Olr report 2005 r 0131 addresses tax exemptions for military retirement pay of the 17 states that we randomly selected only two exempt military pay income from taxes exempting all compensation earned by servicemen including guardsmen and reservists for active duty service. If under age 65 you can deduct up to 14000 of retirement income when filing.

do active duty military pay income tax

do active duty military pay income tax is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in do active duty military pay income tax content depends on the source site. We hope you do not use it for commercial purposes.

Armed forces have special tax considerations for both state and federal purposes.

/arc-anglerfish-arc2-prod-mco.s3.amazonaws.com/public/57VZ3WXC5RAXFAFIXF4A5PICKQ.jpg)

Do active duty military pay income tax. However exceptions based on deployment conditions and special deductions are available. Additionally the military was able to keep some of the deductions that civilians lost in the tax reforms for 2018. The state in which you list with military finance as your official residence will determine the state tax rules you fall under.

Your w 2 form may indicate active duty but the department will not process your return without proof you earned that active duty military pay outside of pennsylvania. This entry puts mpa military pay adjustment next to the entry on line 7 of form ca 540nr. See if you are part of a qualifying organization.

Active duty military pay. Depending on the state you may pay no income tax whatsoever or you may find your military retirement pay is exempt from taxation up to a certain dollar amount. Reserve national guard drill pay is not taxable.

9 states dont have a personal income tax 8 states fully tax military retirement pay 20 states dont tax retirement pay and 13 tax a portion. Enlisted military members are required to pay federal income tax on their earnings. This item is intended to address some issues regarding the treatment of both taxable and nontaxable income taxability of.

Some states do not tax military pay while a few others wont tax it unless you are stationed within the state. If one spouse is a resident of california and the other is not you may file separate state returns. This page provides tax information for current and former military personnel serving in the united states armed forces uniform services and under limited circumstances support organizations.

As a military spouse the author has experienced three combat tours military moves and orders stationing her and her husband outside of their resident state. Domicile or legal residence is an individuals permanent home. Active duty pay is taxable.

Youll pay federal income tax social security medicare and state taxes on your base pay. Military pay including compensation for weekend drills earned within and outside pennsylvania by. Save click until you exit california return.

Active duty members of the us. Is military pay taxable for pa personal income tax purposes. If you are serving in the united states armed forces and your domicile legal residence is north carolina you must pay north carolina income tax and north carolina income tax should be withheld from your military pay regardless of where you are stationed.

To do this within your account you can file the. Your legal residence does not change even though you may be absent for one.

Active Duty Enlisted Basic Military Pay Charts 2019

Active Duty Enlisted Basic Military Pay Charts 2019

State Tax Information For Military Members And Retirees

State Tax Information For Military Members And Retirees

Who Doesn T Pay Federal Income Tax

/GettyImages-82959598-576d33cb5f9b58587538ffe2.jpg) Comprehensive Guide To Military Pay

Comprehensive Guide To Military Pay

/arc-anglerfish-arc2-prod-mco.s3.amazonaws.com/public/57VZ3WXC5RAXFAFIXF4A5PICKQ.jpg) Military Tax Tips New Tax Law Is Mostly Good News

Military Tax Tips New Tax Law Is Mostly Good News

5 Differences Between Military And Civilian Paychecks

5 Differences Between Military And Civilian Paychecks

Who Doesn T Pay Federal Income Tax

Understand The Military Retirement Pay System

Understand The Military Retirement Pay System

Are Military Retirements Exempt From Taxes Finance Zacks

Are Military Retirements Exempt From Taxes Finance Zacks

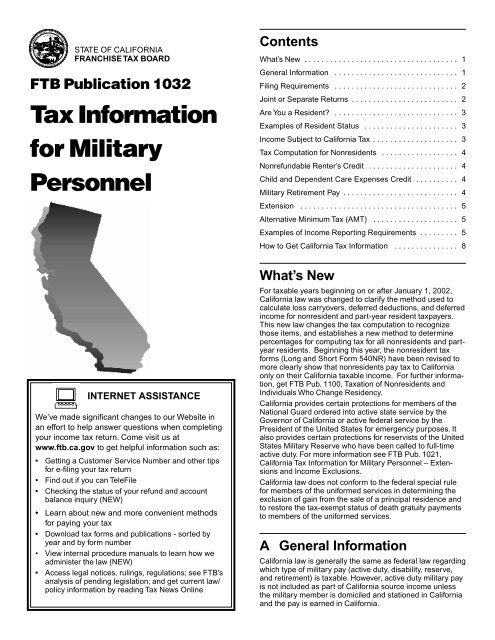

Ftb Pub 1032 Tax Information For Military Personnel

Ftb Pub 1032 Tax Information For Military Personnel