Car buying in australia is more expensive than it might first appear. Your payer works out how much tax to withhold based on information you provide in your tax file number declaration and withholding declaration.

how much tax do i need to pay australia

how much tax do i need to pay australia is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in how much tax do i need to pay australia content depends on the source site. We hope you do not use it for commercial purposes.

17500000 australia tax calculation 202021.

How much tax do i need to pay australia. 3000000 australia tax calculation 202021. Use this simple accurate tax calculator to work out how much you will be paid. The 30k after tax take home pay illustration provides a salary calculation for an australian resident earning 3000000 per annum and assumes private medicare provisions have been made where necessary.

Visit asics moneysmart website to learn more. The most significant change is the extension of a new low and middle income tax offset. Most of your foreign income isnt taxed in australia.

We may need to close down this service or charge for it in the future. We may need to close down this service or charge for it in the future. Our australian income tax calculator calculates how much tax you will pay on your employment income this year.

If you are an australian resident for tax purposes and you. As much as possible the ato collects tax from taxpayers throughout the year rather than in an annual tax assessment. The tax system in australia is a pay as you go payg system.

Withholding rates are calculated on the basis that if your pay and circumstances remain consistent throughout the year you may be entitled to a small refund when you complete your tax return at the end of the financial year. Of course this does not take into consideration the tax withheld from your tfn income but it is better to save more than you need so you dont have any nasty surprises at tax time. Australian residents for tax purposes with a tax file number generally pay a lower rate of tax than foreign residents.

The 175k after tax take home pay illustration provides a salary calculation for an australian resident earning 17500000 per annum and assumes private medicare provisions have been made where necessary. This is the same concept as paye pay as you earn in other countries. Have a temporary resident visa.

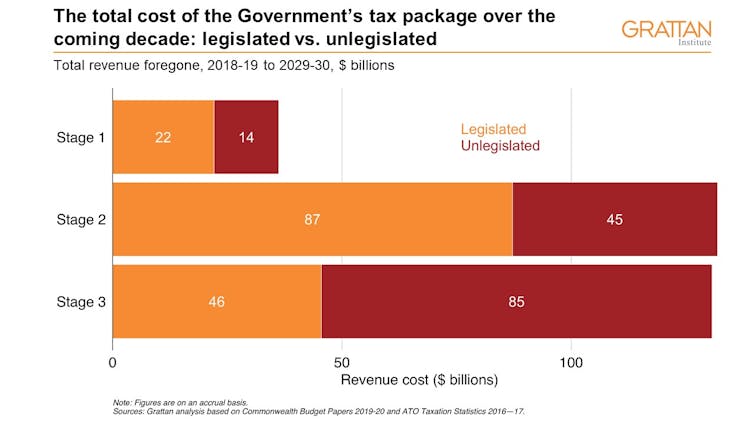

This calculator now includes tax rates for the proposed 2019 2020 tax year as well as the legislated changes in 2022 and 2024. This means that you need to put aside an estimated 50 a week to have enough money to pay your tax when you do your tax return. When you buy a car in australia you usually need to pay tax on the purchase price and this is often not added by the seller until after you have bought the car.

Individual Income Tax Rates Australia And Uk Compared 2015 16

Individual Income Tax Rates Australia And Uk Compared 2015 16

Is Money Transferred To Australia Taxed Sydney Moving Guide

Is Money Transferred To Australia Taxed Sydney Moving Guide

Goods And Services Tax Australia Wikipedia

Goods And Services Tax Australia Wikipedia

Goods And Services Tax Australia Wikipedia

Goods And Services Tax Australia Wikipedia

I Have Some Term Deposits In Australia That Earn Interest

Jurisdiction S Name Australia Information On Tax