Federal tax liens do not take precedence over purchase money mortgages or mortgage loans. 1 this important state law lien super priority is however qualified in three respects.

Do Irs Liens Have Priority Liens Over Mortgages Finance

Do Irs Liens Have Priority Liens Over Mortgages Finance

do federal tax liens have priority over mortgages

do federal tax liens have priority over mortgages is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in do federal tax liens have priority over mortgages content depends on the source site. We hope you do not use it for commercial purposes.

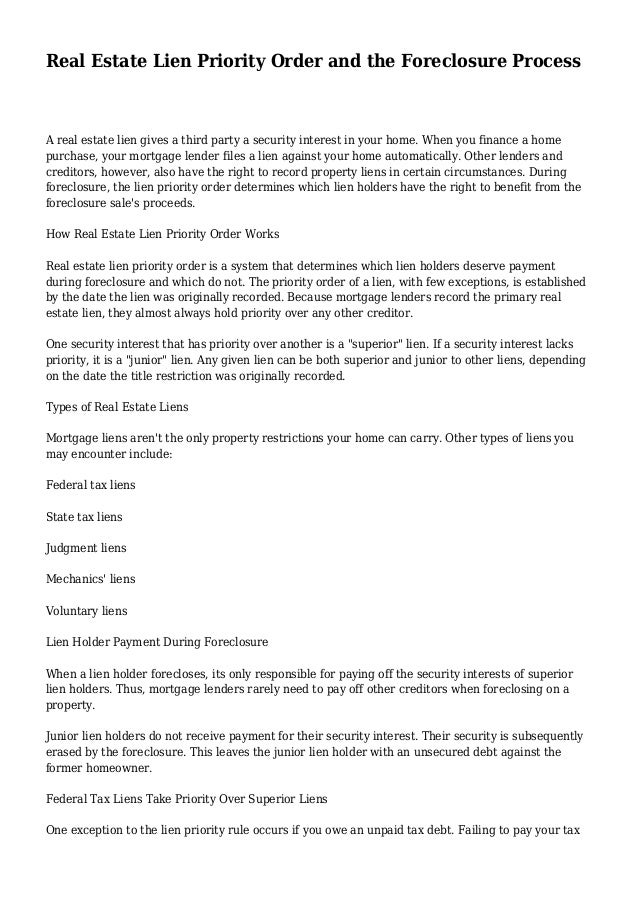

If one lien has priority over another lien it gets paid before the other lien.

Do federal tax liens have priority over mortgages. Generally speaking unless the service first properly files a notice of its federal tax lien the purchaser will have priority over the federal tax lien. Frequently homes have one or more liens on them. The internal revenue code provides that security interests arising from disbursements like loan advances made within 45 days after the filing of a notice of federal tax lien nftl will prime the federal tax lien the 45 day disbursement rule.

The pre existing lien is important only in considering the right to priority. Similarly unless the service first files a nftl the holder of a security interest mechanics lienor and judgment lien creditor will have priority over the federal tax lien. In good faith to secure a real property loan has priority over an already recorded irs tax.

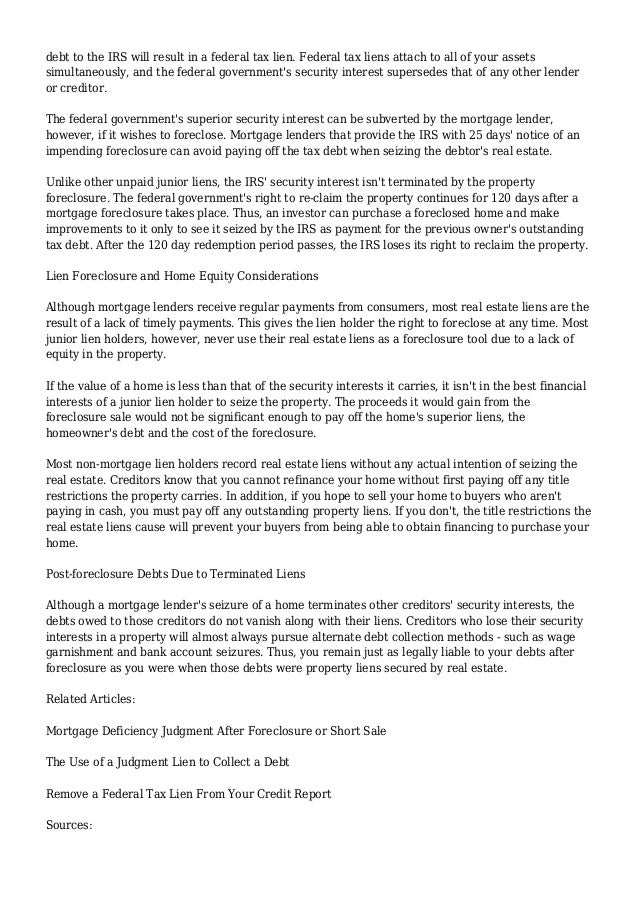

Ity of federal tax liens. A federal tax lien gives the irs the right to foreclose your property but it does not have priority over existing mortgages. While we believed that as a matter of public policy that the federal tax lien priority never would we thought it was a great opportunity to discuss federal tax liens and how they work in relation to previously recorded liens and mortgages.

Yesterday a client asked us if there were a circumstance in which a federal tax lien priority would ever be higher than an existing mortgage. The uni form federal lien registration act adopted in texas in 1989 states that except for qualifying property tax liens and special assessment liens the priority of a federal in come tax lien is set by the date the lien is properly led of record. The irs considers a purchase money security interest or mortgage to be valid under local laws so it is protected even though it may arise after a notice of federal tax lien has been filed.

Prior choate lien cannot prevent attachment of the federal tax lien to taxpayers property. Other taxes however may have different impacts to your mortgage. 45 day period for making disbursements.

Do irs liens have priority liens over mortgages. A state or local tax lien is entitled to priority over a federal tax lien only if it is a choate lien prior to the. Once recorded the established priority continues for ten years.

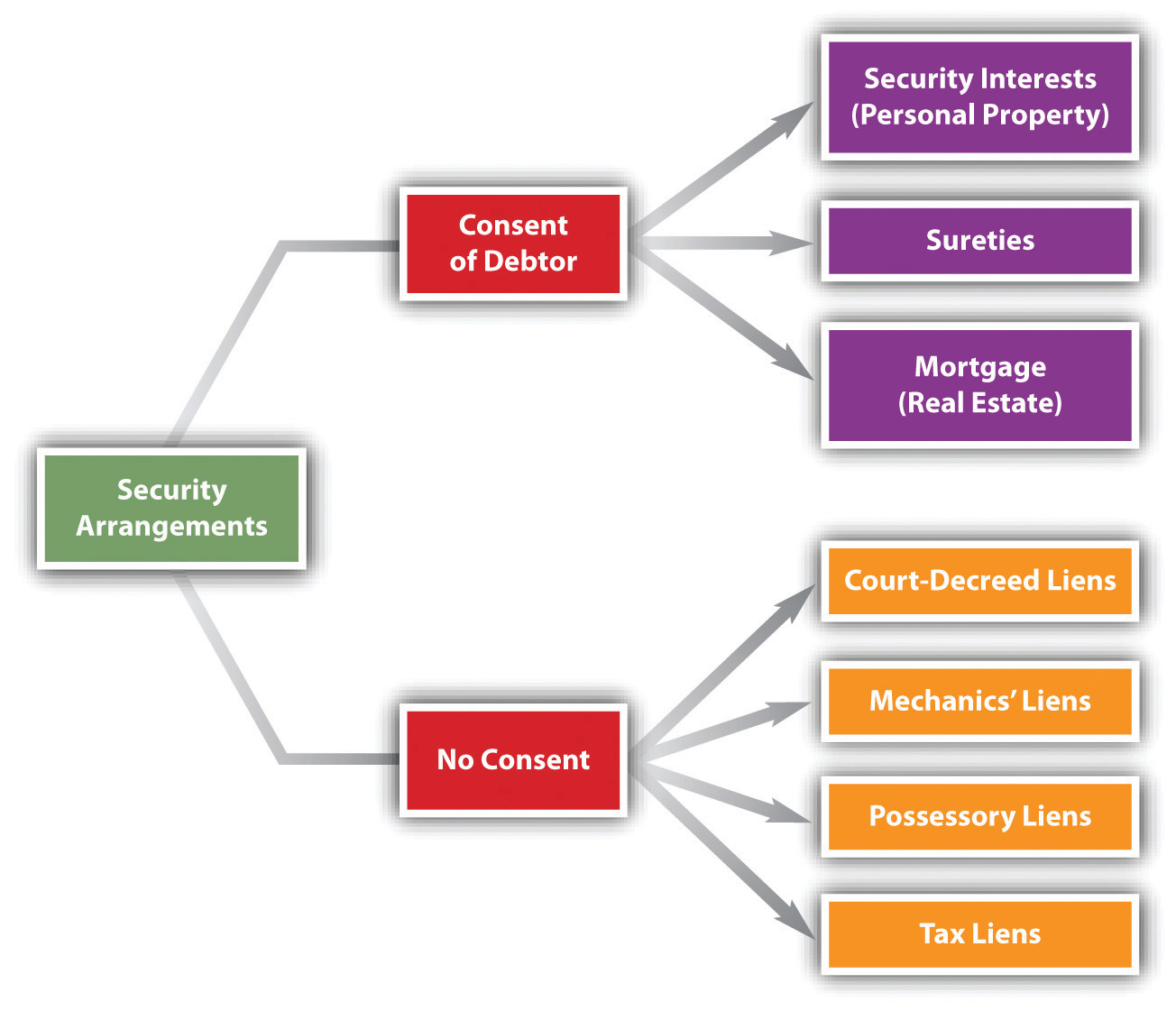

Understanding different types of liens. Do federal tax liens have priority over mortgages. If there is a federal tax lien.

State tax liens 1. Mostly though the tax lien puts the irs first in line for any profits related to the sale of your property. An irs lien doesnt have priority over your mortgage but it can delay or block the sale of property in some cases.

Do irs liens have priority over mortgages. Read on to learn more about different types of liens how lien priority is determined and how priority affects what happens to liens in a foreclosure. Home guides sf gate sf gate.

Real Estate Lien Priority Order And The Foreclosure Process

Real Estate Lien Priority Order And The Foreclosure Process

Mortgages And Nonconsensual Liens

Mortgages And Nonconsensual Liens

How To Sell A Property When There Is A Federal Tax Lien

How To Sell A Property When There Is A Federal Tax Lien

Can The Lender Foreclose If There Is A Federal Tax Lien

Can The Lender Foreclose If There Is A Federal Tax Lien

Federal Tax Lien Federal Tax Lien Priority Over Mortgage

Does A Tax Lien Take Priority Over A Mortgage

Does A Tax Lien Take Priority Over A Mortgage

Reverse Mortgage Credit Tax Lien Judgement Collections

Reverse Mortgage Credit Tax Lien Judgement Collections

Real Estate Lien Priority Order And The Foreclosure Process

Real Estate Lien Priority Order And The Foreclosure Process

5 17 2 Federal Tax Liens Internal Revenue Service

5 17 2 Federal Tax Liens Internal Revenue Service

Tax Liens Chris W Steffens Attorney At Law