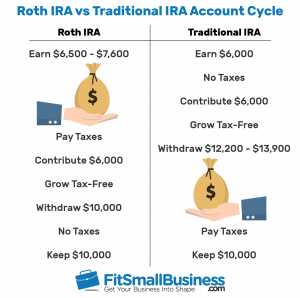

Know that the traditional ira does give you the chance to lower your taxes right away as contributions to traditional iras are generally tax deductible. Roth individual retirement arrangements were introduced in 1998 to offer an after tax option for retirement savings.

New Tax Law Gives Roth Ira More Appeal

New Tax Law Gives Roth Ira More Appeal

do contributions to roth ira affect taxes

do contributions to roth ira affect taxes is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in do contributions to roth ira affect taxes content depends on the source site. We hope you do not use it for commercial purposes.

Roth ira contributions arent taxed because the contributions you make to them are usually made with after tax money and you cant deduct them.

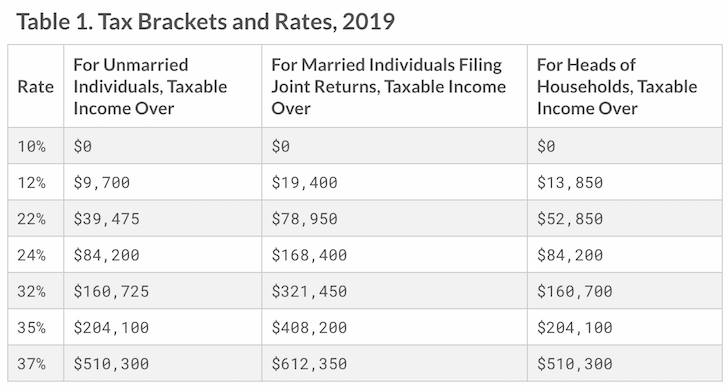

Do contributions to roth ira affect taxes. Roth iras offer tax free growth on contributions and earnings. Contributing to a roth ira doesnt change your adjusted gross income because the contributions are made with after tax dollars. Roth iras allow you to pay taxes on money going into your account and then all future withdrawals are tax free.

Contributing to a roth ira usually wont affect your income tax refund in the current year but it could save you lots of money on your taxes in the future making it particularly useful if you think youll pay a higher tax rate in the future. Retirement savings credit both traditional and roth ira contributions can qualify for the retirement savings credit. Of all the benefits roth iras offerand there are manythe most significant is the way the taxes work.

In some cases though your withdrawals may trigger a tax or penalty. Roth ira contributions arent deductible nor are they reported on your tax return. Below are a simple set of rules you can use to determine if your roth ira withdrawal will be tax free or not.

How much will a roth ira lower my taxes. When do you have to report your roth ira on taxes. You withdraw the amount of your contributions or less which excludes any money your roth ira has accumulated in the form of dividends capital gains interest etc.

The contribution limit which went up to 6000 in 2019 can be deposited into your ira account up until. How converting to a roth ira can affect your taxes taxes can cost a lot depending on the kinds of contributions you made. Earnings in a roth account can be tax free rather than tax deferred.

Cuiffo says the most common last minute deduction for your taxes is an ira contribution. When dont you have to report your roth ira on taxes. For example say your salary is 80000 you dont.

Investing your savings into a roth ira allows you access to more of your money sooner in life without paying taxes and penalties. So keep good records of your ira contributions.

The Only Reasons To Ever Contribute To A Roth Ira

The Only Reasons To Ever Contribute To A Roth Ira

Roth Ira Rules Contribution Limits Deadlines

Roth Ira Rules Contribution Limits Deadlines

Are Roth Ira Contributions Tax Deductible Good Financial

Are Roth Ira Contributions Tax Deductible Good Financial

2019 Ira 401k And Roth Ira Contribution Limits Roth Ira

2019 Ira 401k And Roth Ira Contribution Limits Roth Ira

How Ira Contributions Affect Your Taxes

How Ira Contributions Affect Your Taxes

How Roth Ira Conversions Can Escalate Capital Gains Taxes

How Roth Ira Conversions Can Escalate Capital Gains Taxes

Vanguard Consider The Advantages Of Roth After Tax

Vanguard Consider The Advantages Of Roth After Tax

How Does An Ira Affect Tax Returns Finance Zacks

How Does An Ira Affect Tax Returns Finance Zacks

Individual Retirement Account What Is An Ira Nerdwallet

Individual Retirement Account What Is An Ira Nerdwallet