However you would be taxed on the amount you choose to move at current income rates. Roth ira funds grow tax exempt.

How Roth Ira Conversions Can Escalate Capital Gains Taxes

How Roth Ira Conversions Can Escalate Capital Gains Taxes

are capital gains taxed in a roth ira

are capital gains taxed in a roth ira is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in are capital gains taxed in a roth ira content depends on the source site. We hope you do not use it for commercial purposes.

Into a roth ira.

Are capital gains taxed in a roth ira. 2019 20 capital gains tax rates. Roth iras are a great way to save for retirement but the money is taxed when you contribute. If your ira earns money over the years when you withdraw the money youll wonder if you must pay taxes on those earnings.

A self directed individual retirement account sdira is a type of ira managed by the account owner that can hold a variety of alternative investments. Are capital gains in roth iras to be taxed. Generally you own a roth or traditional ira although some investors opt for both.

Roth ira taxes vs. They are taxed at the same. A roth ira can offer a tax advantaged way to save for retirement.

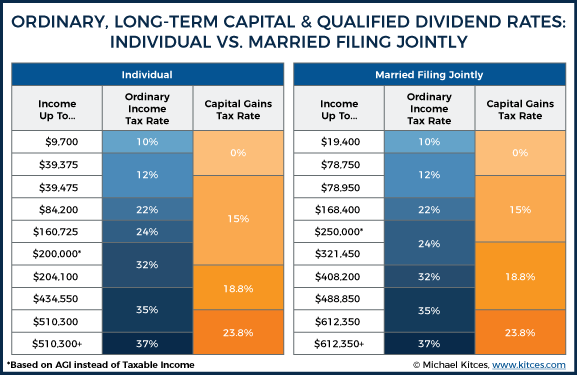

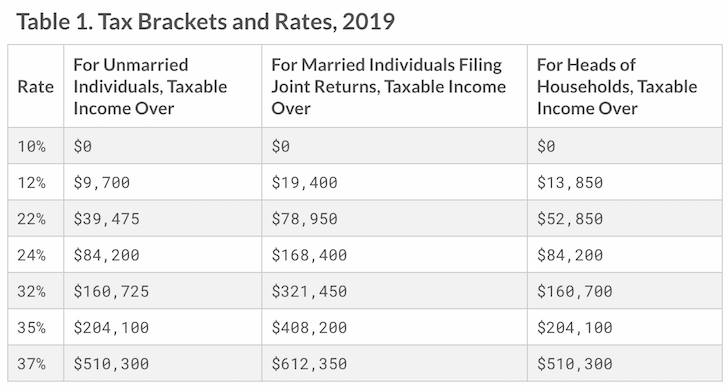

Roth ira conversion income is ordinary income and is taxed the same as wages pensions and other ira distributions and short term capital gains. Not capital gains rates. Any capital gains on the earnings in your ira account do not benefit from lower capital gains tax treatment.

Roth ira short term gains vs. Individual retirement accounts allow you to set aside up to 5000 of earned income in a tax advantaged account as of the 2012 tax year. Investors in regular accounts have to consider whether the gains they realize are subject to relatively high short term capital gains rates or lower long.

Do you have to pay capital gains on roth ira earnings. Its important to know when and what you can withdraw to avoid penalties. The way roth iras are taxed is basically the opposite of how traditional iras and regular 401k.

To comprehend how capital gains are treated understand how each ira functions. How roth ira contributions are taxed. Our tax system taxes ordinary income first and.

Although contributions to a roth are not tax deductible earnings grow tax.

How Roth Ira Conversions Can Escalate Capital Gains Taxes

How Roth Ira Conversions Can Escalate Capital Gains Taxes

Traditional Iras And Roth Iras Which Is Better For Dividends

Traditional Iras And Roth Iras Which Is Better For Dividends

The Tax Impact Of The Long Term Capital Gains Bump Zone

The Tax Impact Of The Long Term Capital Gains Bump Zone

Do You Have To Pay Capital Gains On Roth Ira Earnings

Do You Have To Pay Capital Gains On Roth Ira Earnings

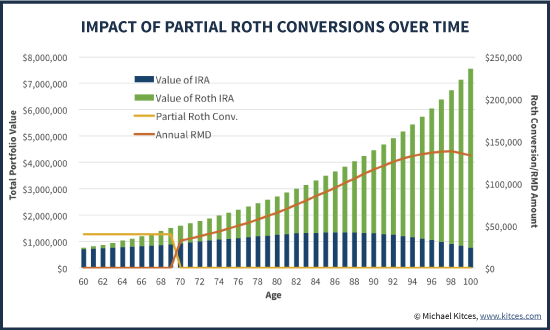

Systematic Partial Roth Conversions Recharacterizations

Systematic Partial Roth Conversions Recharacterizations

Backdoor Roth Ira What It Is And How To Set One Up Nerdwallet

Backdoor Roth Ira What It Is And How To Set One Up Nerdwallet

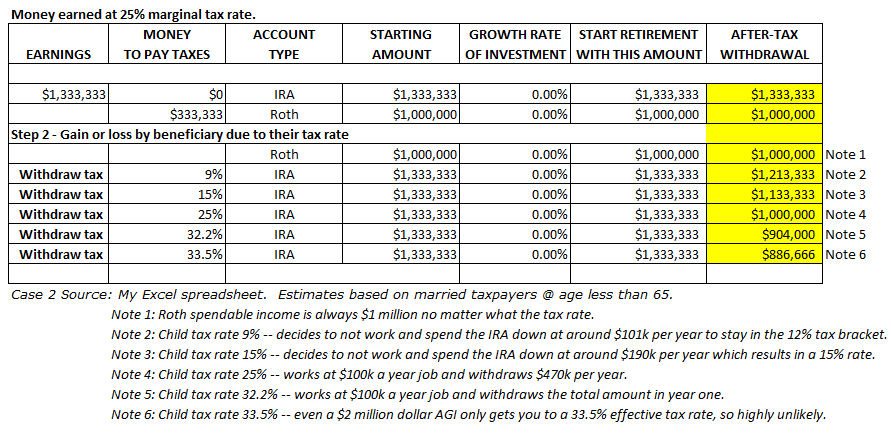

The Only Reasons To Ever Contribute To A Roth Ira

The Only Reasons To Ever Contribute To A Roth Ira

Short Term And Long Term Capital Gains Tax Rates By Income

Short Term And Long Term Capital Gains Tax Rates By Income

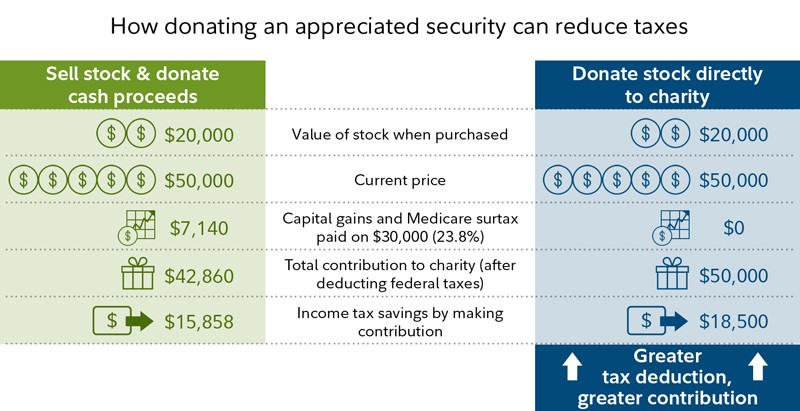

How To Invest Tax Efficiently Fidelity

How To Invest Tax Efficiently Fidelity

The Risk Of The Roth Ira Revolution Seeking Alpha

The Risk Of The Roth Ira Revolution Seeking Alpha