If you answered yes on line 9 or line 10 of the child tax credit worksheet in the form 1040 form 1040a or form 1040nr instructions or on line 13 of the child tax credit worksheet in this publication use. This is the child tax credit worksheet used to determine the amount if any the taxpayer can claim as the child tax credit.

Publication 972 2018 Child Tax Credit Internal Revenue

Publication 972 2018 Child Tax Credit Internal Revenue

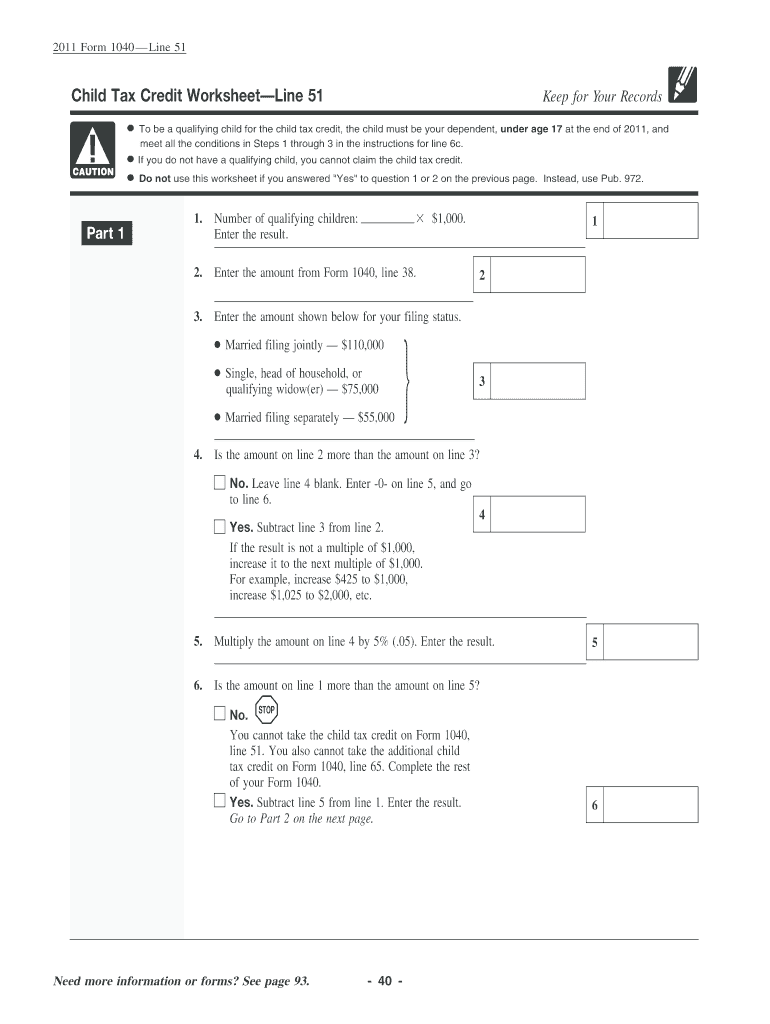

2013 child tax credit worksheet form 1040 line 51

2013 child tax credit worksheet form 1040 line 51 is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in 2013 child tax credit worksheet form 1040 line 51 content depends on the source site. We hope you do not use it for commercial purposes.

Before you begin part 2.

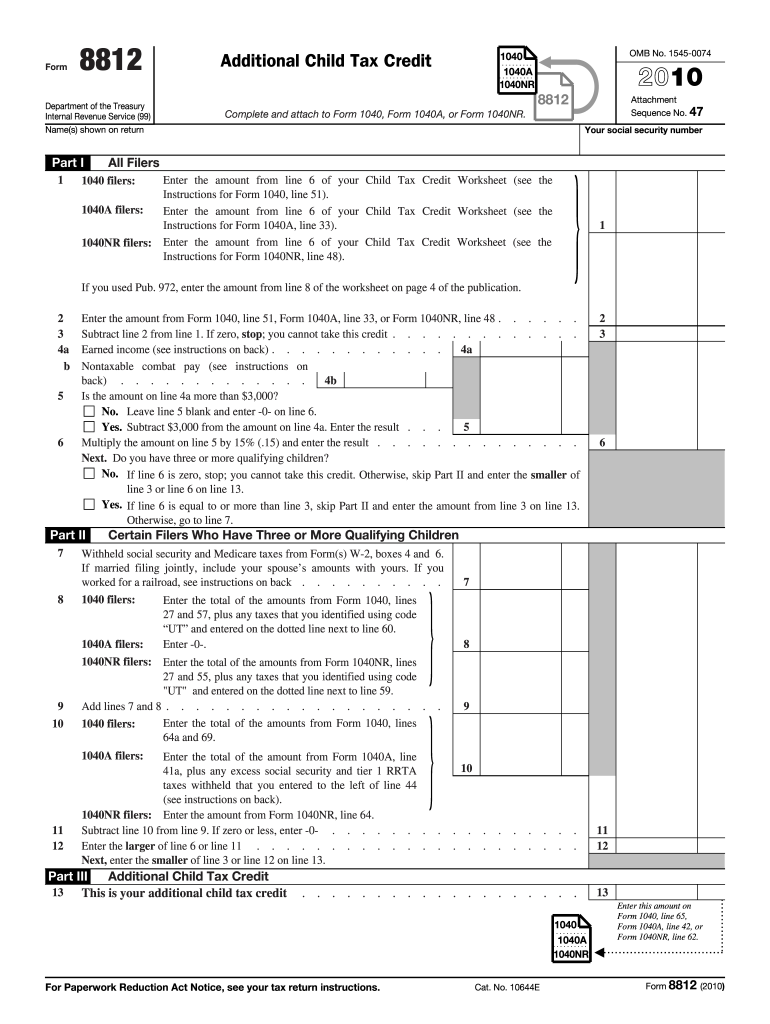

2013 child tax credit worksheet form 1040 line 51. 2010 form 1040line 51 child tax credit worksheetline 51 yes. Or form 1040nr line 7c. This publication is intended primarily for individuals sent here by the instructions to forms 1040 1040a or.

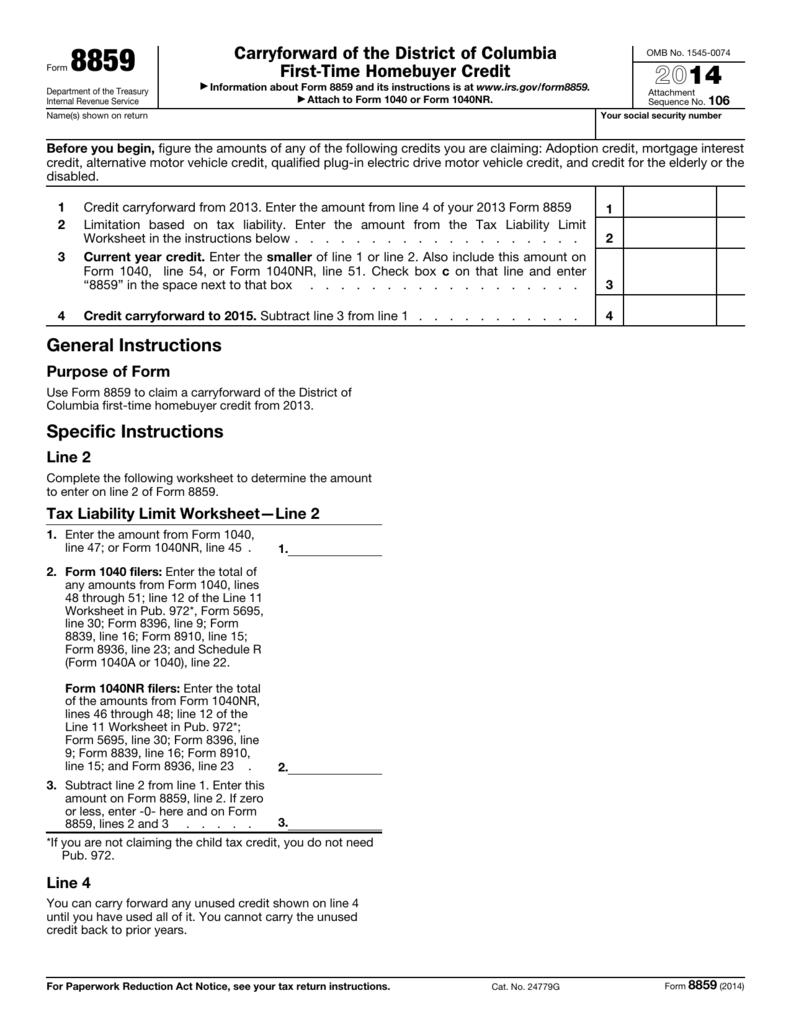

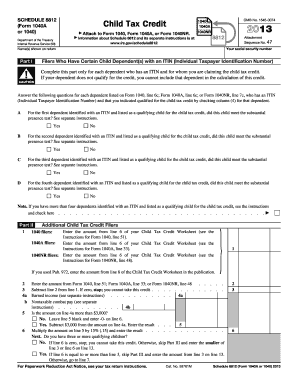

Subtract line 7 from line 3. 2013 instructions for schedule 8812child tax credit use part i of schedule 8812 to document that any child for whom you entered an itin on form 1040 line 6c. Form 1040a line 6c.

Information about schedule 8812 and its separate instructions is at. Now you will add up all the tax credit amounts indicated on the child tax credit worksheet. Printable and fillable 2013 schedule 8812 form 1040a.

This is the amount available to be deducted. And subtract line 8 from line 7. Enter the amount from line 6 of your child tax credit worksheet see the.

To be a qualifying child for the child tax credit the child must be your dependent under age 17 at the end of 2010 and meet all the conditions in steps 1 through 3 on page 15. Compare line 6 and line 9 and enter the smaller one on line 10 and on your 1040 tax form 1040 line 51 or 1040a line 33. Go to part 2.

You can t take the child tax credit on form 1040 line 12a. You also can t take the additional child tax credit on form 1040 line 17b. 2 enter the amount from form 1040 line 51.

And for whom you also checked the box in column 4 of that line is a resident of the united states because the child meets the. To figure the amount of earned income you enter on line 4a of schedule 8812 form 1040a or 1040 child tax credit. Instructions for form 1040 line.

This is a continuation of the child tax credit worksheet from the previous page. Child tax credit worksheetline 51 continued summary. Schedule 8812 form 1040a or 1040 8812 department of the treasury internal revenue service 99 child tax credit attach to form 1040 form 1040a or form 1040nr.

To figure the child tax credit you claim on form 1040 line 51. You may be able to take the additional child tax credit on form 1040 line 65 if you answered yes on line 9 or line 10 above. Complete the rest of your form 1040.

Form 1040a line 33. Or form 1040nr line. This amount is entered on form 1040 line 51.

The additional child tax credit follow the steps below. Form 1040a line 33. 7 part 1 8 2018 child tax credit and credit for other dependents worksheetline 12a keep for your records 1.

Or form 1040nr line 48. Subtract line 3 from line 2. Make sure you figured the amount if any of your child tax credit.

2010 Form Irs 8812 Fill Online Printable Fillable Blank

2010 Form Irs 8812 Fill Online Printable Fillable Blank

Mistakes On Child Tax Credit Form Are Delaying Some Returns

Publication 972 2018 Child Tax Credit Internal Revenue

Publication 972 2018 Child Tax Credit Internal Revenue

2013 Schedule 8812 Form 1040a Or 1040 Child Tax Credit

2013 Schedule 8812 Form 1040a Or 1040 Child Tax Credit

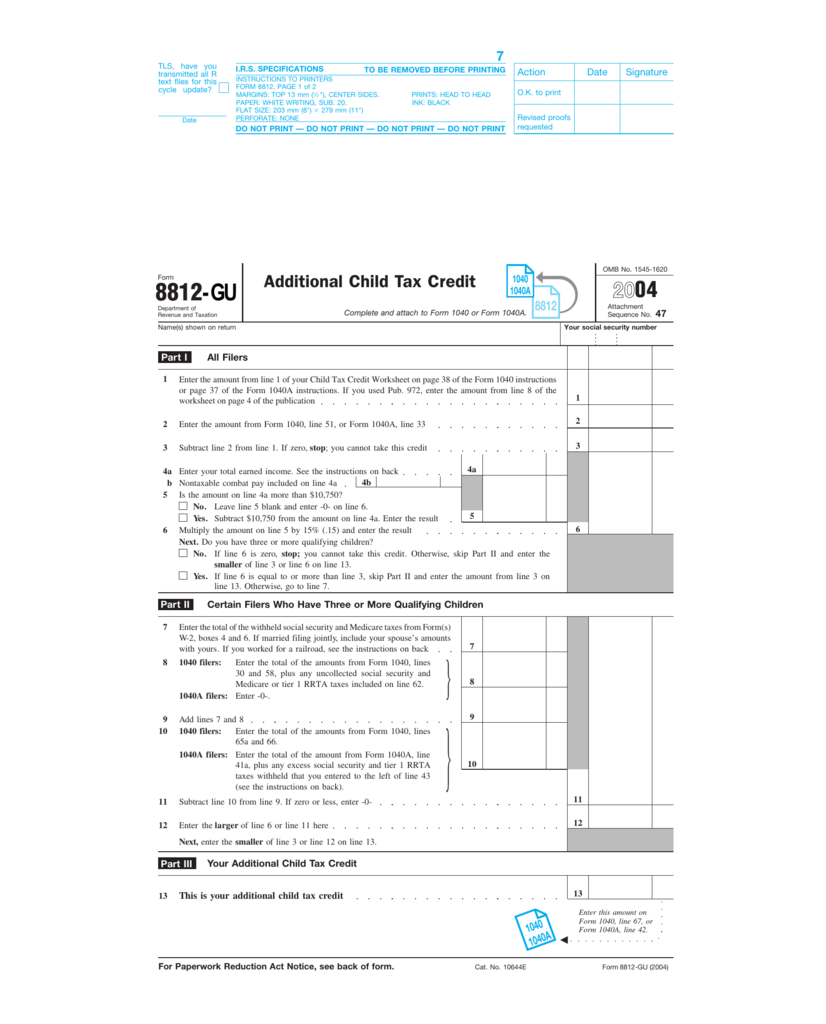

Form 8812 Gu Additional Child Tax Credit 2004

Form 8812 Gu Additional Child Tax Credit 2004

Child Tax Credit Worksheet Fill Online Printable

Child Tax Credit Worksheet Fill Online Printable

U S Individual Income Tax Return Forms Instructions Tax

U S Individual Income Tax Return Forms Instructions Tax

2013 Form Irs 1040 Schedule 8812 Fill Online Printable

2013 Form Irs 1040 Schedule 8812 Fill Online Printable

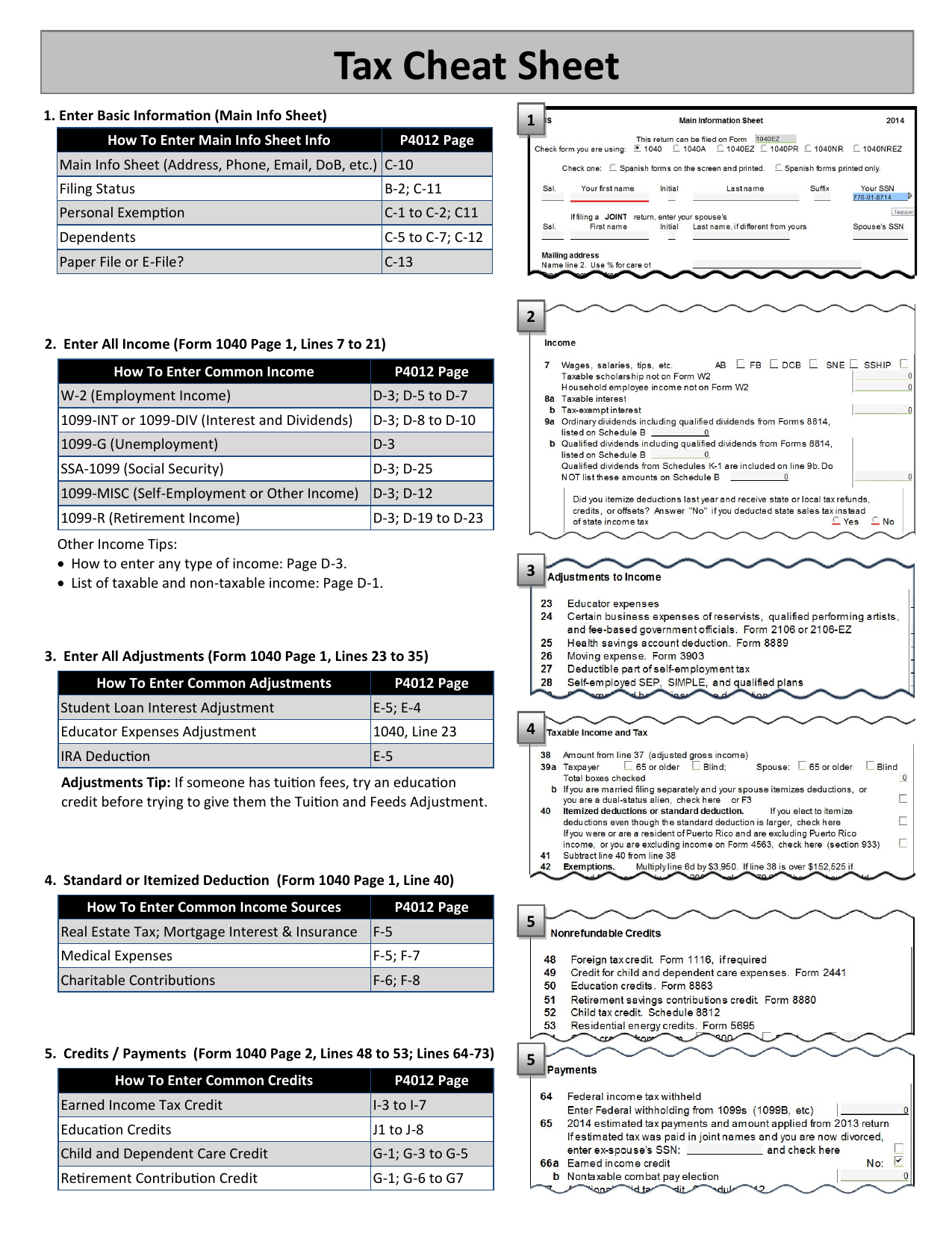

Tax Cheat Sheet Free Tax Campaign

Tax Cheat Sheet Free Tax Campaign