On an income of 30000 your federal withholding should be around 2796. If you are filing a joint return with only 30000 as income no dependents or itemized deductions you would see 1100 go to income tax.

Tax Calculator For 30 000 Salary New Hmrc 2019 2020 Tax

Tax Calculator For 30 000 Salary New Hmrc 2019 2020 Tax

30000 a year how much tax return

30000 a year how much tax return is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in 30000 a year how much tax return content depends on the source site. We hope you do not use it for commercial purposes.

The 30k after tax take home pay illustration provides a salary calculation for an australian resident earning 3000000 per annum and assumes private medicare provisions have been made where necessary.

30000 a year how much tax return. If you made 30000 last year what will your tax return. With an average tax refund of 2763 and median income of 57617 the average taxpayers refund is around 5 of their annual salary. How much is the average tax refund.

Did you withhold enough in taxes this past year. Click here for a 2019 federal income tax estimator. Remember this is just a tax estimator so you should file a proper tax return to get exact figures.

The average tax refund in 2017 was 2763. We achieve this in the following steps. The salary example begins with an overview of your 3000000 salary and deductions for income tax medicare social security retirement plans and so forth.

If you can provide me with your filing status number of dependents and itemized deductions i can provide you with a more exact estimate of your tax situation. Use this calculator to help determine whether you might receive a tax refund or still owe additional money to the irs. You are the only one that has all of the necessary information that will have to be reported on your income tax return for the year in.

2019 tax refund estimator. Then most importantly it depends on how much federal withholding tax you pay every year. Normally lets assume that you are a single person and have no dependents.

So this is what you should have paid to the irs for one taxable year on an income of 30000. That is a 19 increase over last years average refund of 2711. The aim of this 3000000 salary example is to provide you detailed information on how income tax is calculated for federal tax and state tax.

What is the average percentage of tax refund. How we calculated the income tax on 3000000.

If You Make Less Than 50 000 Don T Forget These 3 Tax

If You Make Less Than 50 000 Don T Forget These 3 Tax

How Much Salary Is Needed To Be Eligible For Tax Paying In

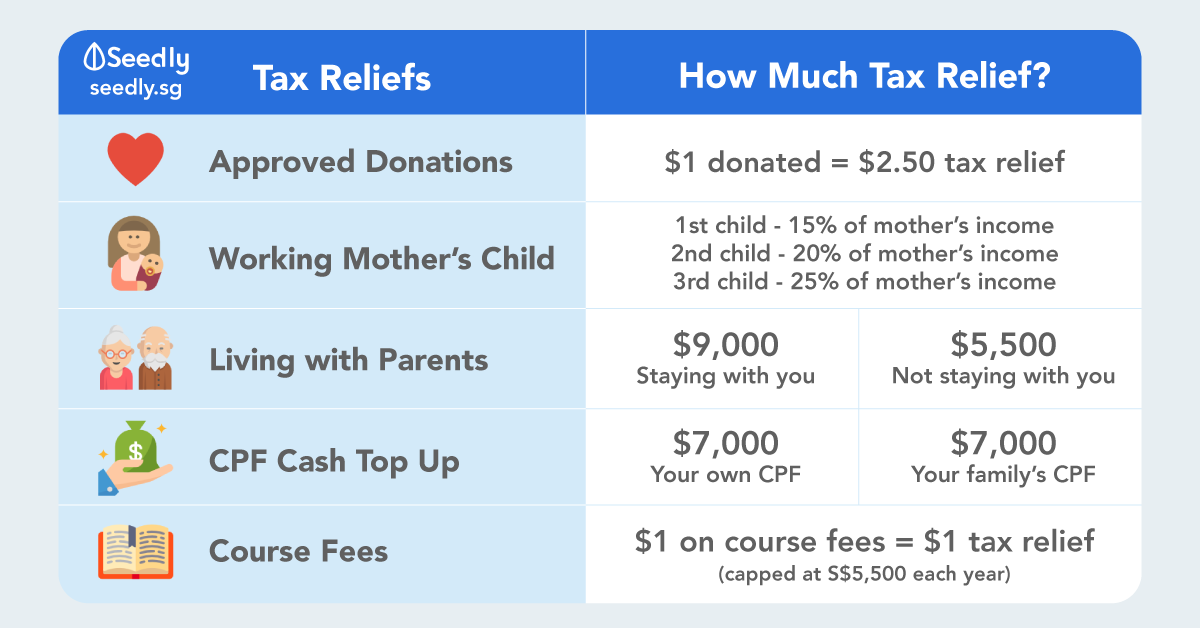

Your Cheat Sheet Personal Income Tax In Singapore Ya 2019

Your Cheat Sheet Personal Income Tax In Singapore Ya 2019

Tax Calculator For 30 000 Salary New Hmrc 2019 2020 Tax

Tax Calculator For 30 000 Salary New Hmrc 2019 2020 Tax

America S Middle Class Is Vanishing Nearly Half Of Workers

America S Middle Class Is Vanishing Nearly Half Of Workers

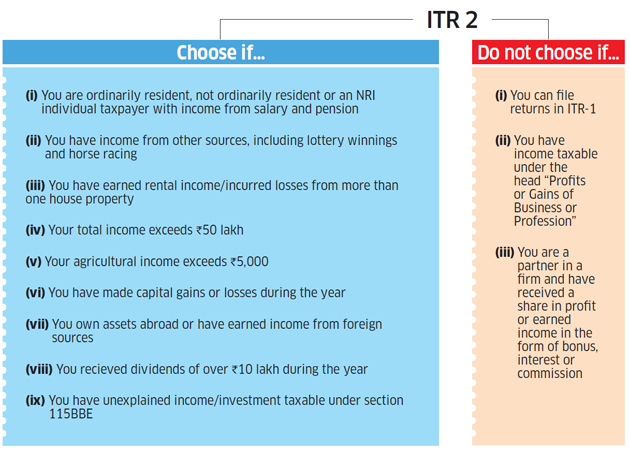

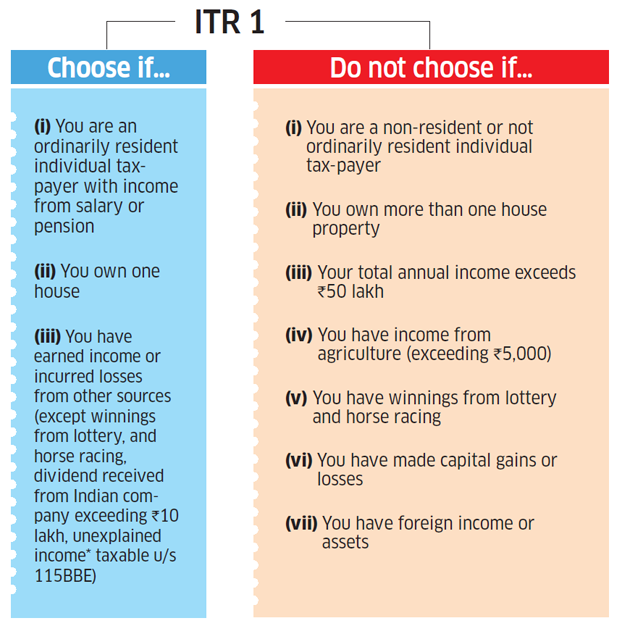

Itr Filing Online 6 Steps To File Income Tax Return Online

Itr Filing Online 6 Steps To File Income Tax Return Online

Itr Filing Online 6 Steps To File Income Tax Return Online

Itr Filing Online 6 Steps To File Income Tax Return Online

Number Of Tax Return Processed All In Figure 6 Shown

Number Of Tax Return Processed All In Figure 6 Shown

Average Real Wages One Year Prior To First Claim Year And

Average Real Wages One Year Prior To First Claim Year And

Tips To Use All The Tax Benefits That Are Available On Home

Tips To Use All The Tax Benefits That Are Available On Home