If the church has agreed to pay half of the social security tax and that amount is added to wages in box 1 doesnt that mean that the pastor will be paying social security on the amount given to him for social security. One major difference between clergy and regular employees is social security and medicare taxesministers are responsible for paying all social security self employment tax on their salary and housing allowance in addition to whatever state and federal.

do ministers pay social security tax on housing allowance

do ministers pay social security tax on housing allowance is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in do ministers pay social security tax on housing allowance content depends on the source site. We hope you do not use it for commercial purposes.

Churches can give ministers a social security allowance or offset to help the minister pay seca taxes.

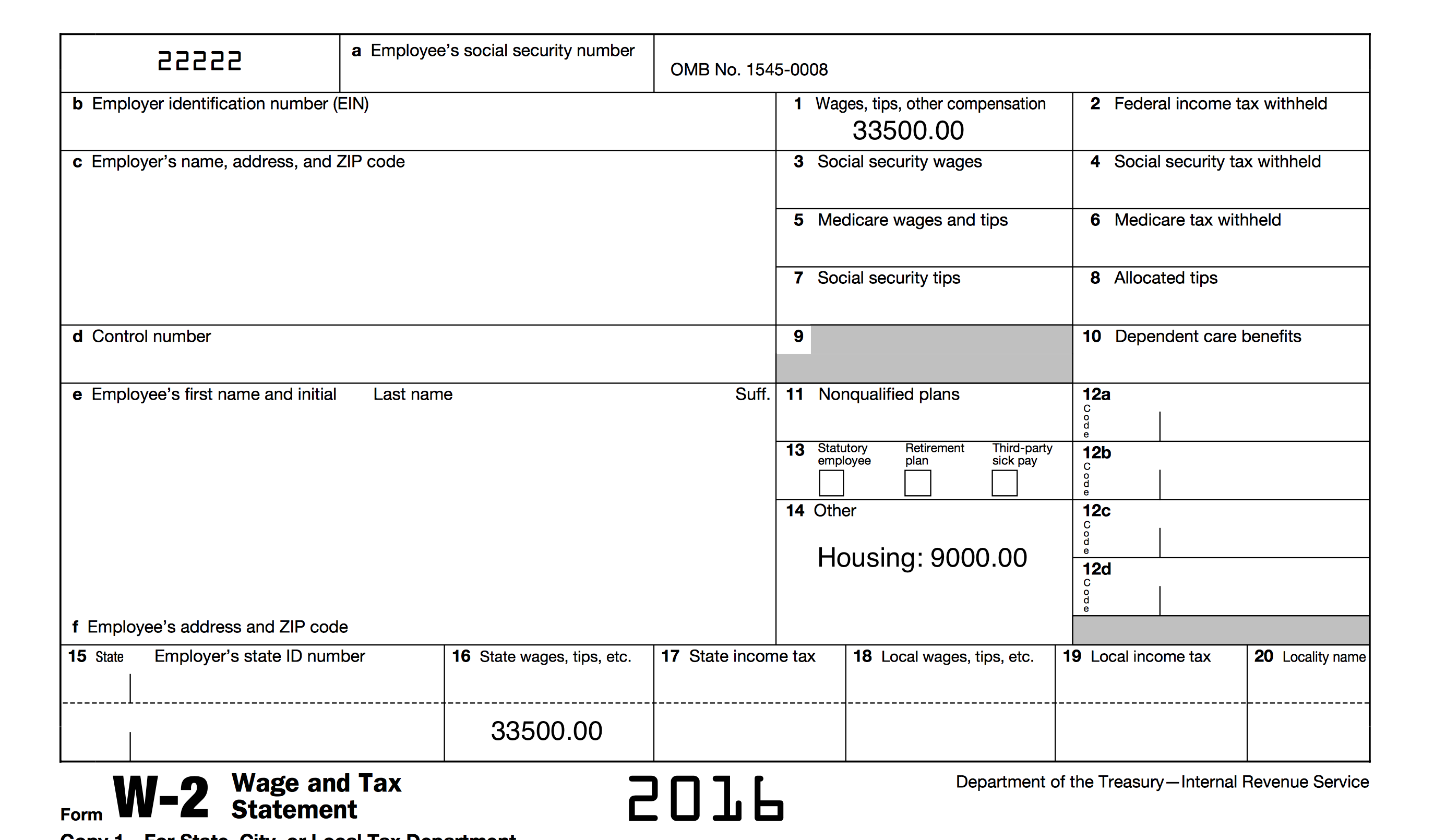

Do ministers pay social security tax on housing allowance. Ministers or church leaders often wonder how to figure the amount of the social security allowance. The services you perform in the exercise of your ministry are generally. This means that they must pay both the employee and the employer share of social security tax under the self employed contribution act seca.

Social security tax allowance. Tax withholding for clergy. The irs does not require churches to pay a social security allowance to its minister staff and provides no guidance on how to structure it.

The minister will have to report the allowance as income for federal income tax purposes and as income for seca tax purposes. The fair rental value of a parsonage or the housing allowance is excludable only for income tax purposes. We suggest that the amount be set at whatever the church would be paying.

The minister must include the amount of the fair rental value of a parsonage or the housing allowance for social security coverage purposes. The irs has ruled that clergy are self employed for purposes of paying social security taxes. Ministers working for churches are treated differently than other employees when it comes to tax withholding.

Clergy social security allowance. But a social security allowance or offset is extra income.

Presenting Our Brand New Minister Housing Allowance

Presenting Our Brand New Minister Housing Allowance

How To Make Quarterly Estimated Tax Payments For Ministers

How To Make Quarterly Estimated Tax Payments For Ministers

Jim Olsen Cpa The Minister And His Taxes The Bible

Polity Class Financial Support Services 1 Church Taxes

Polity Class Financial Support Services 1 Church Taxes

Do Pastors Pay Social Security And Medicare The Pastor S

Do Pastors Pay Social Security And Medicare The Pastor S

Jim Olsen Cpa The Minister And His Taxes The Bible

Clergy Tax Issues American Correctional Chaplains

Clergy Tax Issues American Correctional Chaplains

Tax Questions And Answers For Active Ministers Pdf Free

Tax Questions And Answers For Active Ministers Pdf Free

Tax Questions And Answers For Active Ministers Pdf Free

Tax Questions And Answers For Active Ministers Pdf Free

Clergy Payroll And Tax Issues Summarized Fliphtml5