Depending on where you live you may need to pay taxes on lottery winnings to your state and local governments in addition to the federal government. Prize money taxable income.

What Percentage Of Lottery Winnings Would Be Withheld In

What Percentage Of Lottery Winnings Would Be Withheld In

how much federal tax is paid on lottery winnings

how much federal tax is paid on lottery winnings is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in how much federal tax is paid on lottery winnings content depends on the source site. We hope you do not use it for commercial purposes.

How much tax you will pay on your lottery winnings.

How much federal tax is paid on lottery winnings. If federal and state taxes are paid at time of winning the lottery is the remaining amount taxed as earnings when filing annual tax return. Arizona and maryland both tax the winnings of people who live out of state. Report all of your gambling winnings for the year including lottery prizes bingo winnings raffle prizes and slot machine proceeds on line 21 of form 1040 under other income.

What is the tax rate for lottery winnings. The taxation on lottery winnings can be as high as 45 to 50 in us. You dont have a choice on how much state or federal tax is withheld from your winnings.

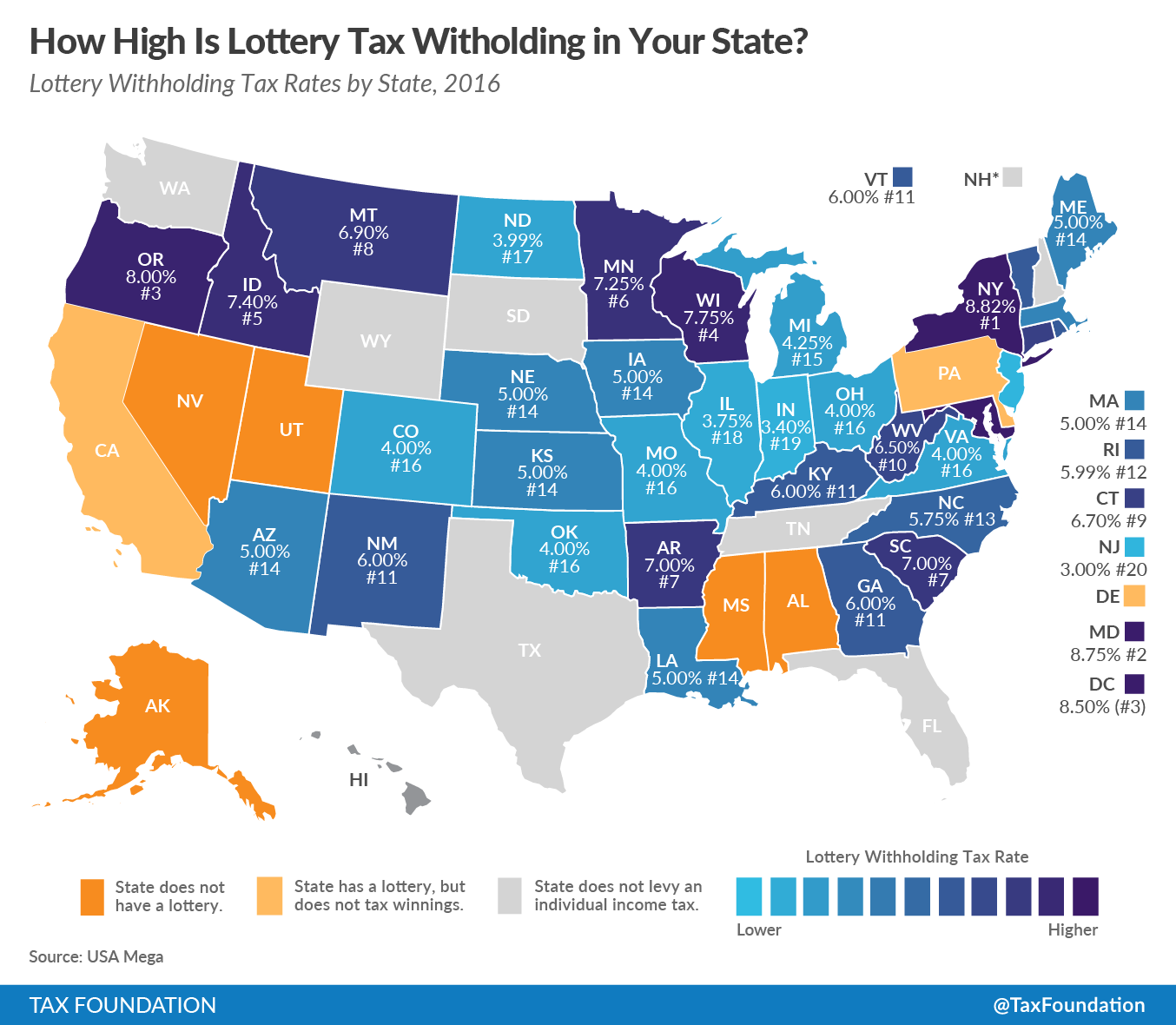

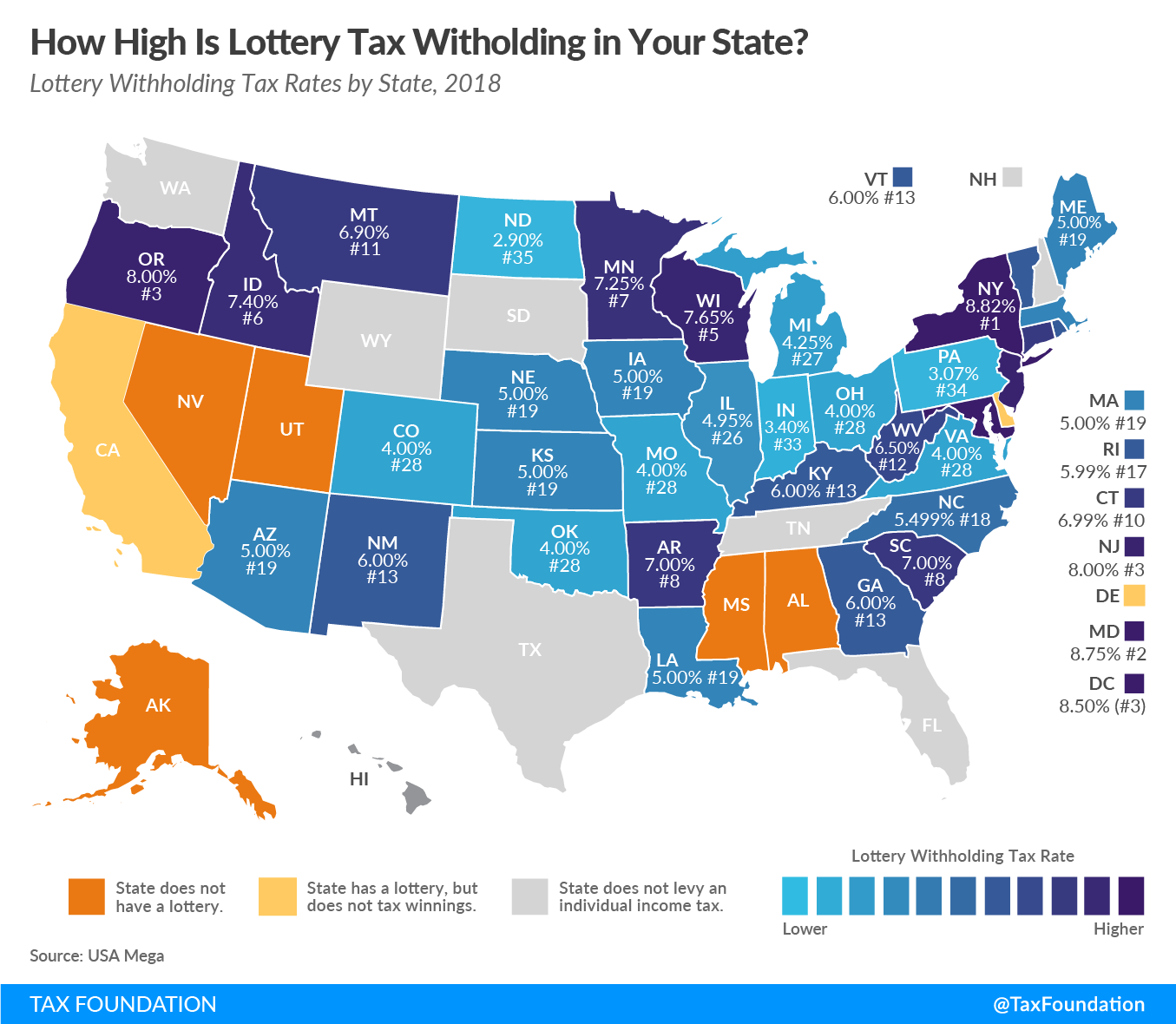

Winning the lottery is something many people dream of but few are prepared for when it actually happens. While you dont have to report lottery winnings of 600 or less if you win more than 5000 the government will hit you with a 24 percent federal withholding tax. Payouts vary considerably across the country ranging from the lowest in new york at 230240220 for the current lump sum to a high of 260925000 in states either forgoing an individual income tax or exempting state lottery winnings.

This includes federal withholding of 25 percent 1375 million though ultimately federal liability could. In the uk there is no tax to pay on lottery winnings. Lottery winnings are taxed like income and the irs taxes the top income bracket 396the government will withhold 25 of that before the money ever gets to the.

Can i change the amount of tax the lottery withholds. This includes the federal tax tax levied by the states and in some cases taxes levied by the cities. The top federal tax rate is 37 on 2018 income of more than 500000 for individuals 600000 for married couples filing a joint return.

Win 500000 or more for a single person or 600000 for a couple and the tax rate jumps to gulp 37 percent. Right off the bat lottery agencies are required to withhold 24 from winnings of 5000 or more which goes to the federal government. Irs does assess taxes on lottery winnings and how much you pay depends upon the tax brackets for the amount of income youve earned including the lottery winnings.

In this article we will try to know about the taxes that the lottery winners are liable to pay to the government. If you have a form w2 g report the amount of taxes withheld from your winnings on line 64 federal income tax withheld from forms w 2 and. In fact of the 43 states that participate in multistate lotteries only two withhold taxes from nonresidents.

What Percentage Of Lottery Winnings Would Be Withheld In

What Percentage Of Lottery Winnings Would Be Withheld In

What Percentage Of Lottery Winnings Would Be Withheld In

What Percentage Of Lottery Winnings Would Be Withheld In

How Much Tax You Will Pay On Your Lottery Winnings

How Much Tax Would A Massachusetts Resident Owe On A 1 5

How Much Tax Would A Massachusetts Resident Owe On A 1 5

How Much Tax Would A Massachusetts Resident Owe On A 1 5

How Much Tax Would A Massachusetts Resident Owe On A 1 5

1 6 Billion Lottery Winner Will Face Huge Taxes Possible

1 6 Billion Lottery Winner Will Face Huge Taxes Possible

What Is The Tax Rate For Lottery Winnings Howstuffworks

What Is The Tax Rate For Lottery Winnings Howstuffworks

Mega Millions Powerball Jackpots Come With Big Tax Bite

Mega Millions Powerball Jackpots Come With Big Tax Bite

Lottery Tax Calculator How Your Winnings Are Taxed Taxact

Lottery Tax Calculator How Your Winnings Are Taxed Taxact

Tallying The Big Tax Bite Of A 1 5b Powerball Win

Tallying The Big Tax Bite Of A 1 5b Powerball Win