Click here for a 2019 federal tax refund estimator. The top 1 percent pays 24 percent of all federal taxes compared to 35 percent of all federal income taxes.

How Much Do The Top 1 Percent Pay Of All Taxes

how much of the taxes do the 1 pay

how much of the taxes do the 1 pay is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in how much of the taxes do the 1 pay content depends on the source site. We hope you do not use it for commercial purposes.

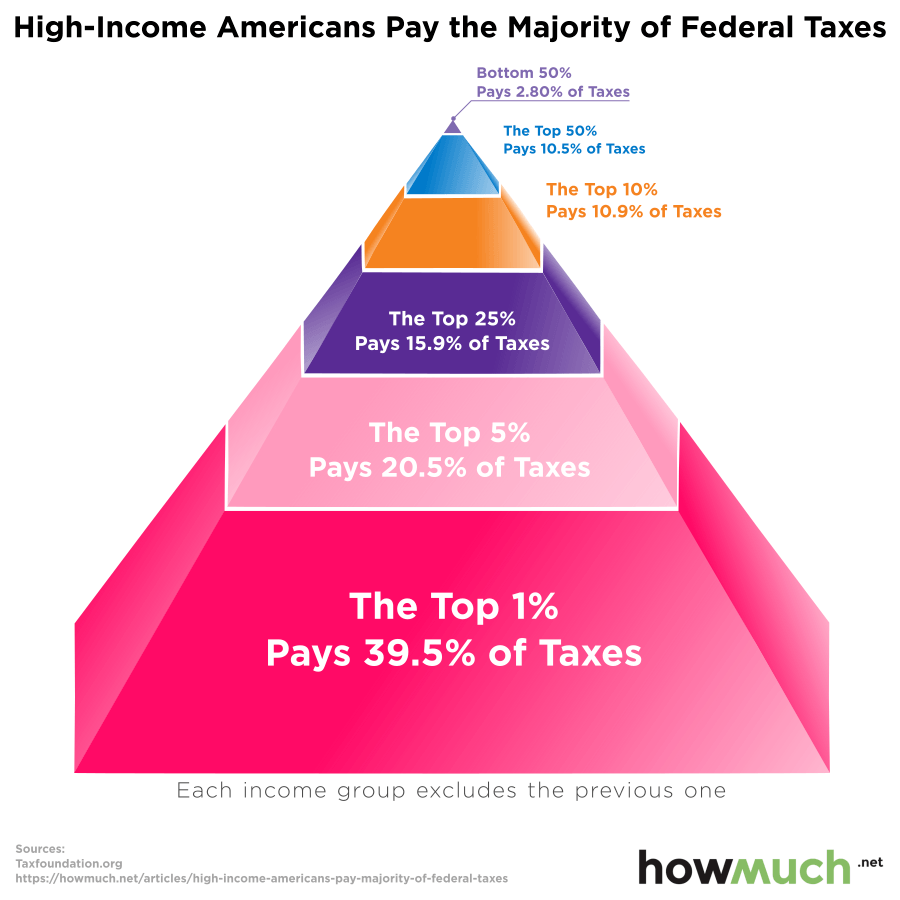

Take a look at the red triangles in the chart above which combine all three major types of taxes.

How much of the taxes do the 1 pay. Smartasset calculated the amount of money a specific person would pay in income sales property and fuel taxes in each county in the country and ranked the lowest to highest tax burden. Income payroll and state and local. 2019 federal income tax calculator.

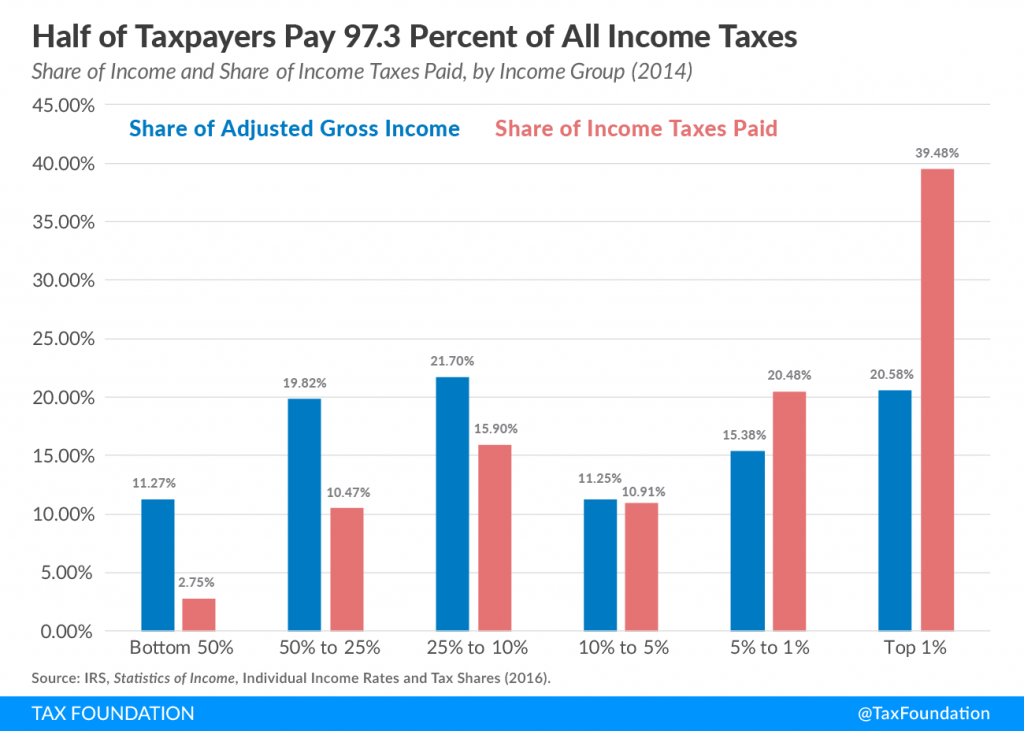

The richest percent of american taxpayers pay in 54264 billion of a total take of federal income tax of 137 trillion. That is one of the most eye catching figures in a study released by the tax foundation earlier this month. The top earning 1 percent of americans will pay nearly half of federal income taxes for 2014 the largest share in at least 3 years a study says.

That much maligned minority the richest percent of americans pay 395 of all federal income tax. According to estimates by the tax policy foundation the top 1 percent of earners incomes in excess of 615000 are paying nearly half 45. Tax reform means changes in how small businesses pay taxes.

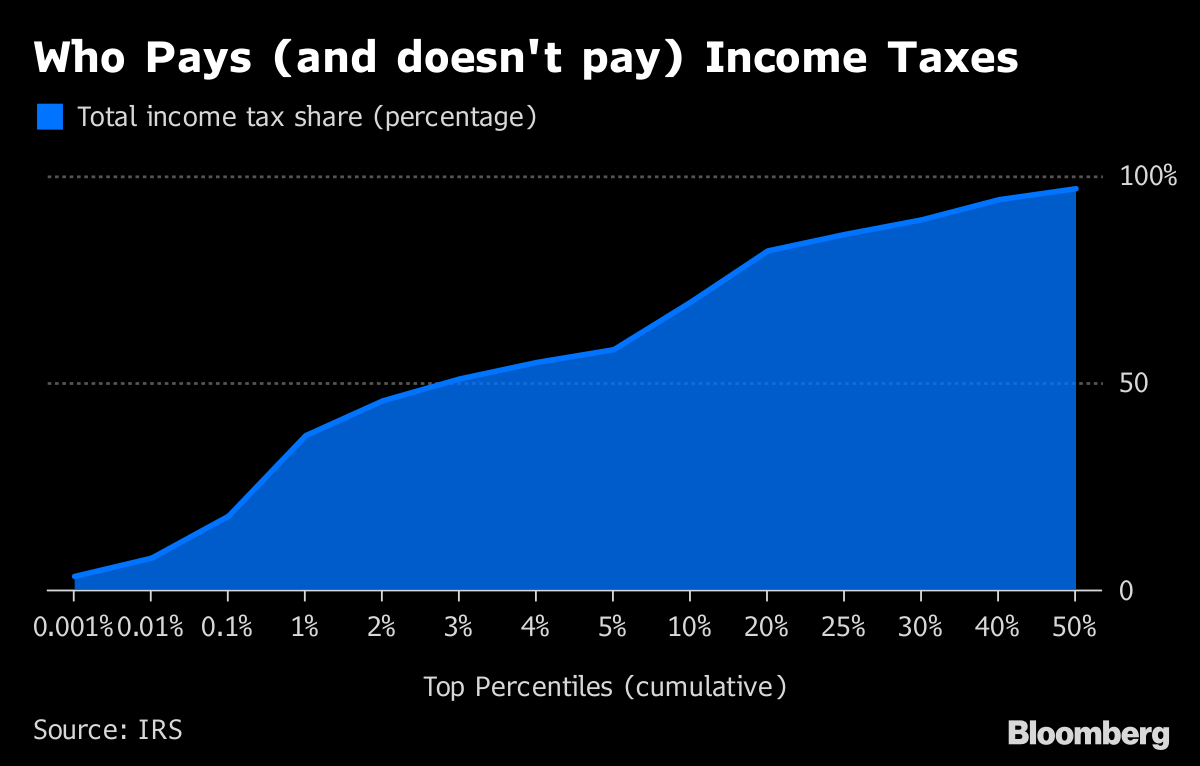

Thank god for the 1. To put that percentage in absolute figures. According to the internal revenue service irs the top one percent of united states taxpayers 14 million paid as much in federal income taxes as the bottom 95 percent 134 million in 2015.

The tax cuts and jobs act signed in december 2017 comes with several key changes to how small businesses pay taxes and how much tax they pay. The top 1 percent of all households got 18 percent of all personal income and paid nearly 28. When looking at just federal income taxes they pay 68 percent of the burden.

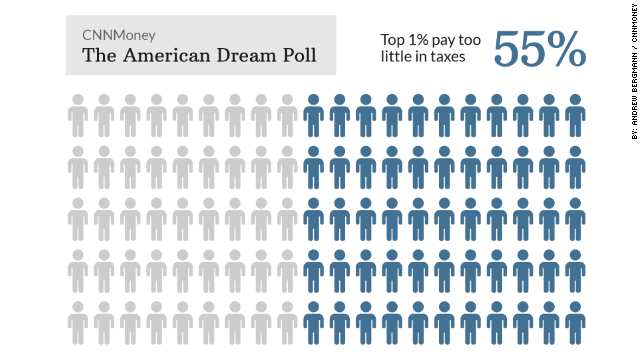

They suggest the overall tax code is indeed progressive although not nearly as much as you might think by looking at just federal income taxes. Wonder how much the rich pay in federal income tax. Taxes are unavoidable and without planning the annual tax liability can be very uncertain.

What percent of taxes does the top 1 percent pay and what percent of the income do they make. Where you live can have a big impact on both which types of taxes you have to pay each year and how much money you spend on them. Use the following calculator to help determine your estimated tax liability along with your average and marginal tax rates.

So how much do the rich and poor really pay.

Summary Of The Latest Federal Income Tax Data 2016 Update

Summary Of The Latest Federal Income Tax Data 2016 Update

Yes The Top 1 Percent Do Pay Their Fair Share In Income

Believe It Or Not The Richest Americans Pay Most Of The

Believe It Or Not The Richest Americans Pay Most Of The

The Top 1 Percent Pays More In Taxes Than The Bottom 90

The Top 1 Percent Pays More In Taxes Than The Bottom 90

Yes The Top 1 Percent Do Pay Their Fair Share In Income

Do The Top 1 Pay Enough Taxes Too Much

Do The Top 1 Pay Enough Taxes Too Much

How Much Do The Top 1 Percent Pay Of All Taxes

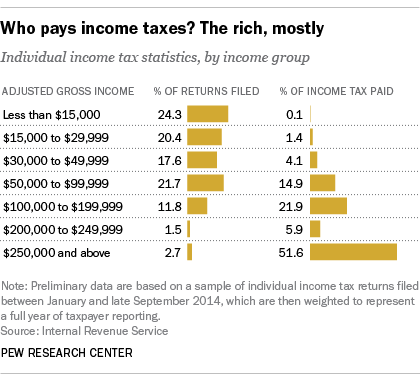

Who Pays U S Income Tax And How Much Pew Research Center

Who Pays U S Income Tax And How Much Pew Research Center

Top 3 Of U S Taxpayers Paid Majority Of Income Tax In 2016

Top 3 Of U S Taxpayers Paid Majority Of Income Tax In 2016

45 Of Americans Pay No Federal Income Tax Marketwatch

45 Of Americans Pay No Federal Income Tax Marketwatch

High Income Americans Pay Most Income Taxes But Enough To

High Income Americans Pay Most Income Taxes But Enough To