Generally payment you receive as a member of the military is taxed as wages. In the eyes of the federal government military retired pay is no different from any other form of income which means that you have to pay income tax on it.

/understanding-military-retirement-pay-3332633_final-e2d76ea63bda4604973777b1b3d9d9b2.png) Understand The Military Retirement Pay System

Understand The Military Retirement Pay System

federal tax rate for military retirement pay

federal tax rate for military retirement pay is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in federal tax rate for military retirement pay content depends on the source site. We hope you do not use it for commercial purposes.

The federal tax rate on pensions is your ordinary income tax rate.

Federal tax rate for military retirement pay. Military retirement pay may be taxed in specific situations. As a veteran whether your retirement pay is also subject to state income tax depends on. Retired pay like other income is subject to federal income taxation unless wholly or partially.

For example 20 states do not tax military retirement at all while 13 states only implement partial taxation. The amount of federal tax deducted from a veterans retirement pay each month is based on the number of exemptions indicated on the veterans w 4 after retirement. And all retired pay is tax free.

Yes a veterans military retirement pay is subject to federal income tax. However youll only be taxed to the extent that you did not contribute any post tax dollars to the pension fund. All non disability retired pay is subject to withholding of federal income taxes.

The military retirement system is arguably the best. 42 states provide various forms of exemptions for military personnel in order to help offset tax responsibilities as thanks for service to the country. The same is true for taxes on ira and 401k distributions made after retirement.

Most military retirement pay is treated and taxed as normal income but in certain cases it can be excluded. The amount withheld is dependent upon the taxpayers amount of wages and the number of exemptions claimed.

Understand The Military Retirement Pay System

Understand The Military Retirement Pay System

Are Military Retirements Exempt From Taxes Finance Zacks

Are Military Retirements Exempt From Taxes Finance Zacks

Experts Servicemembers Should Start Navigating New Tax Law

Experts Servicemembers Should Start Navigating New Tax Law

/arc-anglerfish-arc2-prod-mco.s3.amazonaws.com/public/57VZ3WXC5RAXFAFIXF4A5PICKQ.jpg) Military Tax Tips New Tax Law Is Mostly Good News

Military Tax Tips New Tax Law Is Mostly Good News

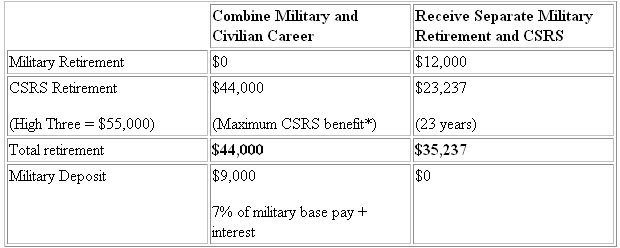

Mixing Civilian And Military Retirement Government Executive

Mixing Civilian And Military Retirement Government Executive

Taxable Income From Retired Pay Military Com

Taxable Income From Retired Pay Military Com

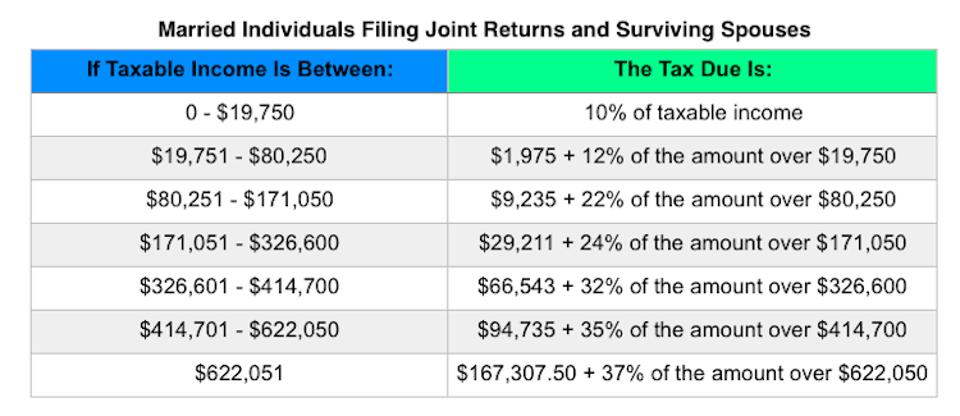

Irs Releases 2020 Tax Rate Tables Standard Deduction

Irs Releases 2020 Tax Rate Tables Standard Deduction

Irs Releases 2020 Tax Rate Tables Standard Deduction

Irs Releases 2020 Tax Rate Tables Standard Deduction

How Is Your Military Pension Taxed Howstuffworks

How Is Your Military Pension Taxed Howstuffworks

Six Things About Military Retirement Pay Military Com

Six Things About Military Retirement Pay Military Com

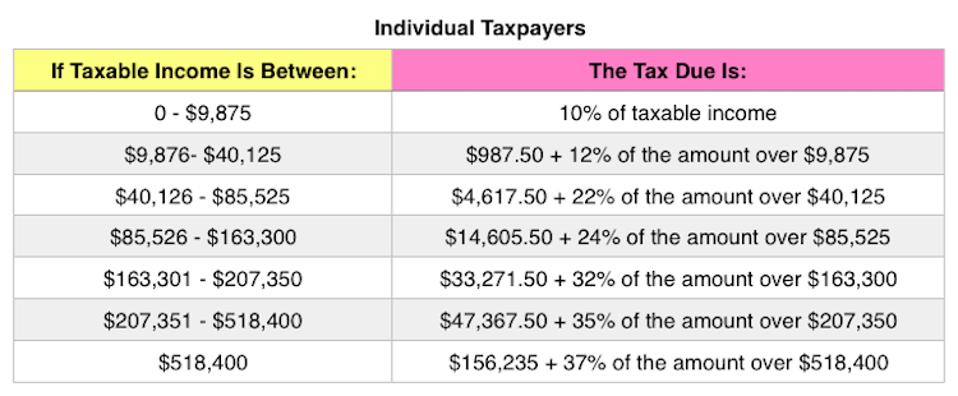

2020 Tax Brackets Rates Released By Irs What Am I Paying

2020 Tax Brackets Rates Released By Irs What Am I Paying