You can use a pay stub to calculate your taxes if you dont receive a w 2 or if you want to get an early idea what your tax obligation or refund might be. But your employer doesnt have to.

Filing Taxes With Your Last Pay Stub

can you file income tax with last paycheck stub

can you file income tax with last paycheck stub is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in can you file income tax with last paycheck stub content depends on the source site. We hope you do not use it for commercial purposes.

Usually your last paystub does not match your w2.

Can you file income tax with last paycheck stub. If the irs is not successful in obtaining the w 2 then they will allow you to use a paystub. Can you e file with last paystub. When you do get the information on say a w 2 if it doesnt match what you filed you.

If you do not get your w 2 the irs allows you to use your paycheck but you must follow the irs rules and call them first after february 28 2018. Every year many people use a paycheck stub to file their taxes early and get an advance on their refund. Can you file taxes with your last pay stub without a w 2.

There are several items that are deducted pre tax that will affect your taxable gross income. Some people go online the first week in january and prepared their tax return using the information on their last paycheck stub because they dont want to wait to receive their w 2. And you cant file until you get the actual w2.

You can use your last paycheck and enter it to get an estimate but be sure to come back and correct it when you get the w2. Occasionally however you might not receive a w 2 because either it was lost in the mail or your employer neglected to file the tax form for one reason or another. It is possible to use a pay stub to file taxes in the traditional way but youll need to notify the irs that youre doing so and fill out a 4852 form.

This can be done in lieu of a w 2. If you are in need of financial assistance and its close to income tax season you can consider filing your taxes early. If your agi is 58000 or less you can use the free file tax software.

If youre anticipating a tax refund youd like to have that money in your hands or in your bank account as soon as possible. If you want to get your tax refund as soon as possible you are probably wondering if you can file taxes with a pay stub and without a w 2. You must have your w 2 and other forms available.

For those wondering can you file taxes with your last pay stub the answer is yes but the best way to do so is online. From your tax rate last year you calculate your adjusted gross income. We urge you to wait.

In this case you can still file your taxes using the information on your year end paycheck stub. Can i use my last check stub to file my taxes. If you didnt even have a last pay stub or a w 2 you still legally have to file your income tax.

Your last ytd paycheck should have all of the information needed to complete your income tax return in the absence of your w 2.

File My Taxes File My Taxes Using Last Pay Stub

3 Ways To Calculate Your Tax Refund Using Your Pay Stub

3 Ways To Calculate Your Tax Refund Using Your Pay Stub

How To Determine Federal Taxable Income From Your Last Pay

How To Determine Federal Taxable Income From Your Last Pay

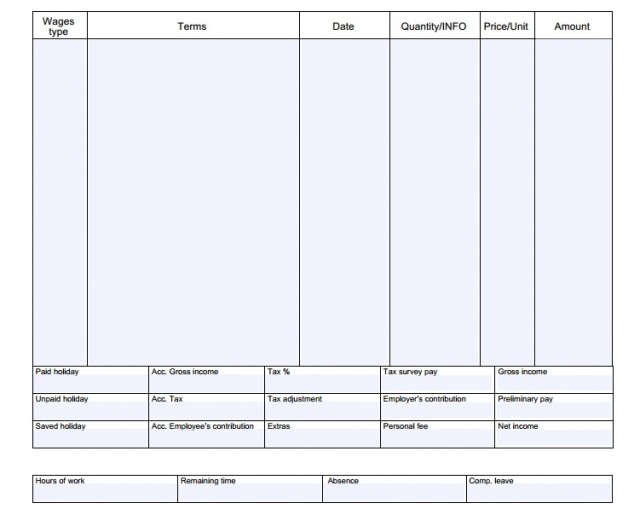

Portland State Finance Administration Human Resources

Portland State Finance Administration Human Resources

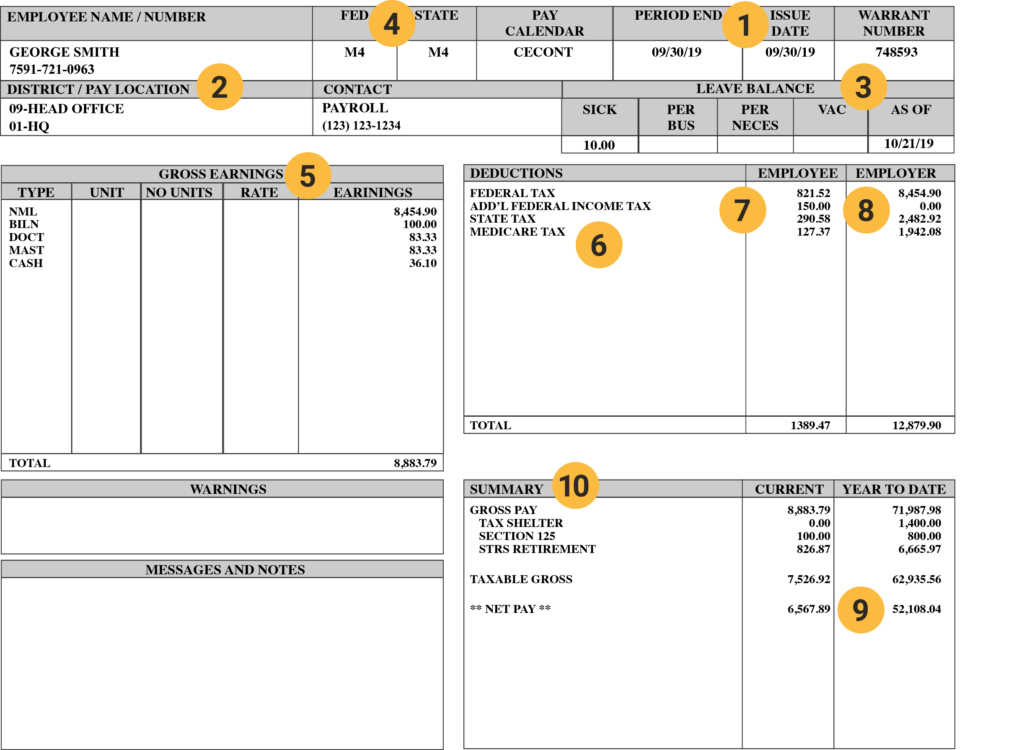

Understanding Your Paycheck Stub How To Read Your Pay Stub

Understanding Your Paycheck Stub How To Read Your Pay Stub

Central Pro Insurance Income Tax Faqs

W 2 Box 1 Wages Vs Final Pay Stub Asap Help Center

W 2 Box 1 Wages Vs Final Pay Stub Asap Help Center

What Is A Pay Stub Do I Need To Provide Pay Stubs For My

What Is A Pay Stub Do I Need To Provide Pay Stubs For My

W 2 Box 1 Wages Vs Final Pay Stub Asap Help Center

W 2 Box 1 Wages Vs Final Pay Stub Asap Help Center

How Do I Read My Pay Stub Gusto

How Do I Read My Pay Stub Gusto