Parking your car can be just as expensive as driving if if not more so. Does anybody know if this is possible.

Tips To Avoid Penalty For Illegal Parking Directasia Insurance

Tips To Avoid Penalty For Illegal Parking Directasia Insurance

can i claim parking tickets on my taxes

can i claim parking tickets on my taxes is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in can i claim parking tickets on my taxes content depends on the source site. We hope you do not use it for commercial purposes.

If you must pay to park at a medical office you can deduct these fees as a medical expense if you have enough medical expenses to deduct from your taxes.

Can i claim parking tickets on my taxes. If youre self employed the basic rule is that any money you spend to park for business is. This was in regards to a case in which a taxpayer was trying to deduct parking tickets as a business expense. Because of those rules the parking deduction for w 2 employees may not be substantial.

No deductions is allowed for any fine or penalty for violating any law even parking restrictions. You were normally required to work away from your employers place of business or in different places. Under your contract of employment you had to pay your own motor vehicle expenses.

Learn which parking expenses may be deductible. The question as to whether parking tickets are tax deductible was decided in 1975 by the tax court when they determined that parking tickets are not business deductions. What are the conditions ie public transport proximity etc.

However if you pay to park legally for example if you put money in a parking meter pay to park in a garage or pay for valet parking then you can deduct the parking fees. How to claim a parking deduction on taxes. In certain cases the canada revenue agency may allow you to deduct parking fees on your income tax return.

Ive been to the ato website and it is fairly vague in clarifying eligibility requirements to claim car parking fees as a tax deduction. You can deduct parking costs related to earning your employment income as long as you meet all of the following conditions. You can only deduct the expenses over that 2 percent amount.

You may want to investigate if your employer provides some pre tax commuter benefits for parking. While you cannot deduct regular parking expenses at work from your taxes you can deduct parking expenses for other reasons. Self employed individuals and small business owners as a self employed individual or a small business owner you are allowed to deduct expenses incurred in order to earn business income.

The good news is that parking can be a tax0deductible expense. If i pay to park my car at work and keep the receipts can i claim. Lets walk through deducting parking expenses on your taxes.

Traffic Why It S Getting Worse What Government Can Do

Traffic Why It S Getting Worse What Government Can Do

How To Fight A Private Parking Ticket Lawyer Reveals This

How To Fight A Private Parking Ticket Lawyer Reveals This

Subcontr Support Ltd Subsupportltd Twitter

Subcontr Support Ltd Subsupportltd Twitter

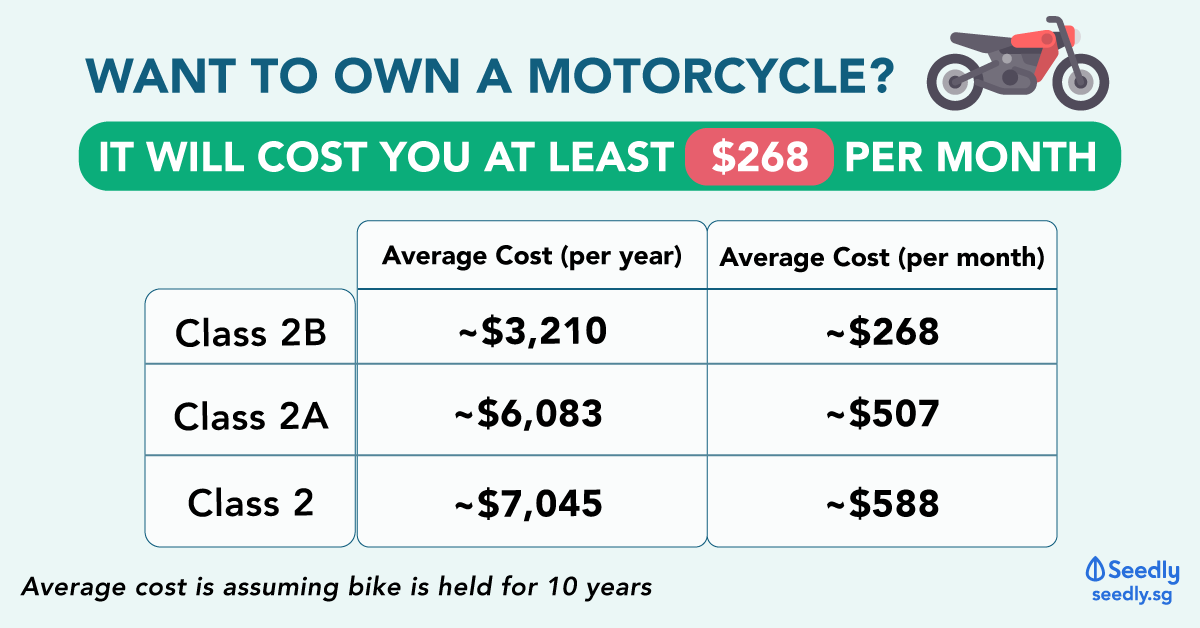

How Much Does It Cost To Own A Bike In Singapore

How Much Does It Cost To Own A Bike In Singapore

Car Park Fines Should You Pay Them

Car Park Fines Should You Pay Them

What Happens If I Leave Parking Tickets Unpaid Reader S

What Happens If I Leave Parking Tickets Unpaid Reader S

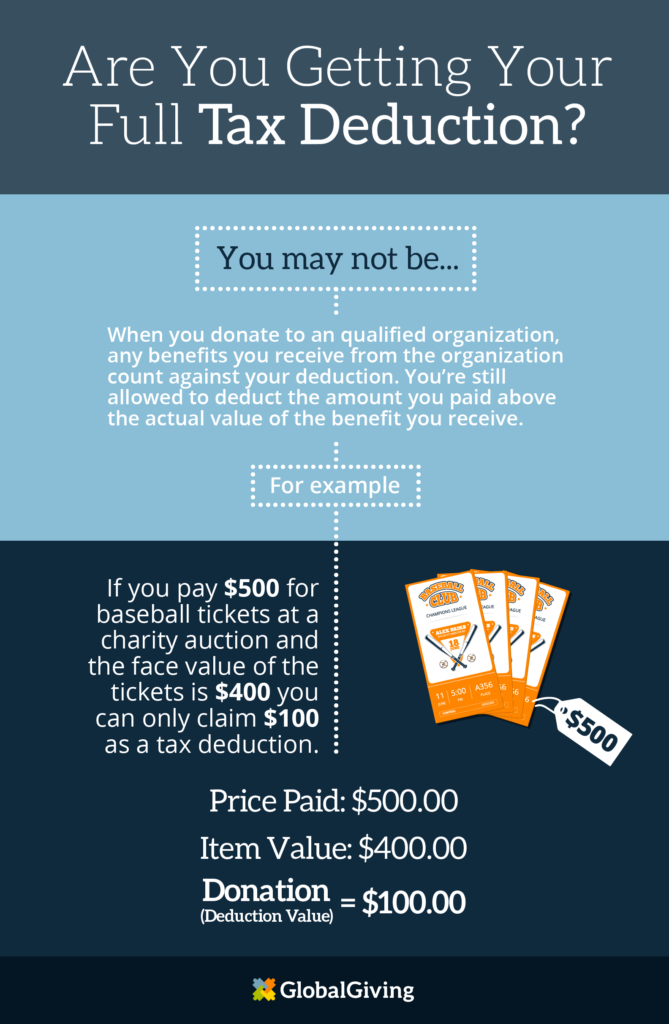

Everything You Need To Know About Your Tax Deductible

Everything You Need To Know About Your Tax Deductible

Police Collected Fines Fees And Forfeitures How Does Your

Police Collected Fines Fees And Forfeitures How Does Your

Tax Deductions 2018 42 Tax Write Offs You May Not Know About

Tax Deductions 2018 42 Tax Write Offs You May Not Know About