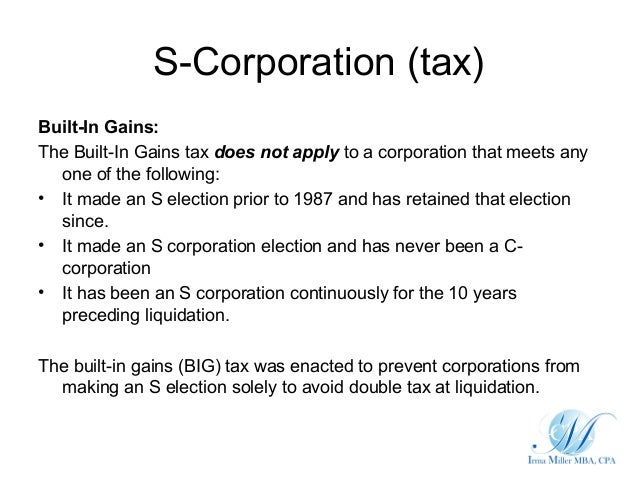

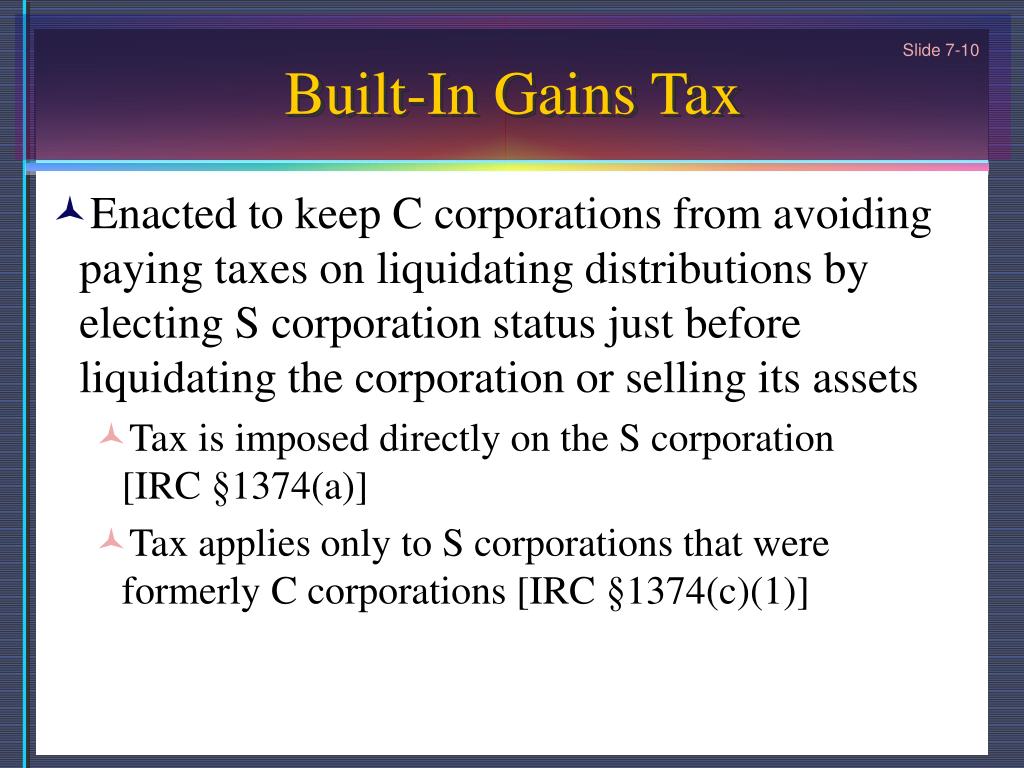

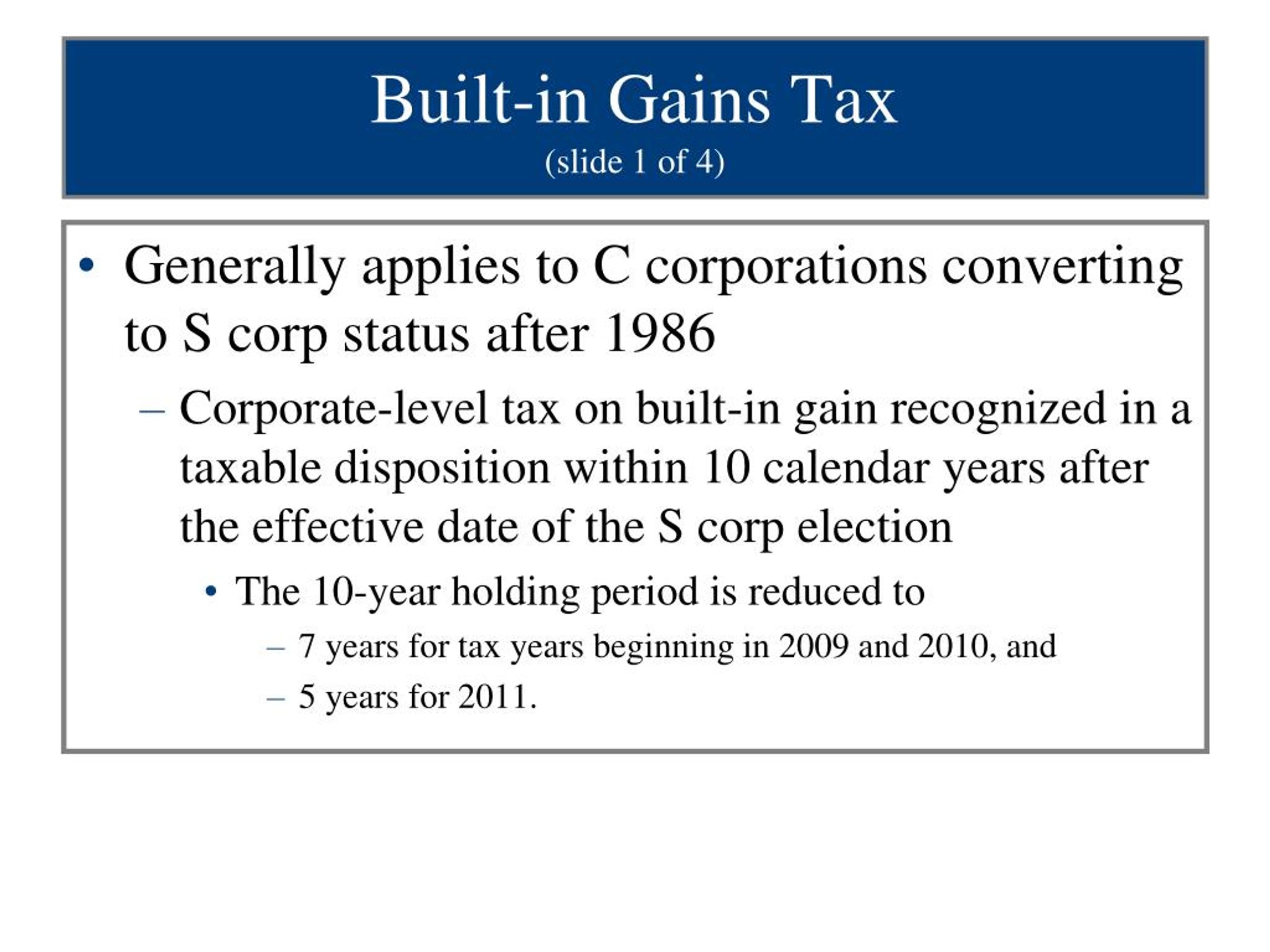

The s corp built in gains tax is imposed to prevent taxable liquidation. Executive summary when a c corporation converts to an s corporation or an s corporation acquires assets from a c corporation in a tax free transaction it may be subject to a corporate level built in gains tax in addition to the tax imposed on its shareholders.

S Corporations Built In Gain Tax

S Corporations Built In Gain Tax

built in gains tax for s corporation

built in gains tax for s corporation is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in built in gains tax for s corporation content depends on the source site. We hope you do not use it for commercial purposes.

The built in gains tax is one levied against an s corporation that used to be a c corporation or received assets from a c corporation.

Built in gains tax for s corporation. Unlike c corporations s corporations generally pay no corporate level tax. Also the s corporation must dispose of the assets that had built in gains in a taxable sale or exchange during a time known as the recognition period. For an s corporation the sale of an asset triggers a single tax.

Every business owner should strive to avoid the built in gains big tax like you would avoid the big bad wolf. This tax is charged when a c corporation becomes an s corporation. The built in gains tax may also be imposed when an s corporation receives assets in a tax free transaction.

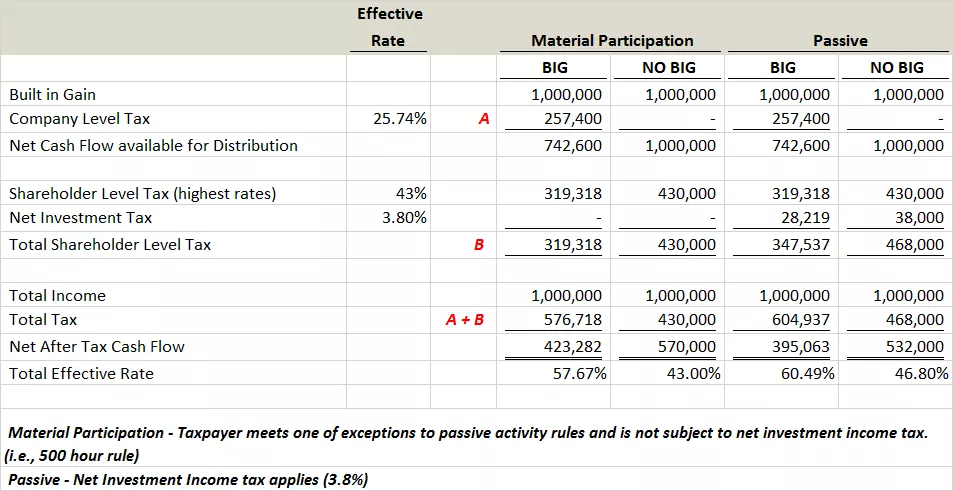

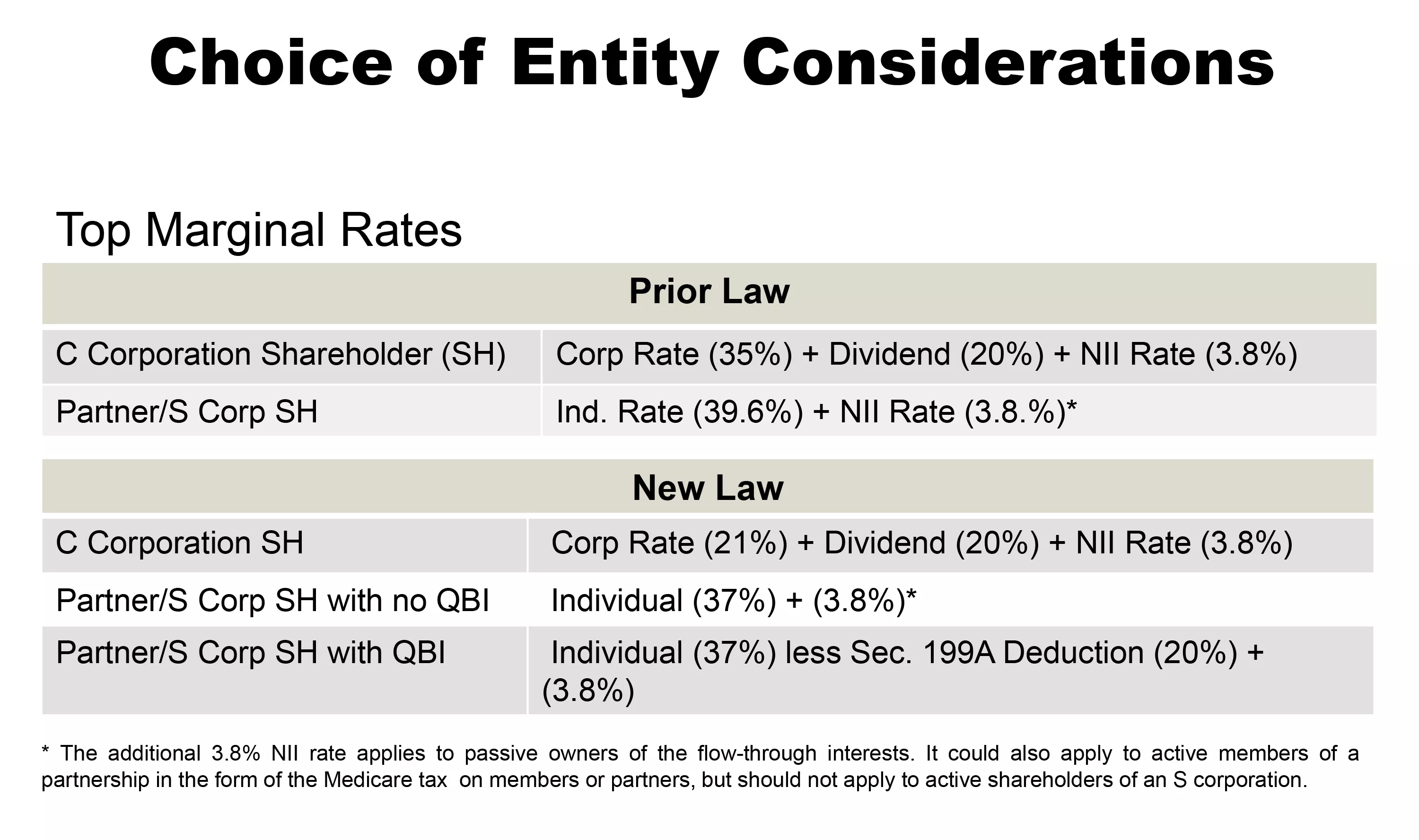

The built in gains tax of 35 applied to certain gains within five years of switching to an s corporation. Its not always possible to avoid it but by planning ahead you can definitely minimize it. With the drop of this rate to 21 the cost has gotten lower but has not been eliminated.

The calculation of big tax is a two step process. If an s corporation that was previously taxed as a c corporation has built in gains attributable to the period during which it was a c corporation it is subject to a corporate level tax the built in gains or big tax when it recognizes the built in gains within a certain period of time after its conversion to s corporation status. Post election appreciation is not subject to the built in gains tax.

Partnerships are now liable for us. Instead items of income and loss of an s corporation pass through to its shareholders. Built in gains tax applies when an s corporation disposes of an asset within five years of acquiring that asset and the s corporation either acquired the asset when the s corporation was a c corporation or it acquired the asset in a transaction in which the basis of the asset was determined by reference to its basis in the hands of a c.

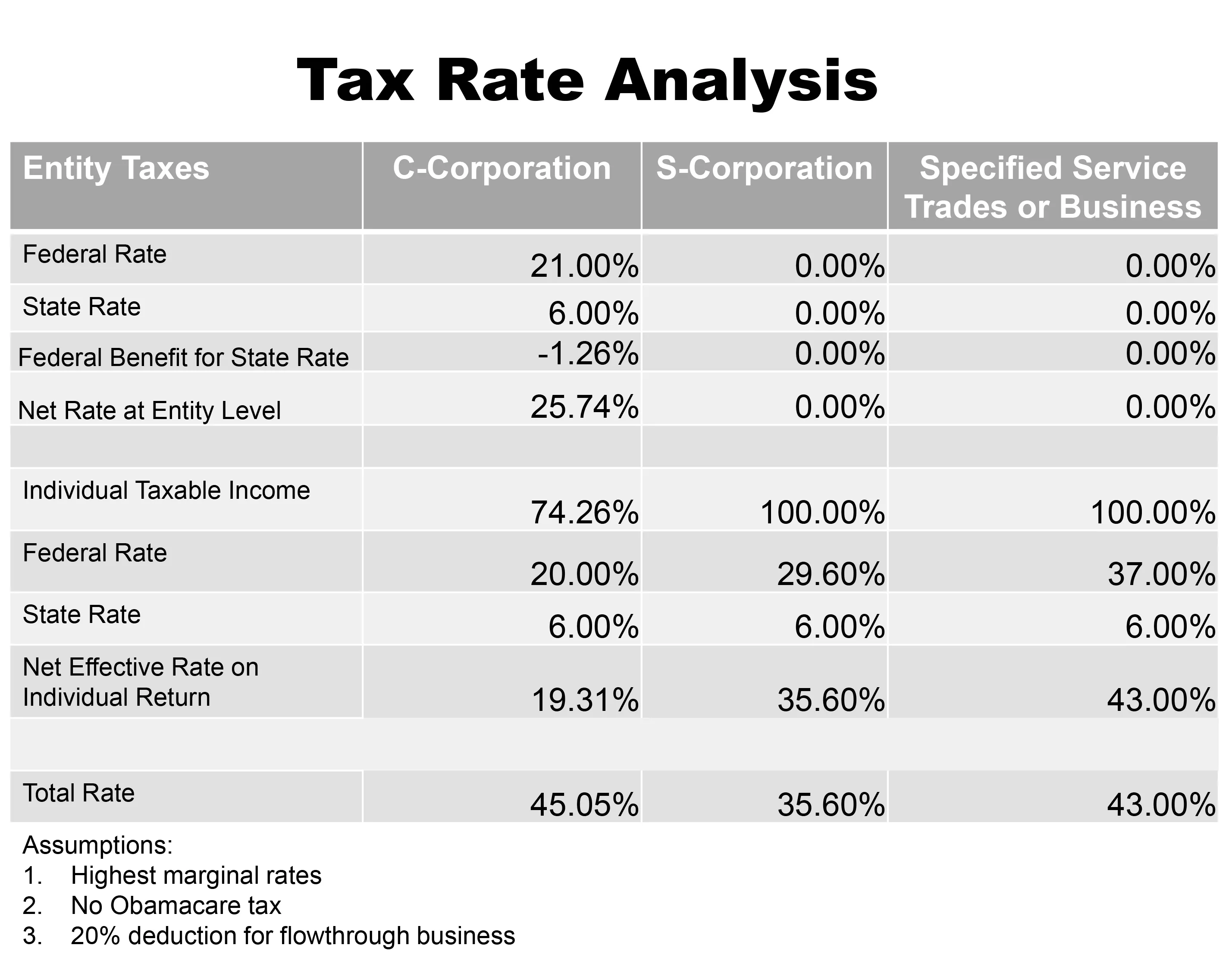

As you can see converting from a c corporation to an s corporation can still be a very effective strategy to reduce taxes in light of 2018 tax reform and the current rate structure. Big is a tax that applies to companies that were previously a c corporation and have made an s corporation election. Notwithstanding the foregoing tax rate increases 2013 may be a good time for certain s corporations to consider a sale of assets.

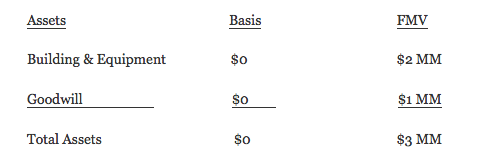

First a c corporation must calculate unrealized big when the corporation elects to be taxed under subchapter s by subtracting the corporations adjusted basis in a particular asset from the fair market.

S Corp Sales Built In Gain And 2013 Tax Law For The

S Corp Sales Built In Gain And 2013 Tax Law For The

Accounting For Different Business Entities

Accounting For Different Business Entities

Ppt S Corporations Powerpoint Presentation Free Download

Ppt S Corporations Powerpoint Presentation Free Download

Chapter 22 S Corporations Ppt Download

Chapter 22 S Corporations Ppt Download

Tax Treatment For C Corporations And S Corporations Under

Tax Treatment For C Corporations And S Corporations Under

Ppt Chapter 12 Powerpoint Presentation Free Download Id

Ppt Chapter 12 Powerpoint Presentation Free Download Id

Tax Treatment For C Corporations And S Corporations Under

Tax Treatment For C Corporations And S Corporations Under

Topic Built In Gains Tax Crew Corporation Elects S Status

Tax Treatment For C Corporations And S Corporations Under

Tax Treatment For C Corporations And S Corporations Under

S Corporation Merger Acquisition Issues Ppt Download

S Corporation Merger Acquisition Issues Ppt Download