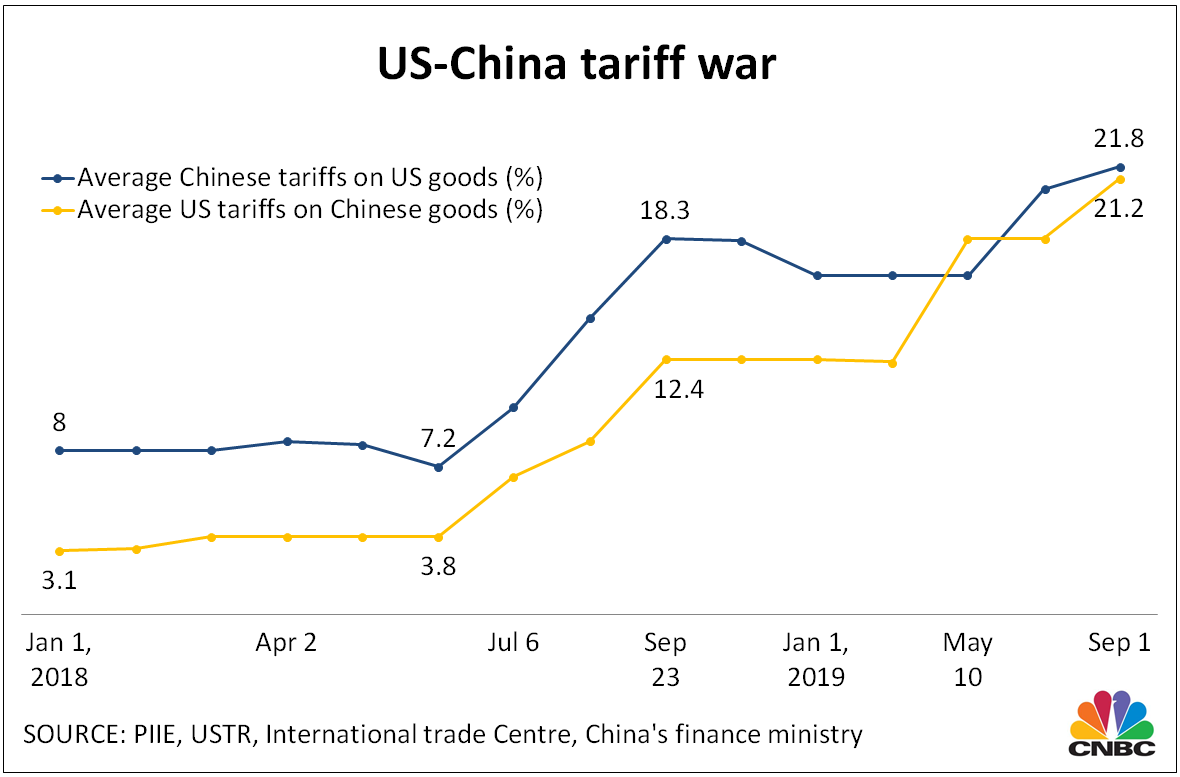

Who S Paying For The Us China Trade War Ft Alphaville

Who S Paying For The Us China Trade War Ft Alphaville

Us Trade Deficit With China Causes Effects Solution

Us Trade Deficit With China Causes Effects Solution

Who S Paying For The Us China Trade War Ft Alphaville

Who S Paying For The Us China Trade War Ft Alphaville

Talking Trade At G20 Can Xi Veer Trump Away From Tariffs

Talking Trade At G20 Can Xi Veer Trump Away From Tariffs

Long Strange Trip How U S Ethanol Reaches China Tariff

Long Strange Trip How U S Ethanol Reaches China Tariff

Explainer Who Pays Trump S Tariffs China And Other

China Economy Facts Effect On Us Economy

China Economy Facts Effect On Us Economy

Business 02 China Sourcing Agent U S Based And China

Business 02 China Sourcing Agent U S Based And China